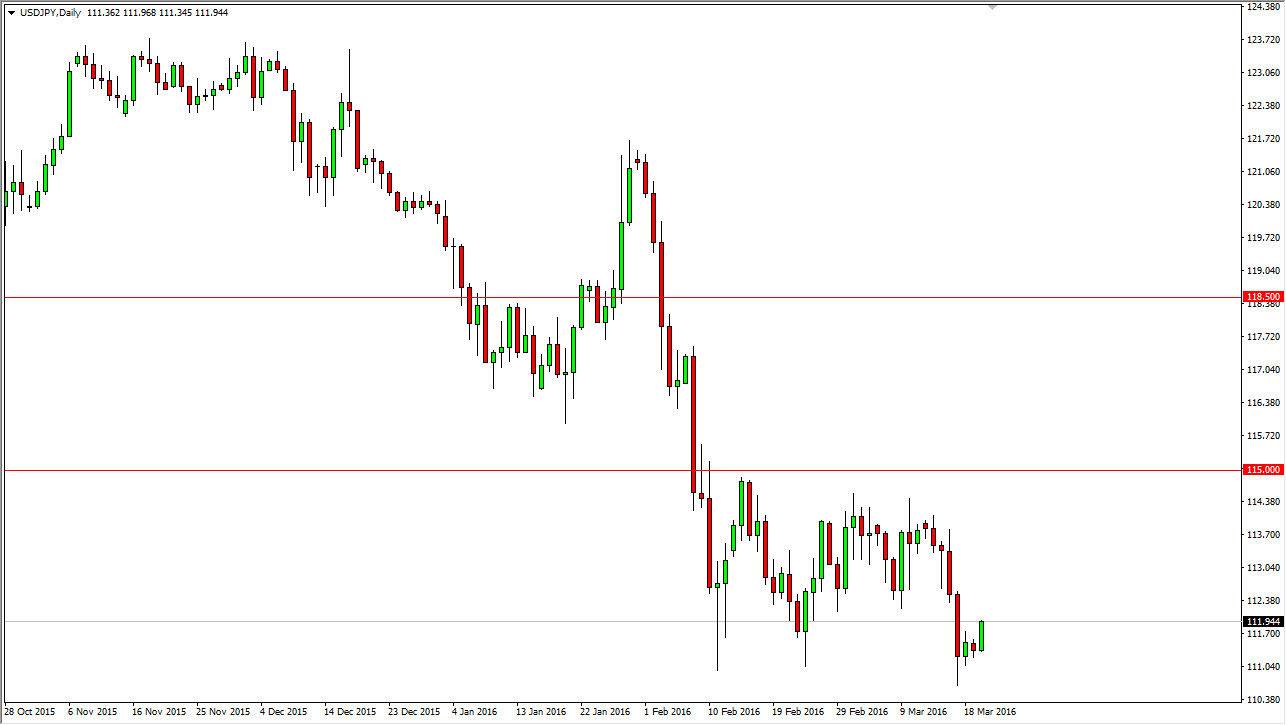

USD/JPY

The USD/JPY pair broke higher during the course of the day on Monday, as it looks like the 111 level is going to continue to offer support. It is at the bottom of a larger consolidation area, and as a result we could go as high as the 114.50 level and still remain in the same consolidation that we’ve been in for some time. Ultimately, if we can break above the 115 level, that could be very bullish and could send this market to the 118.50 level.

That being the case, any rally at this point in time could be difficult to hang onto though, and an exhaustive candle would be reason enough to start selling. I don’t know if we can reach the 114.50 level again, but I do recognize that it’s what we’ve done in the past. Ultimately, the one thing that I think you can count on is quite a bit of volatility.

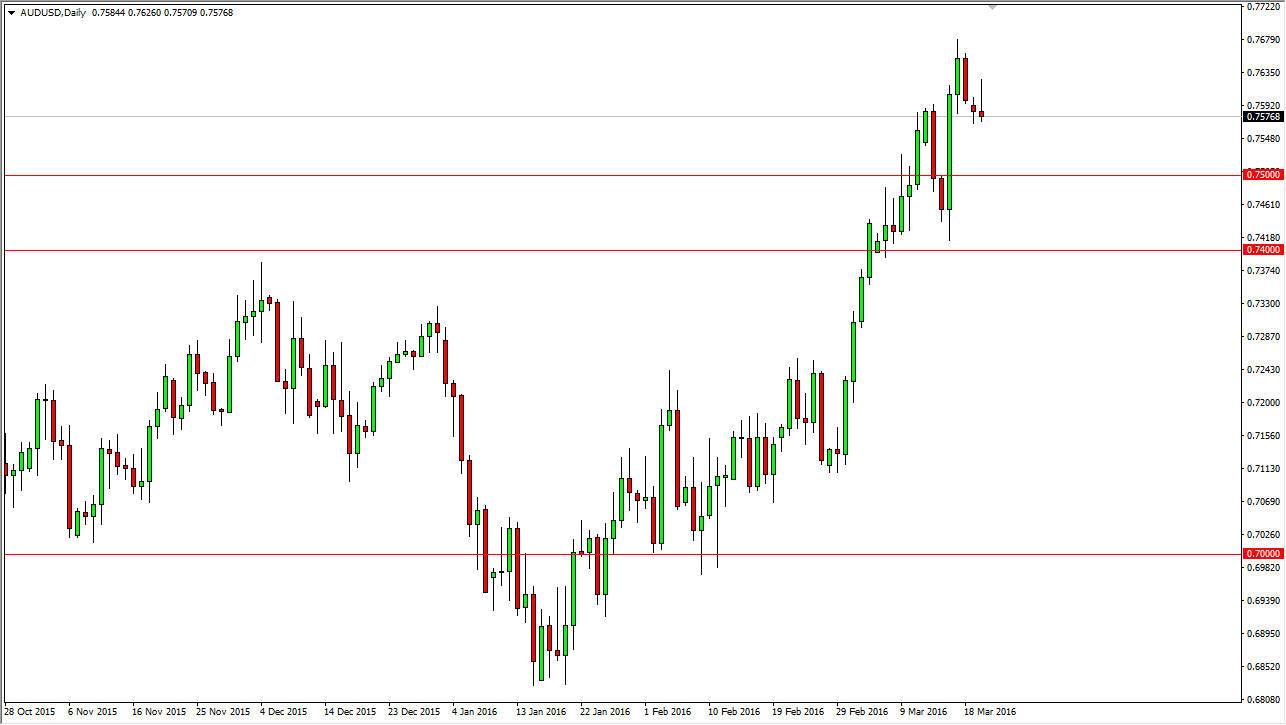

AUD/USD

The AUD/USD pair initially tried to rally during the course of the day on Monday, but turned back around to form a bit of a shooting star. The shooting star of course is a negative candle, and with that being the case it’s very likely that the market will probably try to drive down to the 0.75 level below. That is the beginning of a very significant support level, extending all the way down to the 0.74 handle. I believe that the market will more than likely find plenty of buyers below, so I’m waiting to see whether or not we get some type of supportive candle that we can start buying.

Given enough time, I believe that the Australian dollar should eventually reach towards the 0.80 level, which is the next large, round, psychologically significant number and one that has a massive amount of influence on the longer-term charts. With this being the case, look for gold markets as an indication of where this market could go.