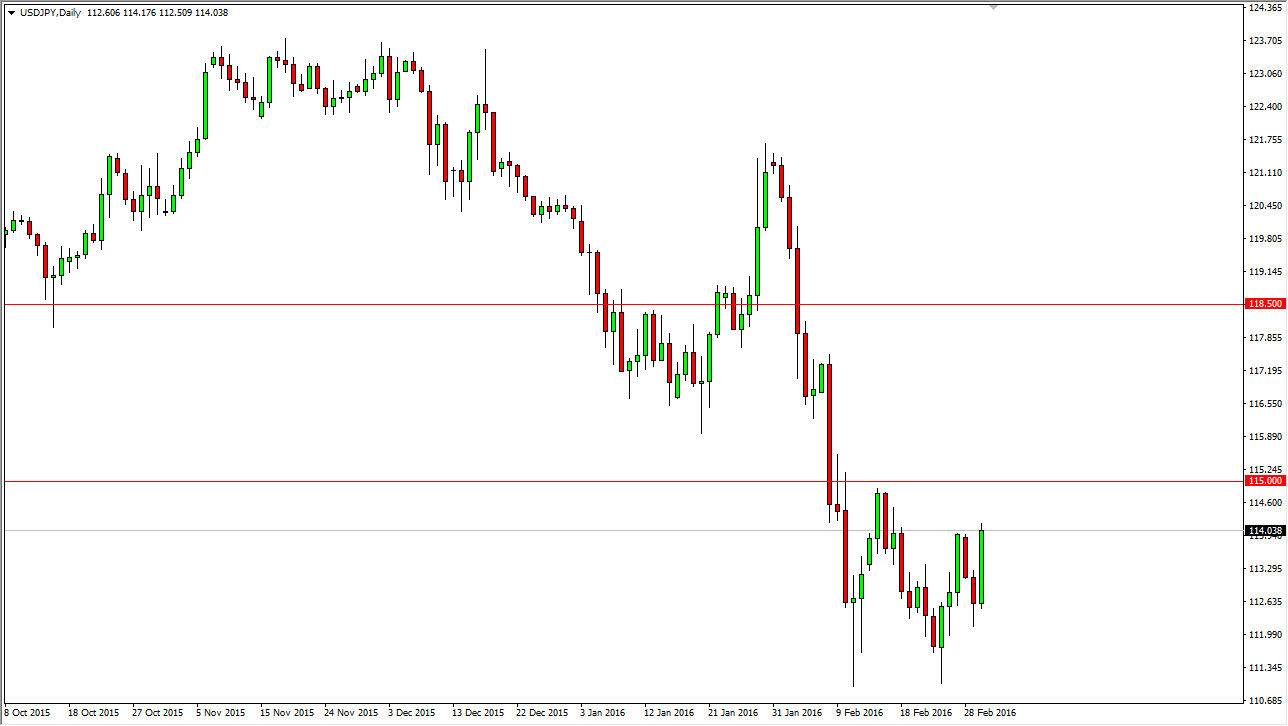

USD/JPY

The USD/JPY pair broke higher during the course of the day on Tuesday, as we bounced a bit and reached towards the 114 handle. At this point in time, I think we are going to try to make it to the 115 handle, but at that point I would expect the sellers to return. After all, it has been resistive a couple of times already, and of course it is a large, round, psychologically significant number. That generally offers quite a bit of interest by the markets, so having said that, the exhaustive candle above would have me selling this market quite rapidly as we are obviously in a downtrend.

All things being equal though, I think that short-term traders will focus on buying, and this of course will be true if stock markets in general rise. After all, this is a market that is very risk sensitive, so pay attention to that as well.

AUD/USD

The Australian dollar rose during the day on Tuesday, as the market continues to see quite a bit of volatility. Because of this, it’s likely that we will see quite a bit of pressure in both directions given enough time, and although it looks as if the Aussie make a higher low, and the longer-term it’s likely that the resistance above will continue. After all, the previous uptrend line has still acted as resistance, and we have not been it will do break above it.

Because of that, I’m waiting to see whether or not we get an exhaustive candle ball that I can start selling again, as although the gold markets have been rather strong, it seems as if the Australian dollar has been ignoring them altogether. This leads me to believe that this pair is all about Asia right now, which isn't exactly performing as one would hope. Given enough time, I think the sellers return.