USD/JPY

The USD/JPY pair fell during the course of the session on Thursday, breaking pretty significantly. However, we did bounce a bit during the course of the session at the end of the day, so it looks as if the market is going to continue to show bearish pressure. It makes sense considering that the Federal Reserve announced that they are not going to do as many interest-rate hikes as originally thought during the year. Because of this, traders are starting to bet against the US dollar and it makes a lot of sense that the Japanese yen would climb and value. With this, we have tested the bottom of the consolidation area that we’ve been in, so with this we could very well get above that of a bounce from here. However, I am hesitant to buy this market and believe that we will continue to see selling opportunities again and again in the short-term.

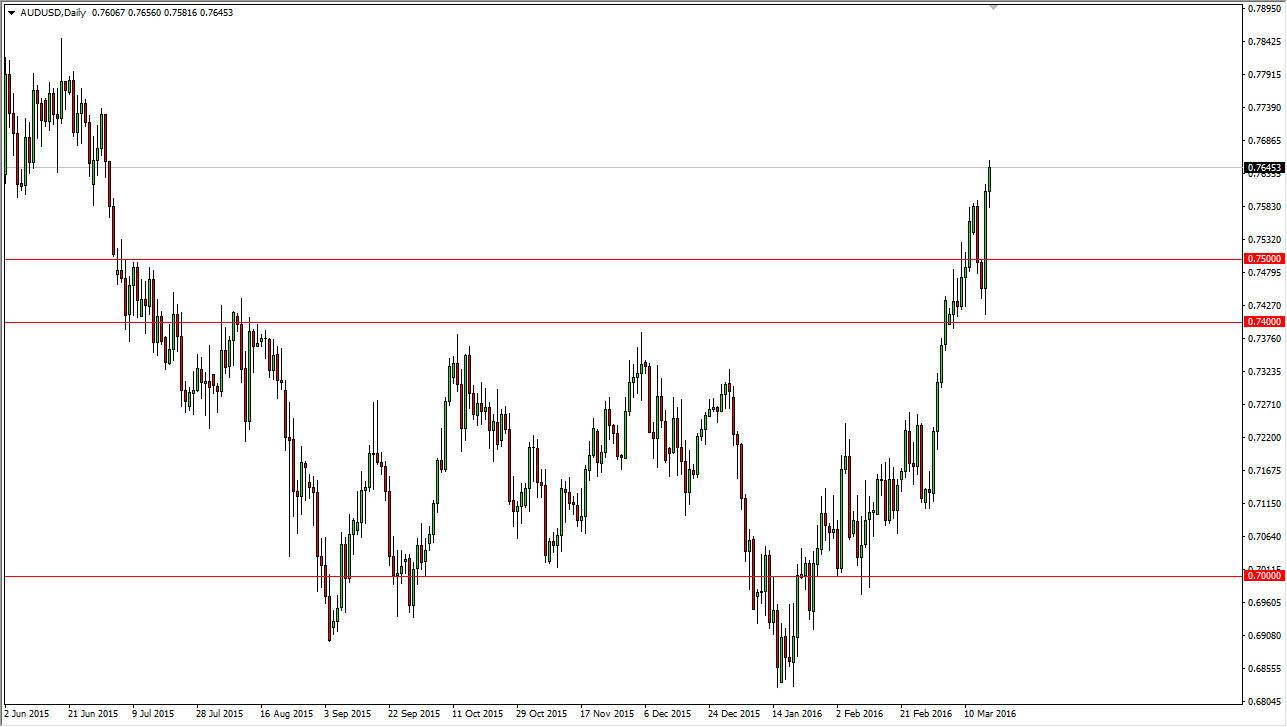

AUD/USD

The Australian dollar initially fell during the day on Thursday, but turned back around to show strength yet again. This is a market that is free to go higher at this point, once we get past the area just above. After all, the market has quite a bit of bullish tendencies to it, as we have recently pulled back but with the Federal Reserve announcing that the market has central bank is going to only cut rates twice during the rest of the year, it makes sense that we will now see quite a bit of bullishness in the Australian dollar, and of course more importantly softness in the US dollar.

Gold markets of course have been rising, and that helps the Australian dollar as well. That being the case, the market should continue higher on short-term pullbacks and perhaps target the 0.80 level above, an area that has been important time and time again on the longer-term.