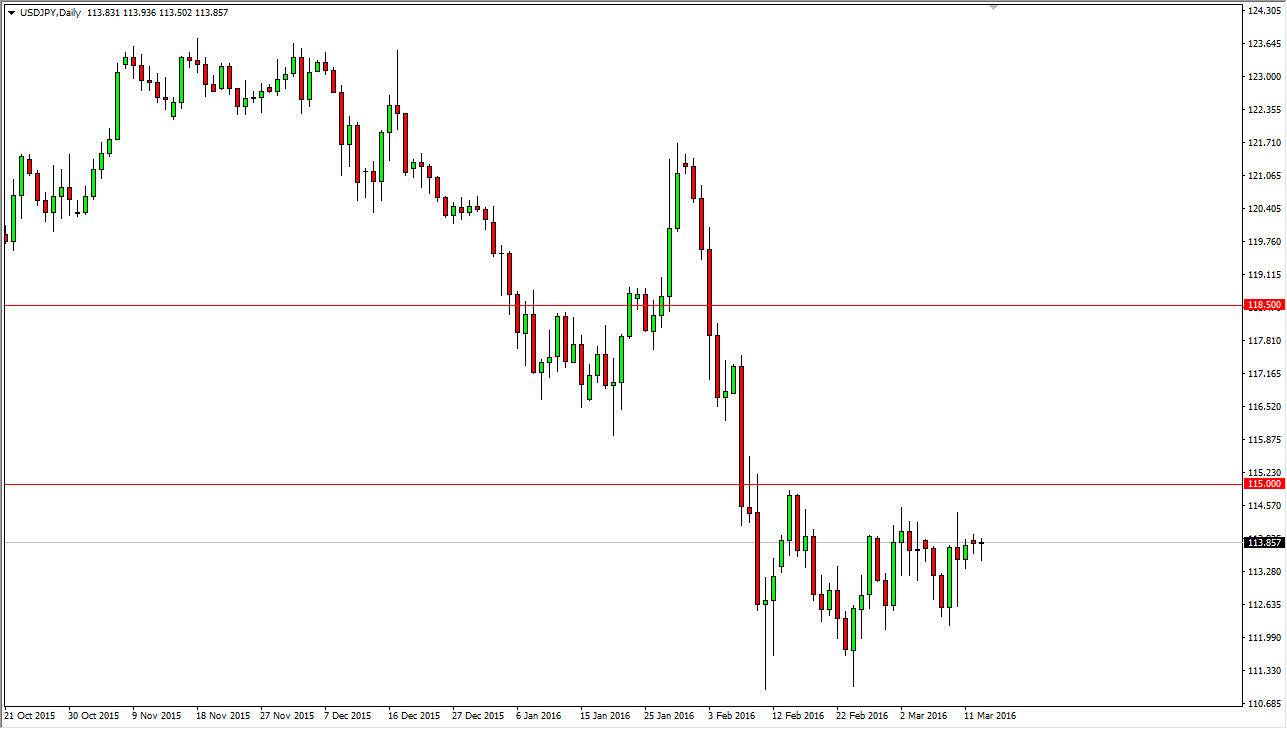

USD/JPY

The USD/JPY pair had a fairly benign session during the day on Monday as we returned to trading. It looks as if we are going to continue to consolidate overall, so at this point in time I don’t really see a trade. We did form a bit of a hammer, and that might suggest that perhaps we are trying to break out to the upside, but we most certainly did not do it yet. It would take a break above the 115 level for me to start buying at this point, and as far as selling is concerned, I suppose I could do it on a break down below the bottom of the session for Monday, but at that point in time I would only be looking for a move down to the 112 handle. With this, I believe that it is going to remain very choppy in this market.

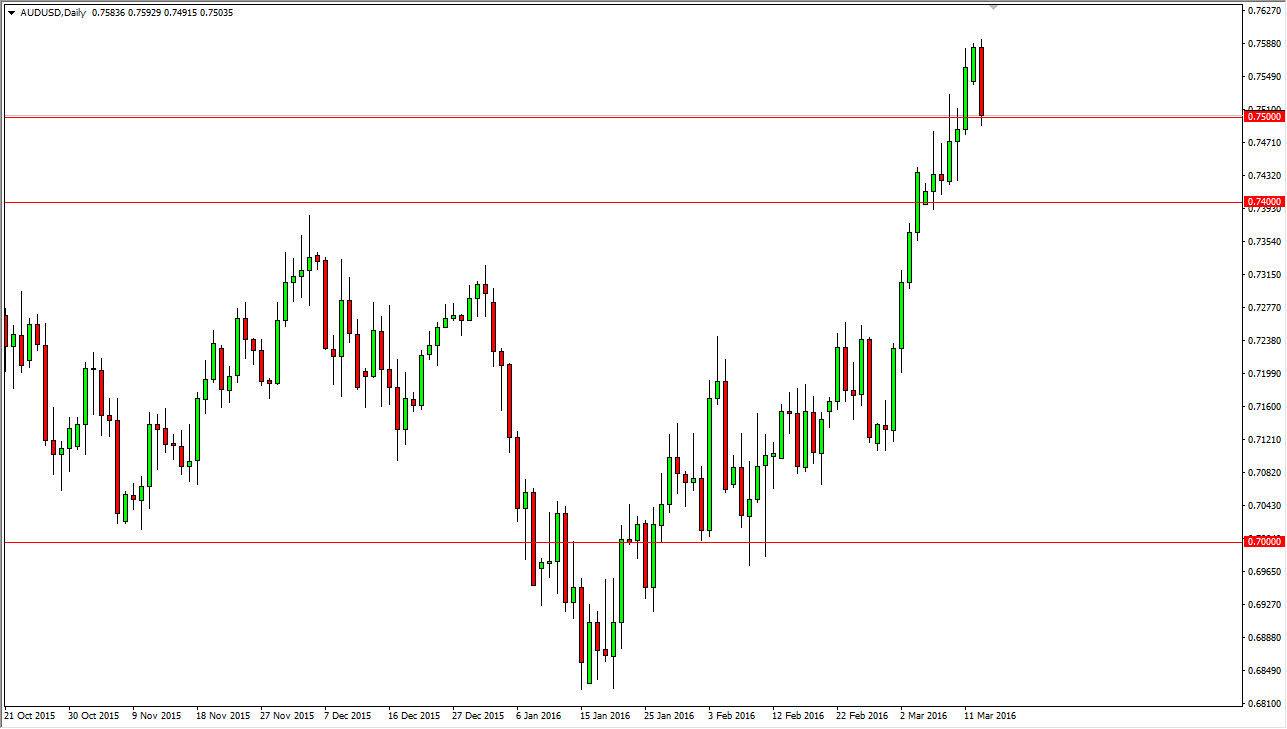

AUD/USD

The AUD/USD pair fell rather significantly during the course of the day on Monday, testing the 0.75 handle. By doing so, it appears that the market is essentially retesting the previous resistance, and it should be noted that on shorter-term charts we are starting to see bits of support. It's because of this that I feel that this market will go higher from here, perhaps reaching closer to the 0.77 handle now. I have no interest in shorting, because even if we break down from here I think there is going to be a significant amount of support all the way down to the 0.74 handle.

The Australian dollar is somewhat highly correlated to the gold markets, and as a result it’s likely that the pair will follow whatever gold is doing. You have to pay attention to that correlation, and I believe that it should return to a positive direction, because quite frankly there are so many central banks other trying to work against the value around currency, hard metals seem appealing.