NZD/USD Signal Update

Yesterday’s signals were not triggered, as there was no bullish price action when the price hit the trend line.

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be taken between 8am New York time and 5pm Tokyo time.

Long Trade 1

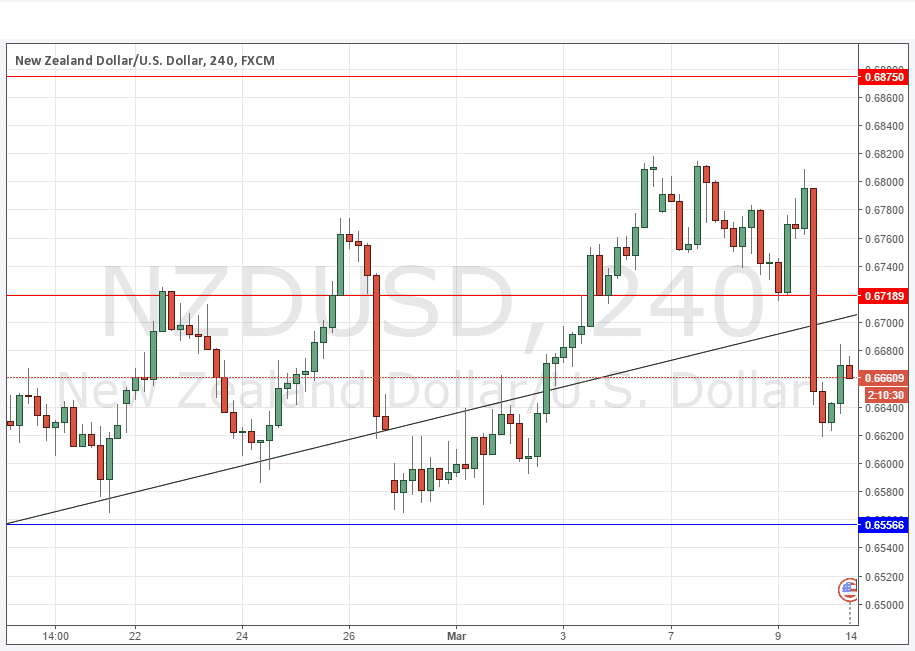

• Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6557.

• Place the stop loss 1 pip below the local swing low.

• Adjust the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

• Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6719.

• Place the stop loss 1 pip above the local swing high.

• Adjust the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

Yesterday’s surprise rate cut by the RBNZ pushed the price of this pair down by almost 2% very quickly. It has recovered somewhat but is now near the middle of its multi-month range. This is often a tough pair to trade and current conditions are no exception to that. The most attractive possible set-up is likely to be a pullback up to 0.6719 or at least to a price very close to that number, followed by a bearish turn providing an opportunity to enter a short trade.

There is nothing due today concerning the NZD. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time. .