The market started the week on the back foot, testing the 1208/5 support level, but weaker-than-expected economic data out of the United States helped gold recover initial losses and close above the 1221 level. The XAU/USD pair traded as high as $1223 an ounce after the Commerce Department's report showed that personal spending rose only 0.1% in February. The report also revealed that the personal consumption expenditures index, the inflation gauge preferred by Federal Reserve policy makers, climbed 0.1%.

The key levels remains unchanged, as the market is stuck in a relatively tight range. A deluge of key U.S. economic indicators will be released this week but it seems that the highly anticipated non-farm payrolls report will likely set the tone for the greenback for the rest of the next month. If fresh data convince the Fed that the economy is strong enough to endure higher interest rates, the downward pressure could increase.

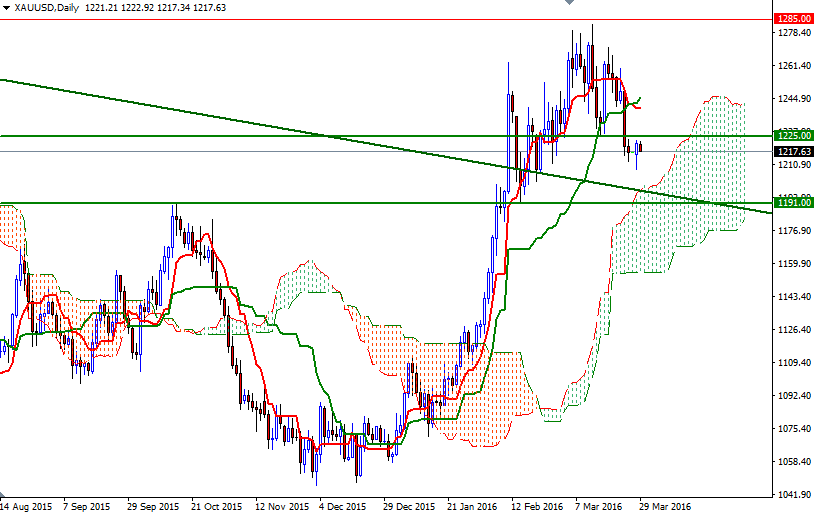

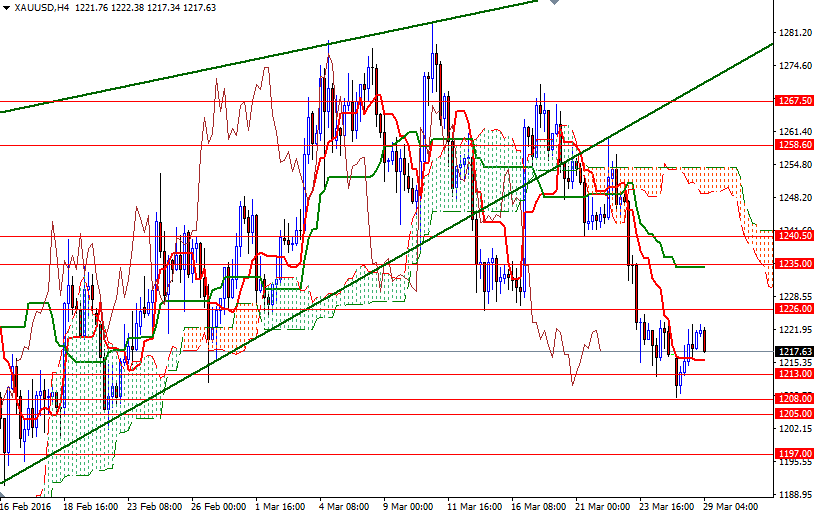

From a technical point of view, there are two things that I pay attention at the moment. Firstly, we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both the daily and 4-hourly charts, along with Chikou Span/Price crosses in the same direction (4-hour chart). Secondly, the medium-term outlook still points to an upwards bias, with the market sailing beyond the weekly and daily clouds. If XAU/USD can break through 1226/5, we might see a bullish attempt targeting the 1235 level. The bulls will have to capture this strategic camp in order to gain more momentum and challenge the bears on the 1243-1240.50 battlefield. However, if the 1213 support gives way ,a retest of the 1208/5 region might be realistic. A sustained break below 1205 would imply that the 1199/7 zone might be the next port of call.