By: DailyForex.com

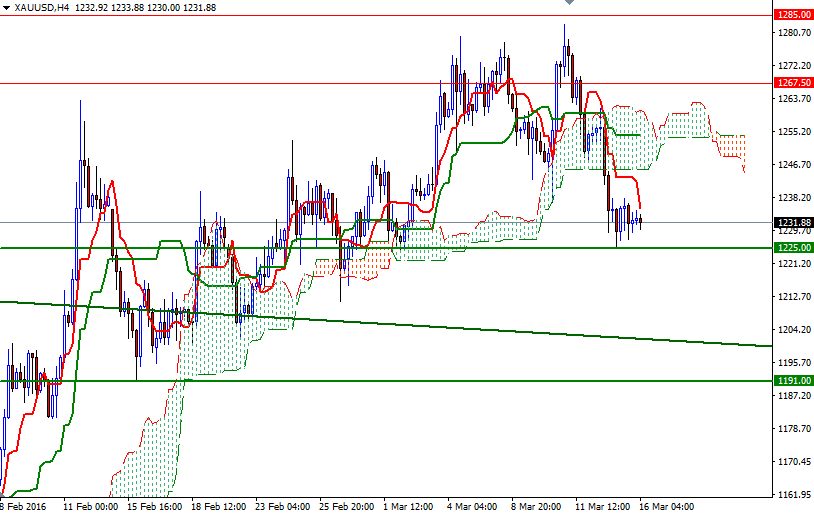

Gold prices fell for a third straight session on Tuesday and settled at $1232.36 an ounce as investors continued to trim bullish bets ahead of the Fed's announcement. The XAU/USD pair tried to pass the 1238/5 resistance but the bulls run out of steam and as a result the precious metal bounced roughly between the 1238 and 1225 levels. In economic news, the Commerce Department reported that retail sales dipped 0.1% in February. Underscoring the report's weakness, January's numbers were revised down to show a 0.4% drop instead of a 0.2% gain. A separate report from the New York Fed revealed that manufacturing activity in the region climbed to 0.6 from -16.6 a month earlier.

Investors now turn their attention to the U.S. Federal Reserve's policy announcement today. The Federal Open Markets Committee is expected to keep interest rates unchanged but the market participants will be sensitive to any guidance on the pace of future rate hikes. If policy makers give any signal that there are more rate hikes than the market projects, it could be positive for the greenback.

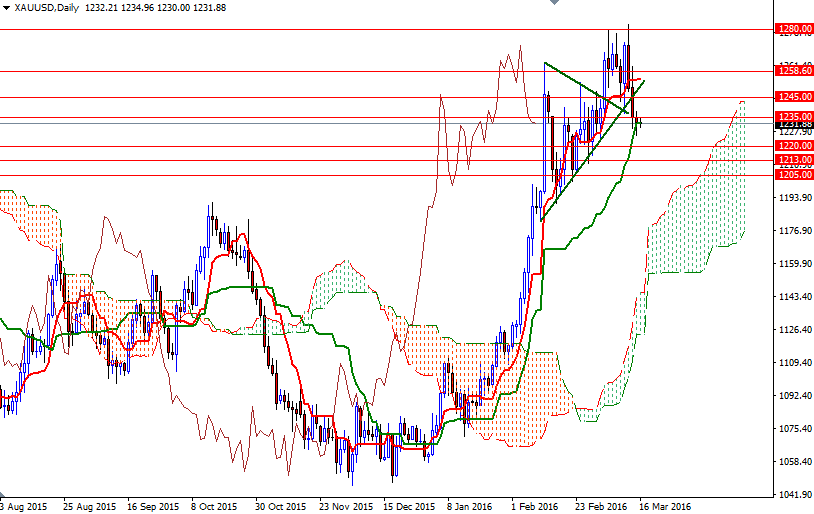

The key levels remains unchanged, as the market continues consolidating between the 1238/5 area on the top and the 1227/5 area on the bottom. Although the medium-term outlook still points to an upwards bias, the short-term picture is unclear and will likely depend on the direction prices will exit. If XAU/USD can break through 1238/5, we might see a bullish attempt targeting the 1248/5 region. The bulls will have to capture this strategic camp in order to gain more momentum and challenge the bears on the 1260-1258.60 battlefield. However, if the 1227/5 support gives way, a retest of the 1220 level might be realistic. A sustained break below 1220 would imply that the 1213 level might be the next port of call.