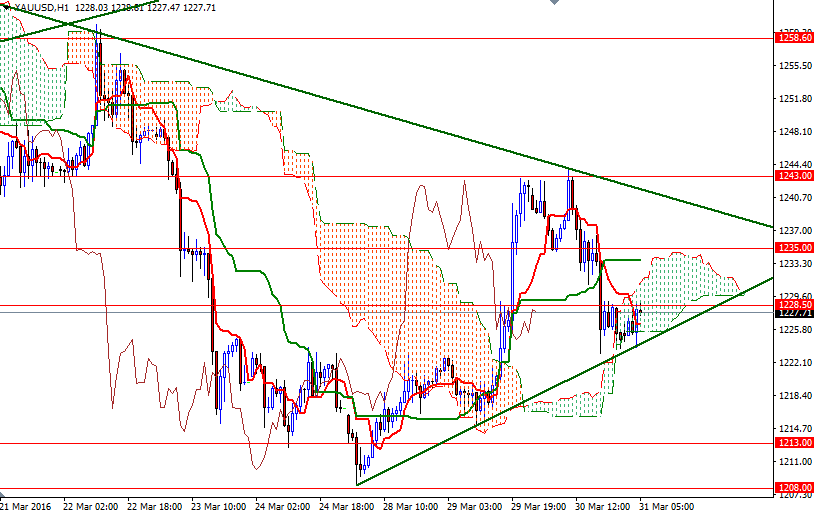

Gold prices dropped $16.16 an ounce yesterday, giving back most of the gains made in the previous session, as expectations that U.S. interest rates will stay low led investors into riskier assets. The XAU/USD pair initially bounced off the support around the $1235 level but encountered significant amount of resistance at $1243 once again. The bull's inability to pass through this barrier that has been resistive lately put extra pressure on the market. Consequently, prices broke below $1235 and headed lower.

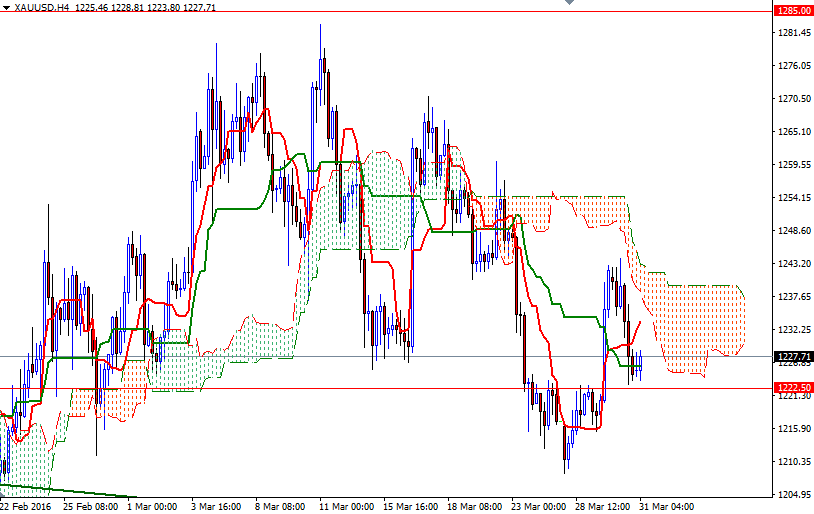

Trading above the Ichimoku clouds on the weekly and daily charts suggest that, the medium-term directional bias remains bullish. However, the 4-hour chart indicates downside risks remain and this recent downswing could drag XAU/USD towards the daily cloud, unless prices anchor somewhere above 1243. Since penetrating the 1243 resistance would cause short-term charts to realign with longer-term bullish inclinations, the possibility of an attempt to revisit the 1258.60 level could increase.

From an intra-day perspective, the initial resistance level now stands in the 1229.40-1228.50 area, followed by 1235. I think a break up above 1235 would give the bulls the extra power they need to challenge the bearish trend line sitting at 1240. To the downside, keep an eye on the 1222.50 level. The bears will need to demolish this support in order to increase pressure on the market and test the 1215.30-1213 support area. A daily close below 1205 would indicate that the bears will be aiming for 1199/7 afterwards.