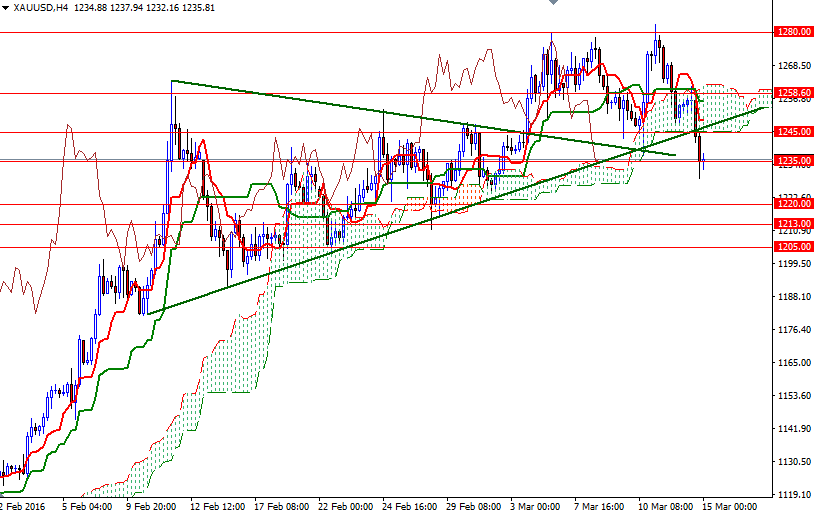

Gold prices ended Monday's session down $15.27, to settle at $1234.96 an ounce, pressured by strength in the dollar and global equity markets. The market initially tried to break upwards but came under fresh selling pressure at around the $1258.60 level where the Tenkan-Sen (nine-period moving average, red line), Kijun-Sen (twenty six-period moving average, green line) and the top of the 4-hourly Ichimoku cloud clustered and reversed its course. Not surprisingly, breaking below the $1245 level accelerated the downward movement and dragged the XAU/USD pair to the next significant support around the $1235 level.

Prices are currently hovering just above this level in Asian trade but apparently long-side profit taking is weighing on the market. The short-term charts are bearish at the moment, with the market trading below the Ichimoku cloud on the 4-hour time frame, plus we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines. As I pointed out yesterday, if XAU/USD can't hold above 1235, then the market will have a tendency to revisit the critical 1225 level.

Breaching the 1225 support is essential for a bearish continuation. In that case, the market will be aiming for 1220 (and possibly 1213). The bulls will have to push prices back above the broken trend line if they don't intend to throw the towel. Clearing the resistance in the 1248/5 region would suggest that a bearish reaction may have to wait a little longer as the bulls will be targeting the 1260-1258.60 area.