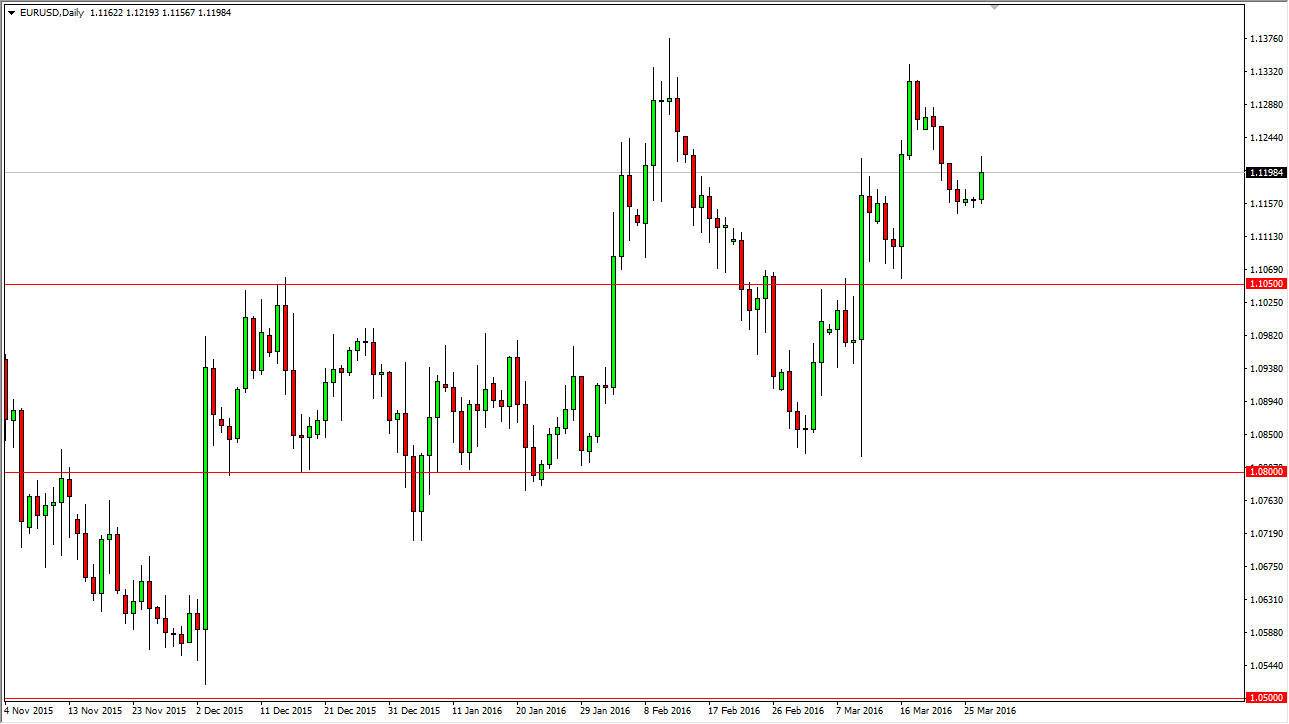

EUR/USD

The EUR/USD pair rose during the course of the session on Monday, as we broke above and towards the 1.12 handle. However, there is more than enough support below that even if we get from here, and should be a buying opportunity. Given enough time, I fully expect to see this market reach towards the 1.13 level above, which has been resistive previously. I feel that we will eventually break above there, and given enough time we should then reach towards the 1.15 handle.

Any pullback at this point in time should have plenty of support though, especially all the way down to the 1.1050 level. That is essentially the “floor” in this market, and I feel that it’s only a matter of time before buyers enter every time we got towards that area.

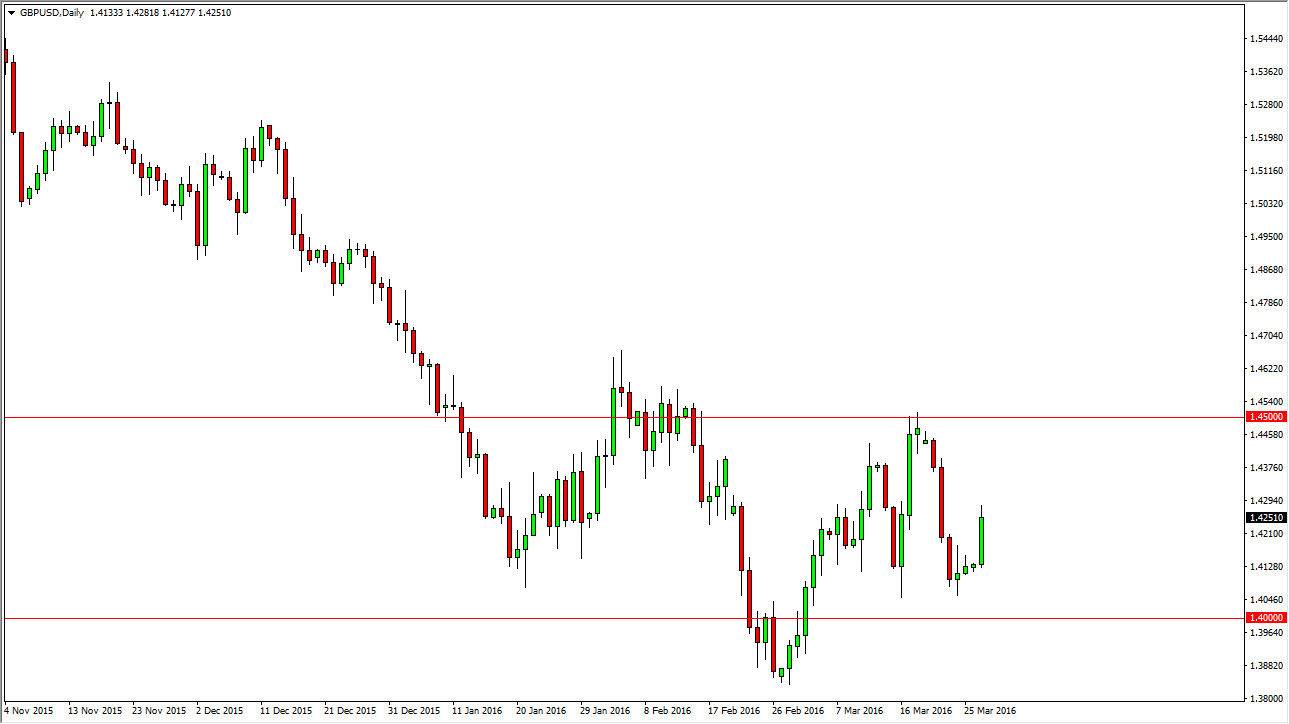

GBP/USD

The GBP/USD rose during the course of the session on Monday, testing the 1.4250 level. The candle was fairly strong, and now it looks as if we are going to continue towards the top of the recent consolidation area, which extends all the way to the 1.45 handle. Given enough time it should be a market that is back and forth, and I have a hard time believing that the market is going to break out for any real length of time as we have the Federal Reserve which of course stepped away from the least some of its interest-rate hikes this year, if not all of them. On top of that, it’s possible that the market is going to continue to punish the British pound as there are concerns that the United Kingdom will leave the European Union. That being the case, it’s going to be difficult for this market again too much, but at the same time I don’t think that will sell off drastically only because of the situation with the US central bank. Choppiness should continue to be the way going forward.