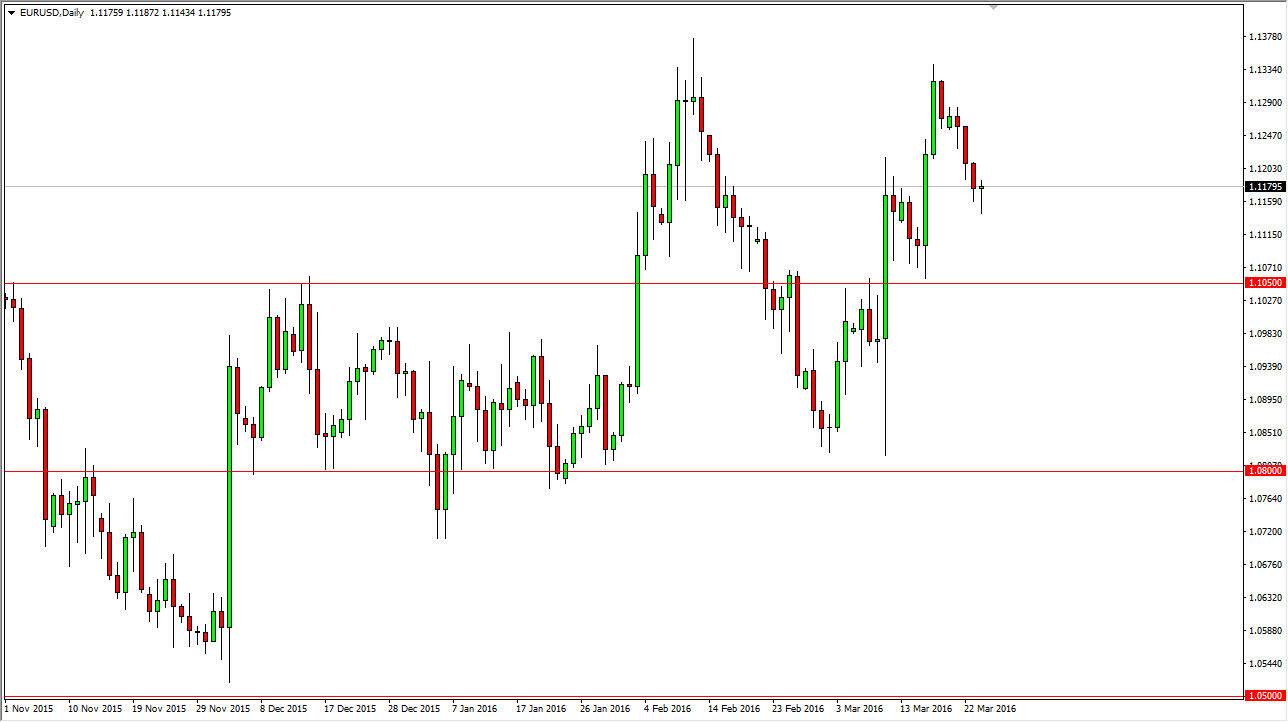

EUR/USD

The EUR/USD pair initially fell during the course of the session on Thursday, but found enough support below to turn around and form a perfect hammer. This hammer sits upon the top of a massive collection of trading just below, and with that being the case I feel that this hammer has formed at roughly the perfect spot. If we can break above the top of this hammer, I feel the market then goes to the 1.13 level, perhaps even the 1.15 handle.

Below current trading levels is the 1.1050 level, which is supportive in my opinion. We have seen a nice bounce from there, and it should continue to offer buying pressure so I think it’s only a matter of time before we rally anyway. Even if we break down below the bottom of the hammer which is normally a very negative sign in my opinion, I believe that the market will find plenty of buyers between here and the aforementioned 1.1050 level.

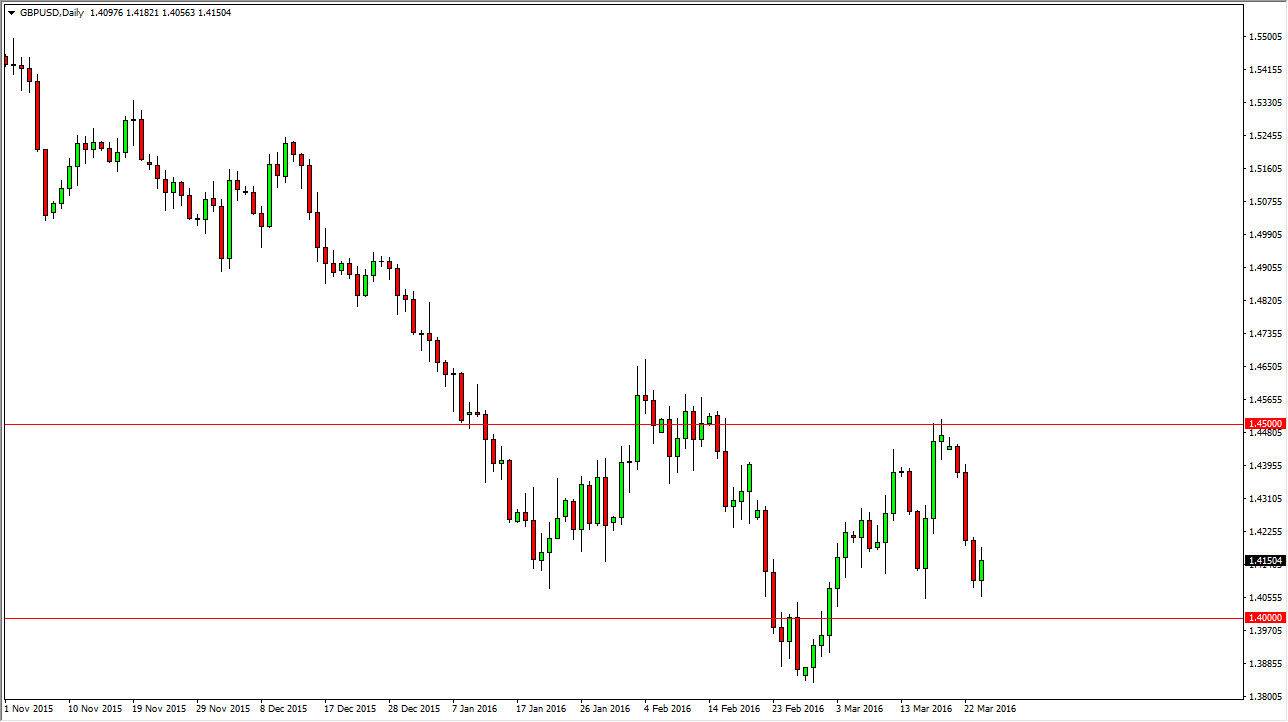

GBP/USD

The GBP/USD pair went higher during the course of the session on Thursday as we bounced off of the 1.40 region. This is an area where I had suggested previously that there would be a lot of support and it makes sense that we simply continue to consolidate as there is so much in the way of volatility and concern when it comes to the Federal Reserve stepping away from interest-rate hikes which of course works against the value the us dollar. On the other side of the Atlantic though, we have concerns about the United Kingdom leaving the European Union and that of course will work against the value of the British pound.

With that being said, I feel it’s only a matter of time before we returned to the other side of consolidation. On a break above the top of the range for the Thursday session, I feel that this market will go higher but it will probably be more of a grind than a straight shot.