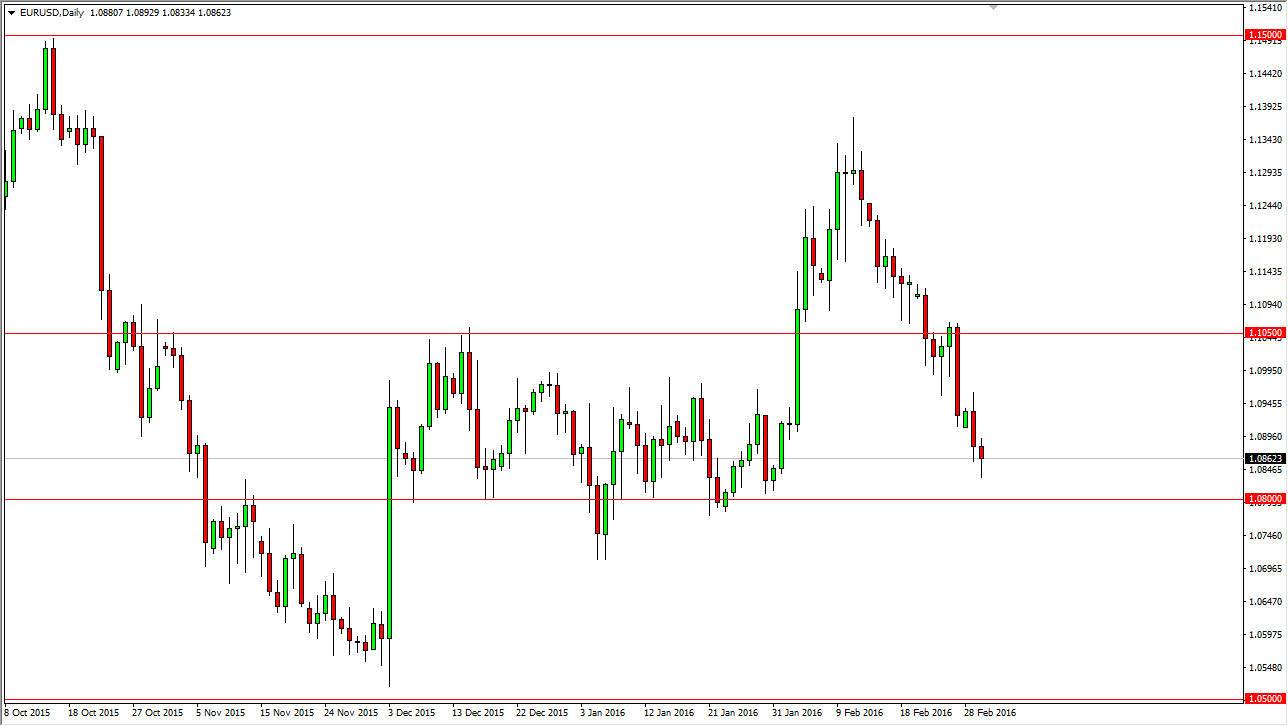

EUR/USD

The EUR/USD pair initially fell on Tuesday, as we continue the downtrend. However, by the end of the day we saw enough buyers enter this market to turn things back around and form a hammer. The hammer of course is a very bullish sign, and as a result I believe that it’s only matter of time before we go much higher. The next target would be the top of the recent consolidation area, so I think that a break above the top of the hammer probably sends this market looking for the 1.10 level or so.

On entering, if we break down below the bottom of a hammer, I don’t see any reason why we don’t reach towards the 1.08 handle next. A move below there would be very negative, as it would show a significant breakdown below what is an obvious support level.

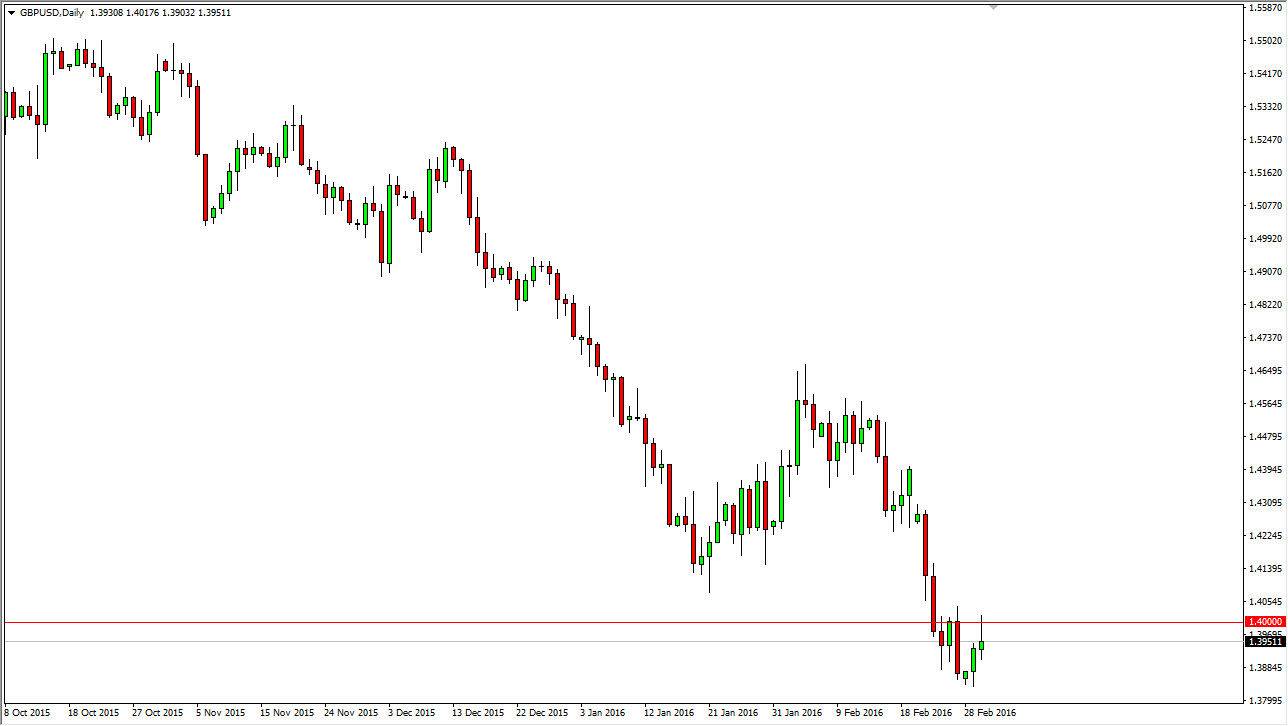

GBP/USD

The GBP/USD pair initially tried to rally during the day on Tuesday, but found the 1.40 level to be a bit too resistive to continue. By seeing this, we ended up turning back around to form a shooting star which of course is one of the most bearish candlesticks that you can find. On top of that, the market could very well have a lot of fears when it comes to whether or not London leaves the European Union. Also, you have to keep in mind that the US dollar is considered to be a safety currency, and there are a lot of concerns out there. The US Dollar Index looks very bullish of the moment, so it makes sense that this pair would continue to the downside.

On the other hand, if we break above the top of the shooting star, we could have a short-term move to the 1.43 level where I think even more selling would enter the fray. Ultimately this point in time though, I believe that the breakdown below the bottom of the candle for the session on Tuesday more than likely sends this market looking for the 1.35 level.