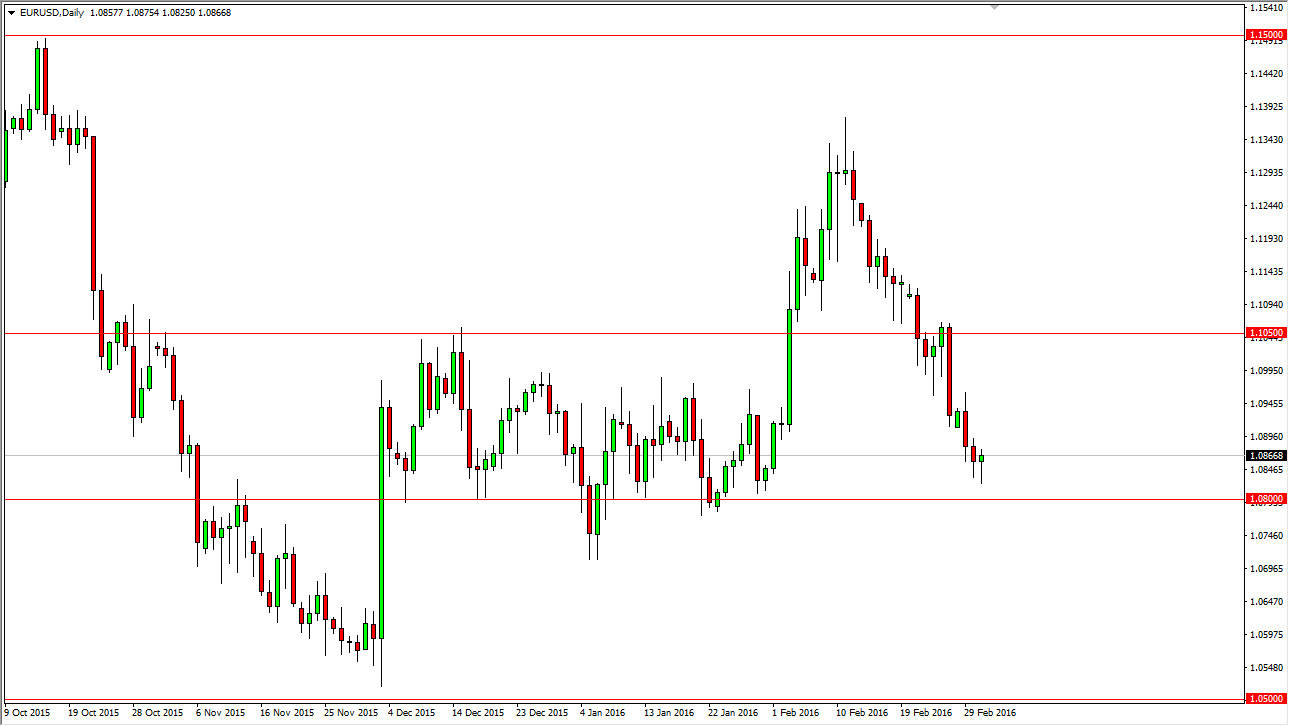

EUR/USD

The EUR/USD pair fell initially during the course of the session on Wednesday, but found enough buying pressure underneath to turn things back around and form a hammer. It looks as if we could very well bounce from here significantly, perhaps reaching as high as 1.10 given enough time. On a break of the top of the candle for the session on Wednesday, I believe that the buyers will come back into this market and take control yet again.

Having said that, this is a market that will probably be somewhat choppy simply because the central banks are looking to keep interest rates low, and by extension monetary policy soft. Because of this, you can expect to see quite a bit of volatility in this market, as there will be continued headline risk going forward.

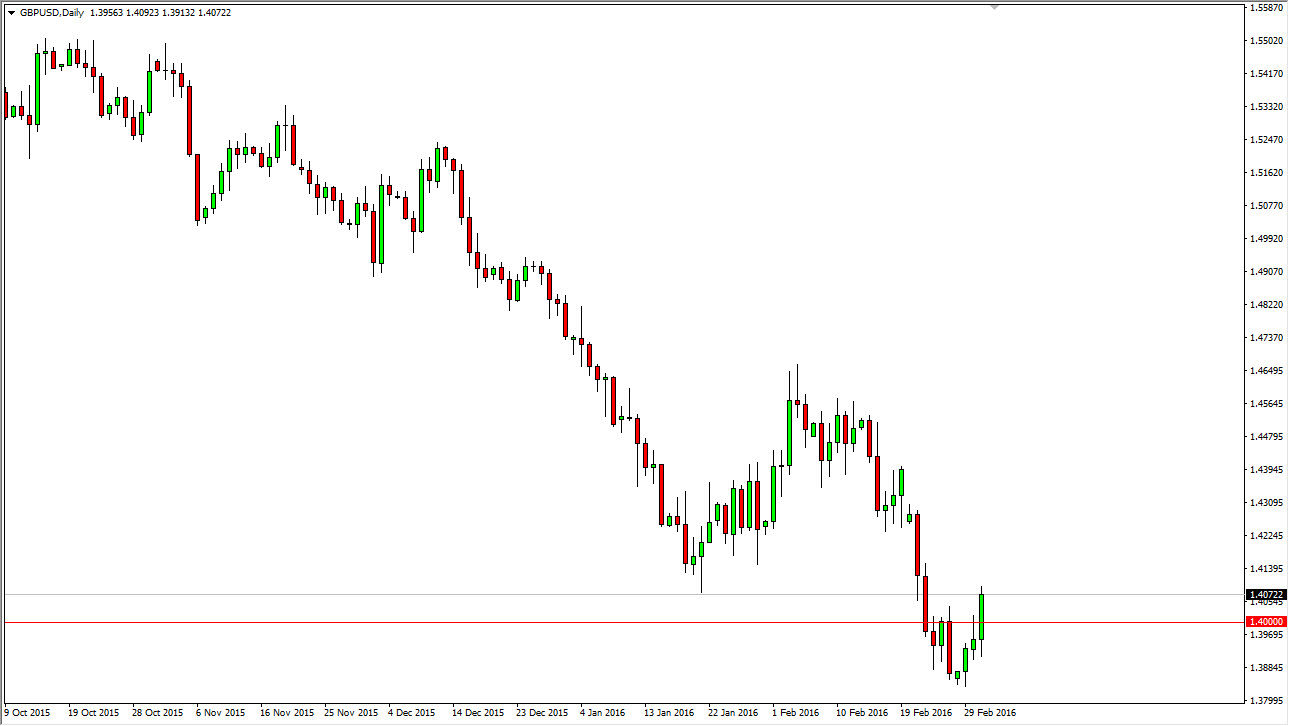

GBP/USD

The British pound had a strong session during the day on Wednesday, as we continue to see quite a bit of volatility in the GBP/USD pair. Ultimately, this is a market that looks like it could go as high as 1.43 level given enough time, but I anticipate seeing quite a bit of selling pressure in that general vicinity as it had been previously so supportive. I think that the British pound will continue to fall overall given enough time, especially considering the fact that the US dollar often is treated as a safety currency.

Because of this, the market will start selling off if there is some type of headline risk war negative economic news out there. On top of that, you have to keep in mind that the jobs number comes out of America on Friday, so there is the possibility that we have a fairly quiet session today, followed by a massive move tomorrow. Obviously, the jobs number is very influential in this market, as it is an almost anything involving the US dollar.