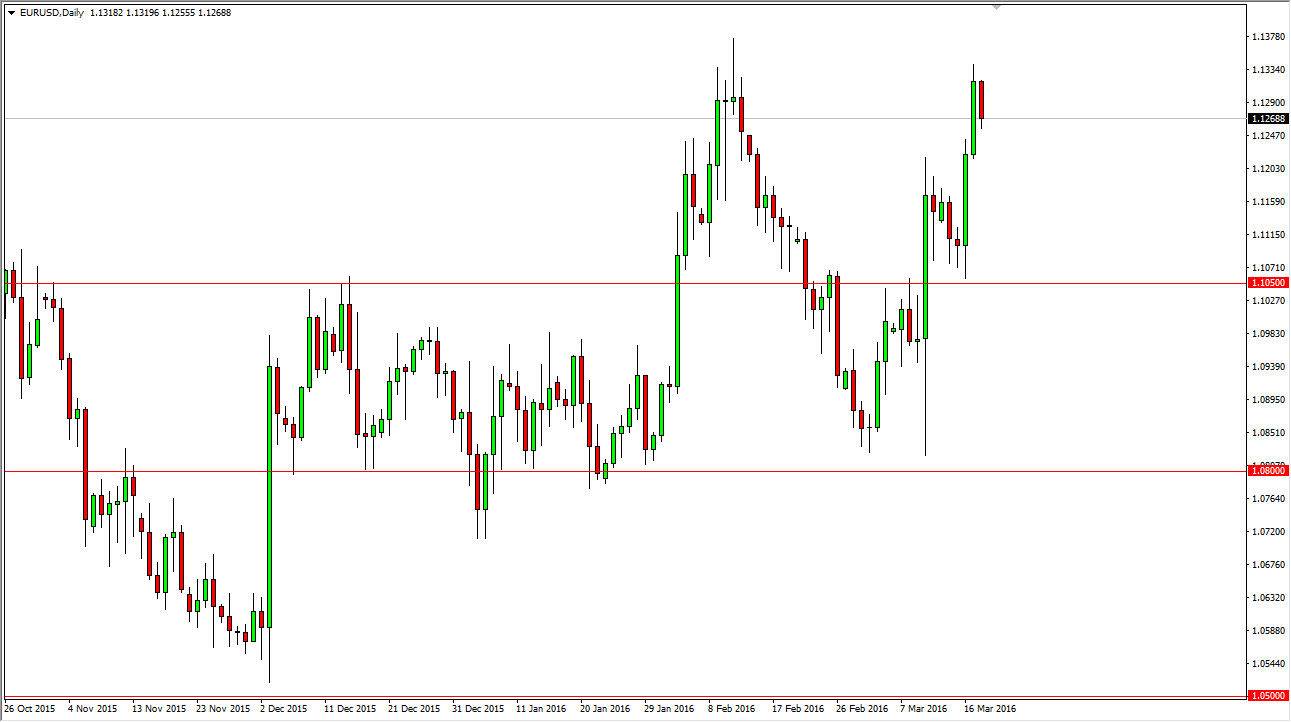

EUR/USD

The EUR/USD pair pulled back during the course of the session on Friday, showing the 1.13 level as being overly exhaustive. This is a market that should continue to go higher given enough time, but at this point in time we are waiting to see whether or not we can find a supportive candle below. At that point in time, I would be willing to buy a supportive candle all the way down to the 1.1050 level. On the other hand, if we break above the top of the 1.13 level, I’d be willing to buy that market as well.

With the Federal Reserve looking very unlikely to raise interest rates as much as once originally thought, it’s very likely that the US dollar will continue to suffer. That almost guarantees that the Euro has to go higher.

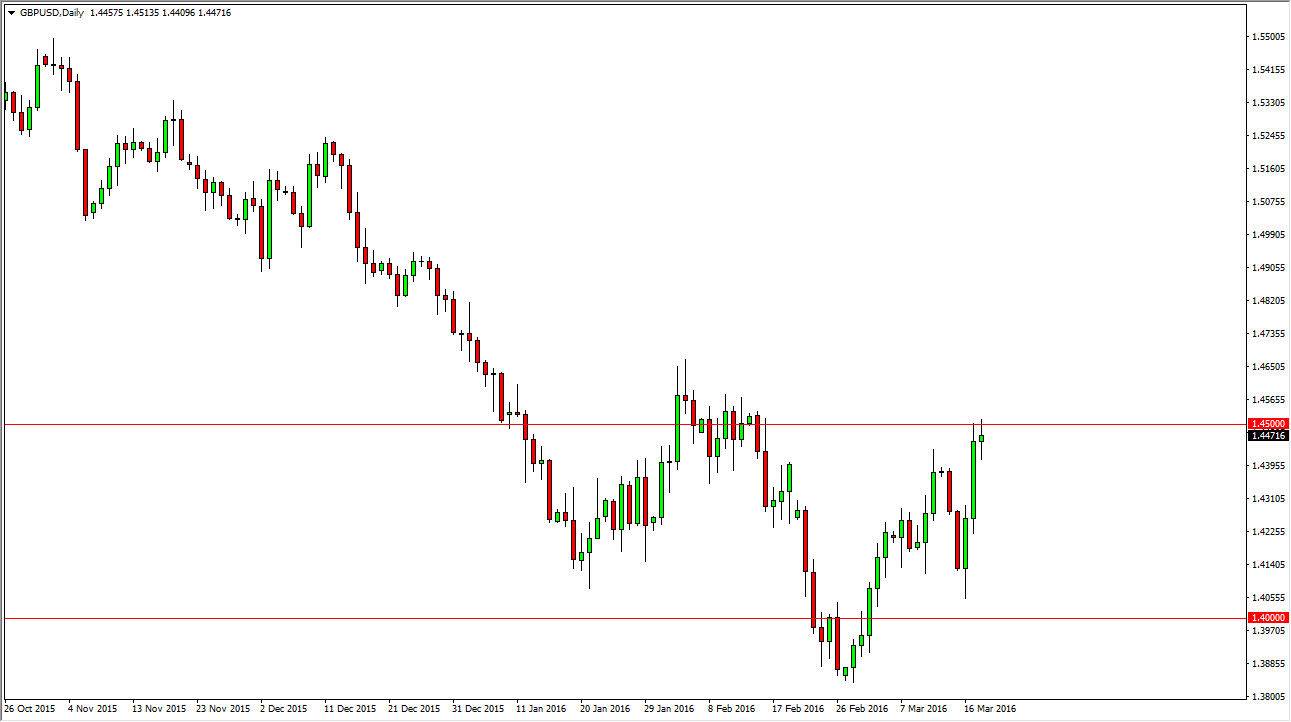

GBP/USD

The GBP/USD pair went back and forth during the course of the session on Friday, and ended up forming a massive neutral candle. We are sitting just below the 1.45 level, which is a massive resistance barrier due to the fact that it is not only a large, round, psychologically significant number, but it also has been an area of interest in the past, especially at the beginning of the year.

Pullbacks at this point in time should be buying opportunities going forward, and therefore I think that if we get a pullback it will more than likely offer the buyers value as we should continue to go higher. Keep in mind that the British pound is going to have a little bit of a negative cloud above it, as we wonder whether or not the British are going to leave the European Union.

Ultimately though, I do believe that this market goes higher so I am preferring to buying short-term pullbacks, but if we can break above the 1.46 level, that would be a nice buying opportunity as well.