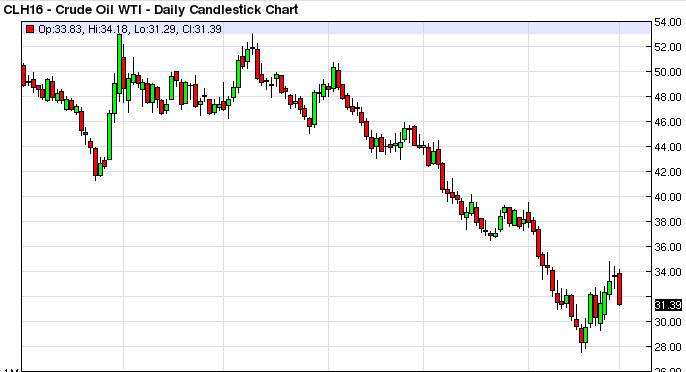

WTI Crude Oil

The WTI Crude Oil market fell significantly during the course of the day on Monday, breaking below the $32 level. The fact that we closed towards the bottom of the candle of course suggests that we are going to see quite a bit of bearish pressure, and as a result I believe that were going to try to reach towards the $30 handle. Any bounce at this point in time should attract sellers though, so I think that’s a selling opportunity as well on short-term candles and show signs of resistance. I have no interest in buying this market at this point. I see a massive amount of resistance all the way to at least the $40 level, so at this point in time it is still “sell only.”

Natural Gas

Natural gas markets gapped lower at the open on Monday, as we have broken significantly below the $2.20 level. Because of this, the market looks as if it is trying to reach the $2.10 level below, which has been rather supportive. I think we break through there sooner or later, and as a result we will see a continuation of the bearish pressure. At that point, I would anticipate the markets reaching towards the $1.90 level after that. I think at this point in time rallies continue to offer selling opportunities, and do not look at how this market has turned back around until we get well above the $2.50 level.

The supply is far too strong for the demand, and having said that I believe that the market should continue to be one that shows quite a bit of bearish pressure, so I am still selling natural gas as I believe we are a long way from turning things around for any significant amount of time going forward.