WTI Crude Oil

The WTI Crude Oil market gapped higher initially during the day on Friday, and then went back and forth to show quite a bit of volatility. The volatility of course suggests that the market is still a bit confused, but could eventually find enough momentum to do something. Given enough time, I still think that the sellers come back into this market, so I’m a bit hesitant to go long at this point in time. I feel that we will eventually reach down towards the $28 level again, and that the $36 level above is going to be resistance. Any type of resistant candle near that area should be an opportunity to take advantage of the rally that of course is going against the overall trend.

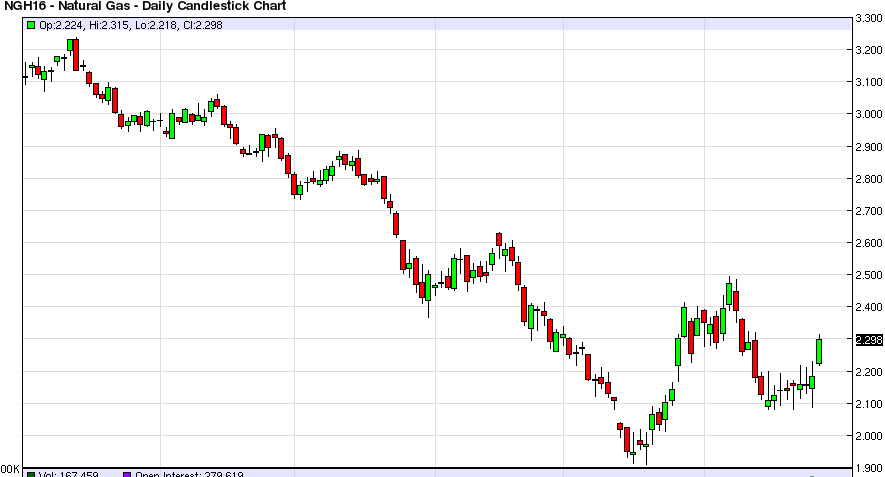

Natural Gas

The natural gas markets gapped higher at the open on Friday, breaking above the $2.20 level. That being the case, we went much higher and reached towards the $2.30 level. However, this is the beginning of pretty significant resistance, so it’s only a matter of time before we see a resistive candle to start selling in my opinion. It is not until we break above the $2.50 level that I feel comfortable buying, so even though it looks bullish all of a sudden, I think it’s only a matter time before the sellers come back down. Having said that though, we have made a “higher low” recently, so a break above the $2.50 level would also not only be that, but also a “higher high.” That would be the very essence of a trend change.

Until we get that, I can only sell this market but right now it looks like it might be difficult to do so just due to the explosive nature of the move on Friday. I will be observing this market.