USD/CAD Signal Update

Yesterday’s signals were not triggered as the price never reached any of the key levels.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm New York time.

Long Trade 1

* Long entry following a bullish price reversal on the H1 time frame upon the next touch of 1.3675.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Long entry following a bullish price reversal on the H1 time frame upon the next touch of 1.3620.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

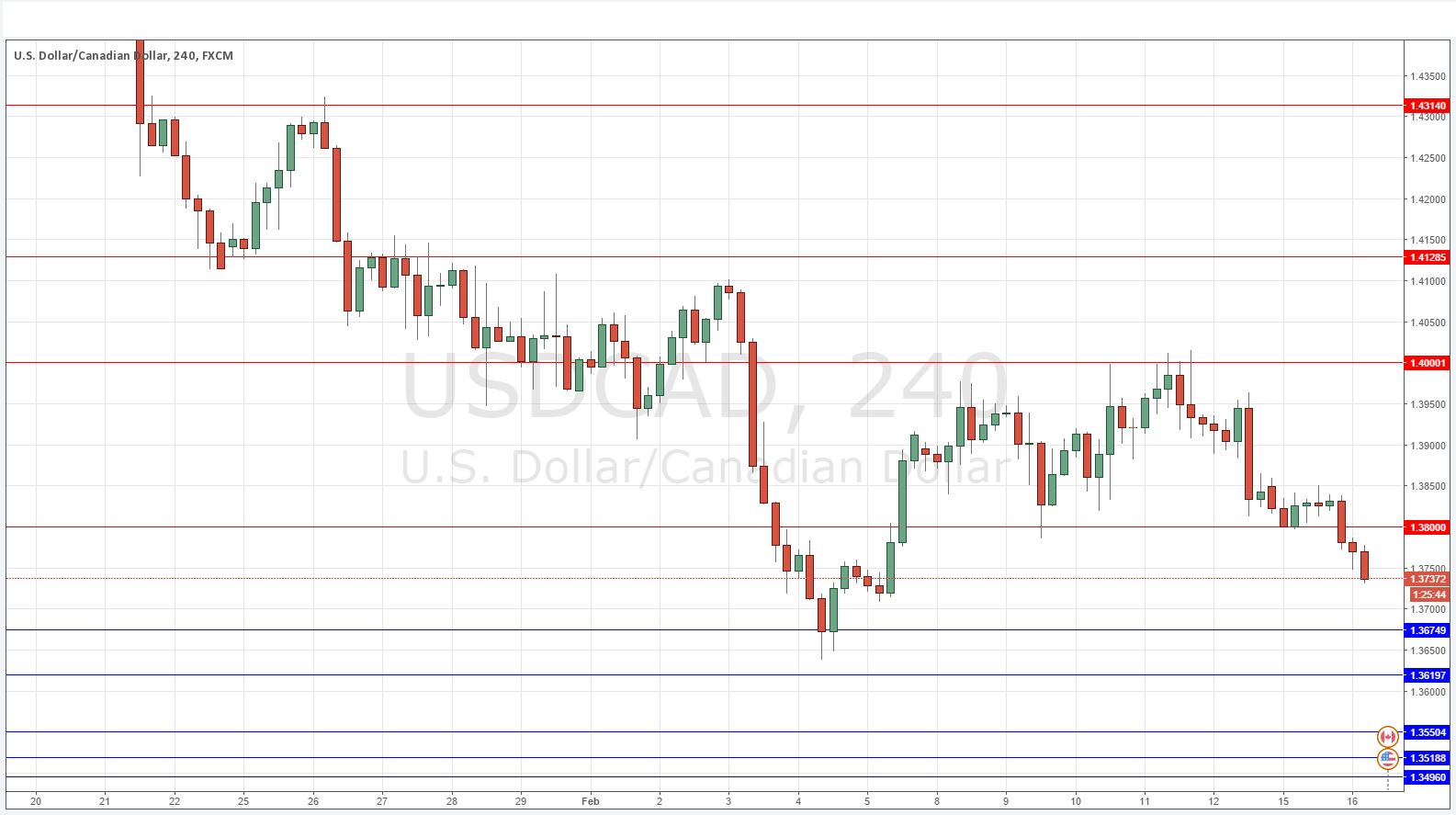

* Short entry after bearish price action on the H1 time frame following a touch of 1.3800.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

At the London Open yesterday it looked as if this pair was going to move up. I suggested that 1.3850 was a key level to watch and that was a good line in the sand, as the repeated failure of the price to get up there presaged a move down below the support at 1.3800 which now looks likely to have flipped to become resistance.

There are a couple of key support levels not very far away that could be hit today, but a short off a pullback to 1.3800 looks like a better bet.

It is significant that even with the USD strength yesterday, the price just could not really move up, although the USD was easily able to do so against the JPY, EUR and CHF.

There is nothing due today concerning the USD. Regarding the CAD, there will be a release of Manufacturing Sales data at 1:30pm London time.