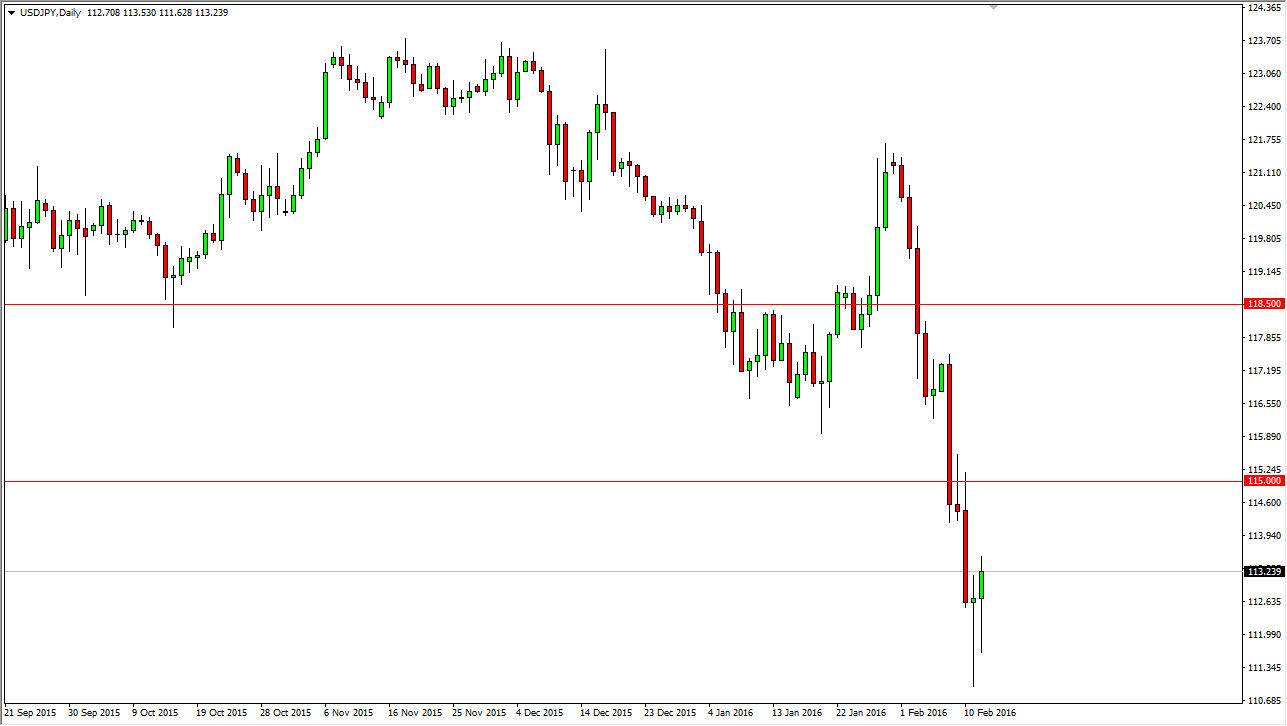

USD/JPY

The USD/JPY pair initially fell during the course of the day, but found enough support below to turn things back around and form a nice-looking hammer. The hammer of course is a bullish sign and as a result I think we will probably see this market bounce from here. Ultimately though, I feel that the 115 level should be massively resistive, and with that I’m simply looking for some type of resistant candle above in order to start selling again. After all, keep in mind that this market is highly sensitive to risk appetite around the world, and that certainly is something that continues to be very negative.

On the other hand, we could break down below the bottom of the hammer for the Thursday session, but the 110 level is just below there, so I need to see this market break down below there in order to sell, so that large, round, psychologically significant number could have an effect.

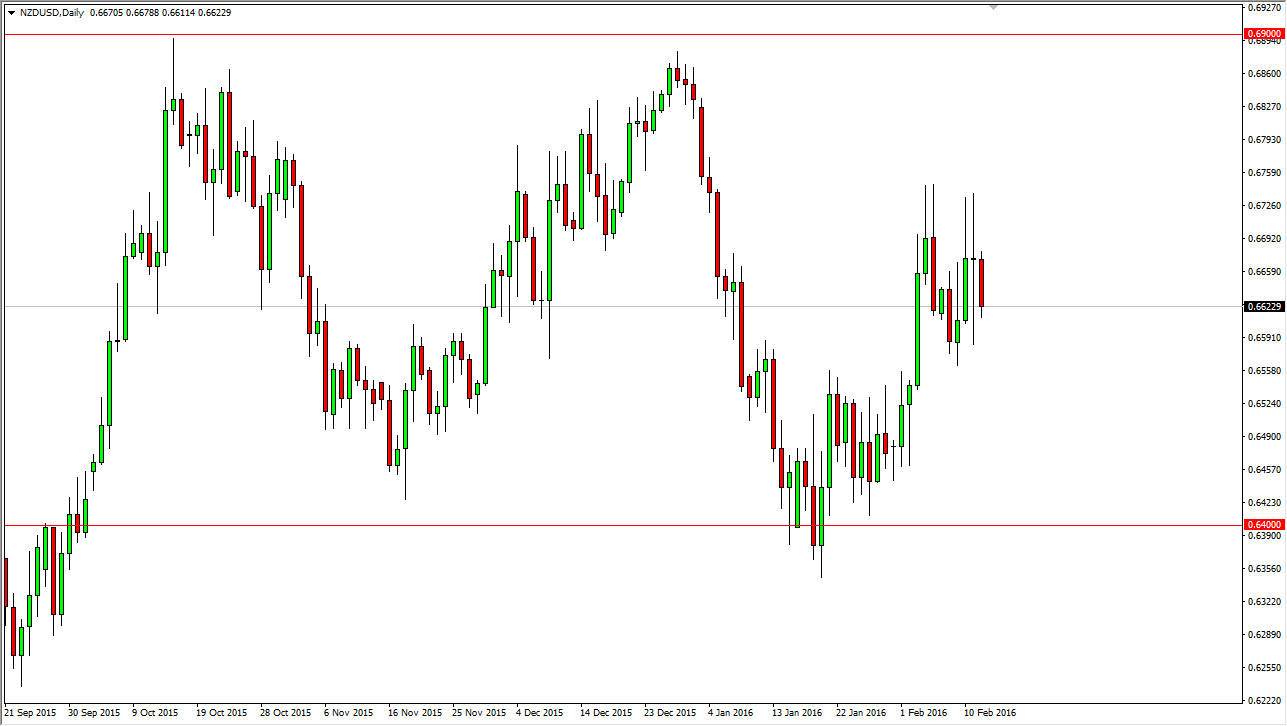

NZD/USD

The NZD/USD pair fell during the day on Friday, as we continue to grind away and go back and forth. The market looks as if it is simply going to continue to bounce between the 0.65 level on the bottom and the 0.67 level on the top. Keep in mind that the New Zealand dollar is highly sensitive to commodity markets, and as a result it’s going to be difficult to put any real money into this market as there is so much volatility.

All things being equal, I believe that this market is probably best left alone as the choppiness is going to be difficult to deal with. That’s only true if you are a short-term scalper though, because we do have a well-defined range as mentioned above, and that of course gives us an opportunity to make real money going back and forth. Ultimately, the only thing I see is a scalping opportunity.