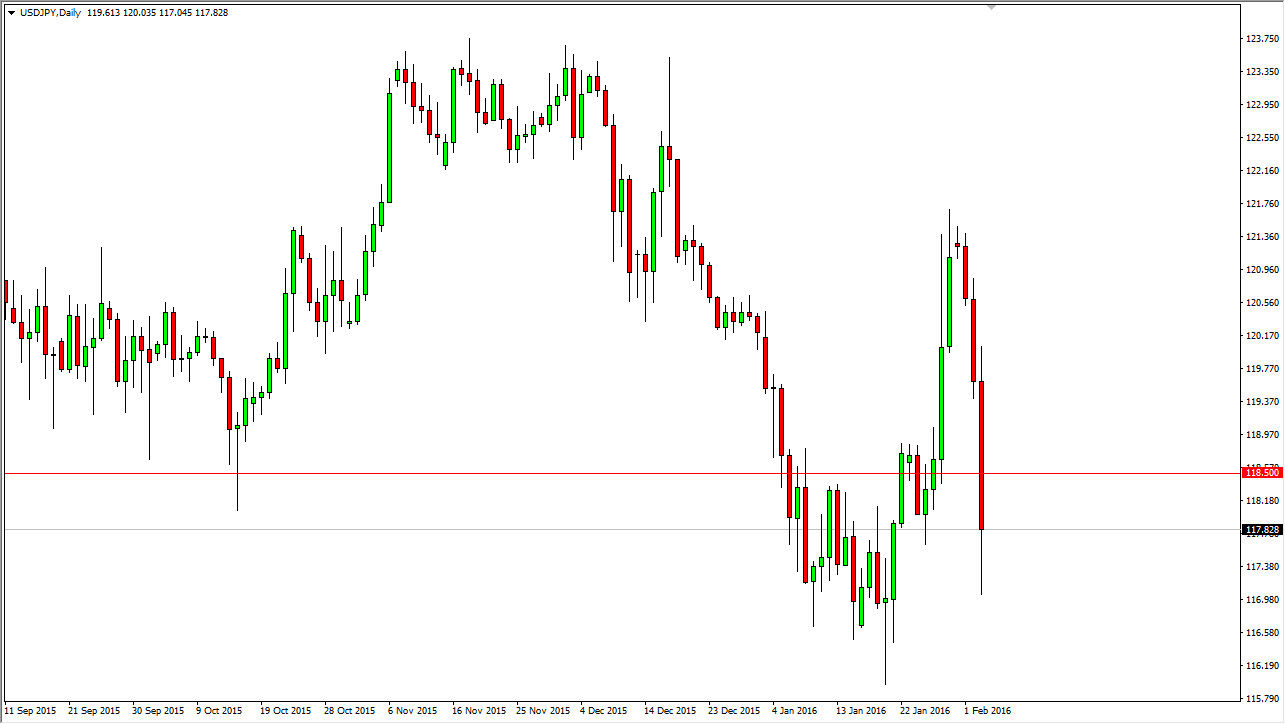

USD/JPY

The USD/JPY pair broke down significantly during the course of the day on Wednesday, slicing through the 118.50 level. By doing so, the market looks like it’s suddenly is struggling with the idea of breaking down, but by the end of the day we did get a bit of a bounce. While the market still looks rather negative, we have to keep in mind that tomorrow the Nonfarm Payroll Numbers come out, and with that we could get a complete turnaround in a flash. Because of that, I am actually looking at this market as one that could probably be avoided today due to the fact that there is quite a bit of back and forth. However, I believe that the jobs number will be exactly what moves this market next, so we will have to wait to see what we get next.

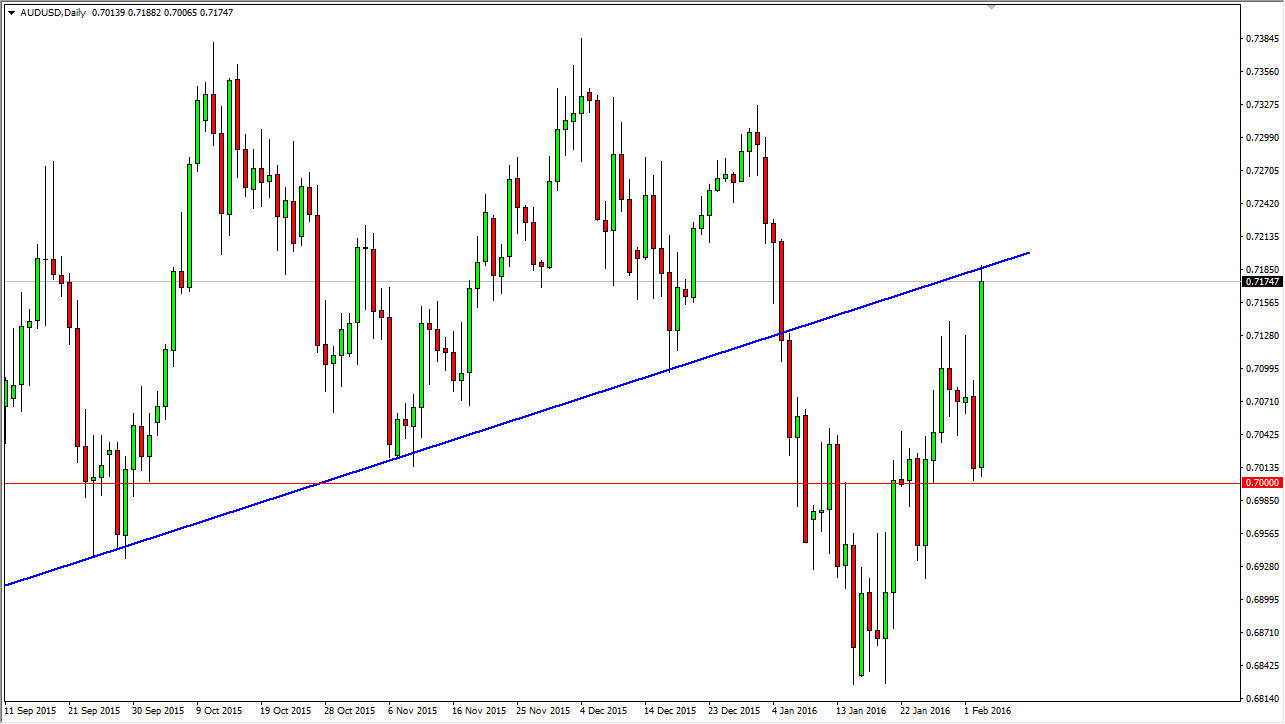

AUD/USD

The AUD/USD pair launched itself in a very violent fashion during the day on Wednesday, testing the bottom of a previous uptrend line that should now be fairly resistive. Because of this, we are now at an area that could cause quite a bit of resistance. Ultimately, this is a market that if we break above the top of this uptrend line, I could be a buyer. However, we have the Reserve Bank of Australia releasing its Monetary Policy Statement. Because of this, the market could very well be volatile during the day and that could be reason enough to see this market go in one direction or the other. With this, it’s very likely that the market will be one that’s worth paying attention to today, but at this point in time we will have to wait until that announcement comes out before we see how we react. Because of this, I will follow what the market does the one hour after the announcement comes out.