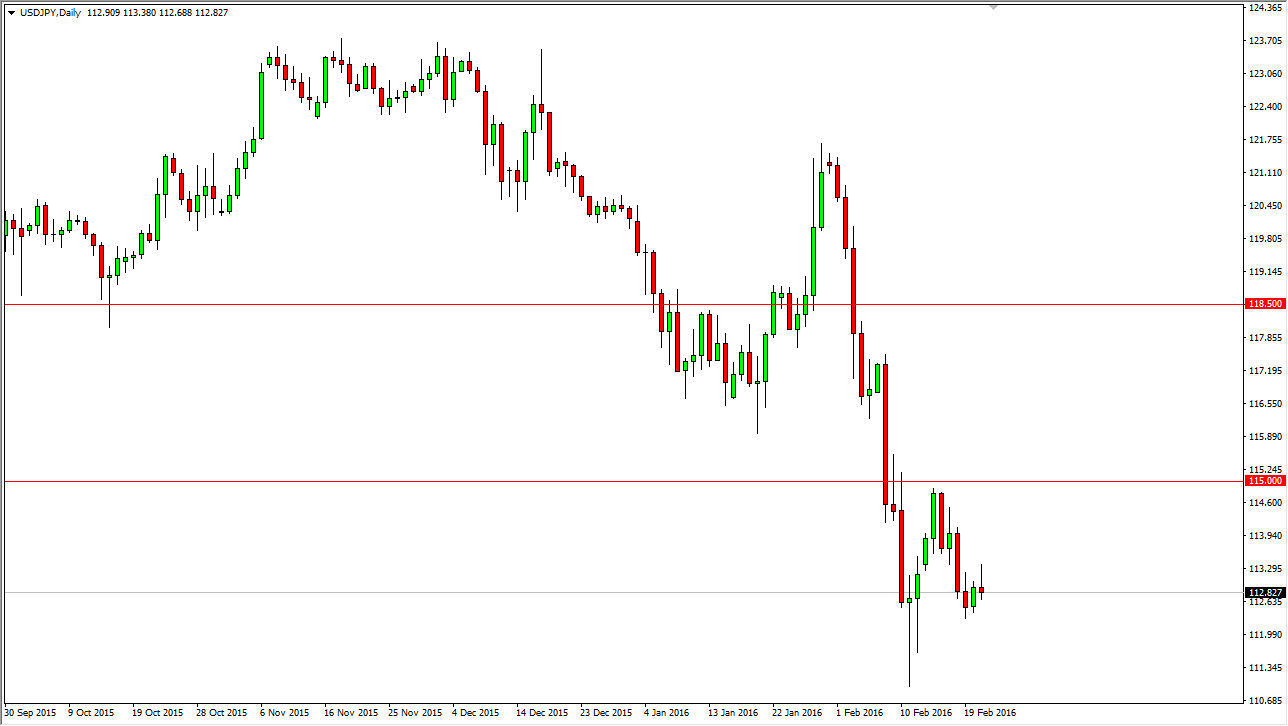

USD/JPY

The USD/JPY pair initially rallied during the course of the session on Monday, but turned back around to form a bit of a shooting star. Because of this, we feel that the market will probably drop from here and therefore offer selling opportunities on signs of exhaustion. Keep in mind that this pair does seem to be somewhat risk sensitive, so if stock markets fall it could very possibly be an opportunity to sell. On entering, I believe that the 115 level above is the absolute “ceiling” in this market, so if we can get above there I would be willing to buy this pair. At the moment though, it does seem as if the Japanese yen is strengthening overall, which makes quite a bit of sense as there are a lot of concerns around the world economically.

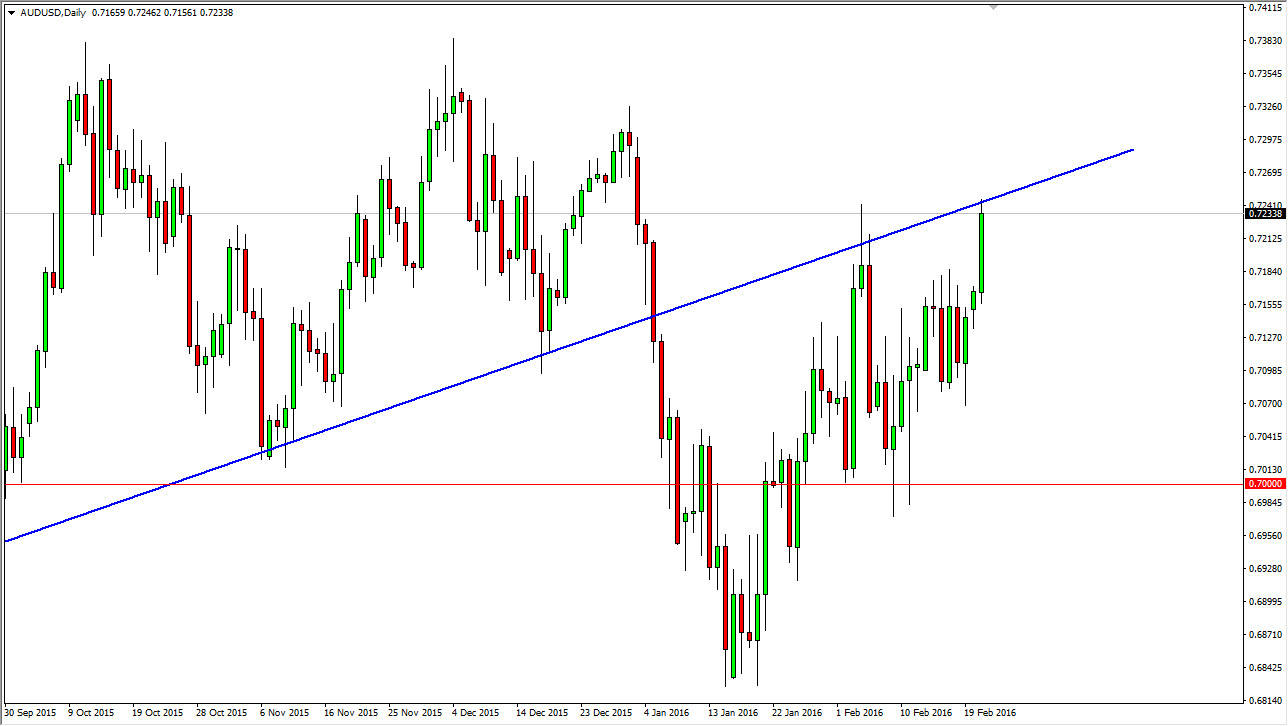

AUD/USD

The AUD/USD pair broke higher during the course of the day on Monday, slamming into the bottom of the uptrend line that had recently been so supportive of the Aussie. Now, it should end up being a very resistant candle. Ultimately, this market will decide where wants to go next, depending on which direction we go from this trend line. If we can close above it, this market should continue to grind its way much higher and therefore the Australian dollar becomes a currency that you can own. On entering, we get some type of resistant candle that we could very well drop from here. Keep in mind that the Australian dollar is often influenced by gold, but is also quite often influenced by what’s going on in Asia. Perhaps this is a simple sign of the Australian dollar trying to catch up to the rally in the gold market, as it has been rising for some time, while the Australian dollar has been a bit lackluster.

Either way, this is a market that should make up its mind fairly soon, and as a result this is a market that should make a longer-term move fairly soon. With that being the case, this is a market that you should be paying quite a bit attention to.