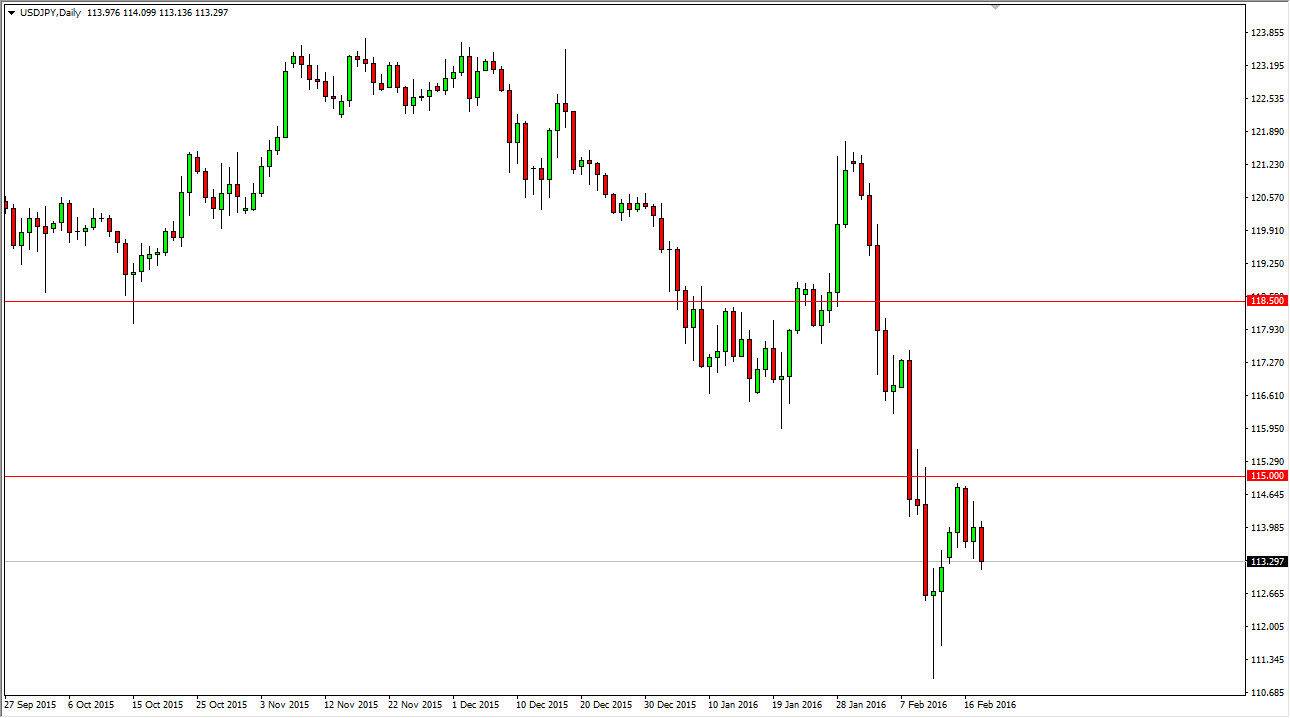

USD/JPY

The USD/JPY pair fell significantly during the course of the day on Thursday, breaking the bottom of the shooting star from Wednesday. Because of this, the market looks as if it is going to grind its way a little bit lower, but I think that there is enough support below to keep this from being a quick move. Rallies at this point in time should continue to sell off, at least as long as we can stay below the 115 handle. As a longer below there, I think that the sellers we firmly in control. On the other hand, if we could break above there I think that the buyers would suddenly take over in the market could probably go to the 117 level without too many issues. Keep in mind that this pair tends to be very sensitive to risk appetite around the world, so pay attention to what the stock markets do.

AUD/USD

The AUD/USD pair did almost nothing during the session on Thursday as we continue to hover just below the 0.72 handle. That area should continue to be resistive, and as a result I find that it’s going to be difficult for this market to go above that level. If we do, we could very well try to reach towards the 0.7350 handle. The meantime, I believe that short-term pullbacks are possible, which would just simply be a return to consolidation. We could go as low as 0.70, and if I had to place a trade in the Australian dollar, it would be to the downside as I think it’s the most likely move.

Keep in mind that the Aussie dollar has not strengthen while gold rallied, at least not markedly so, and as a result I feel that the Australian dollar is paying more attention to Australian that it is the traditional commodity markets.