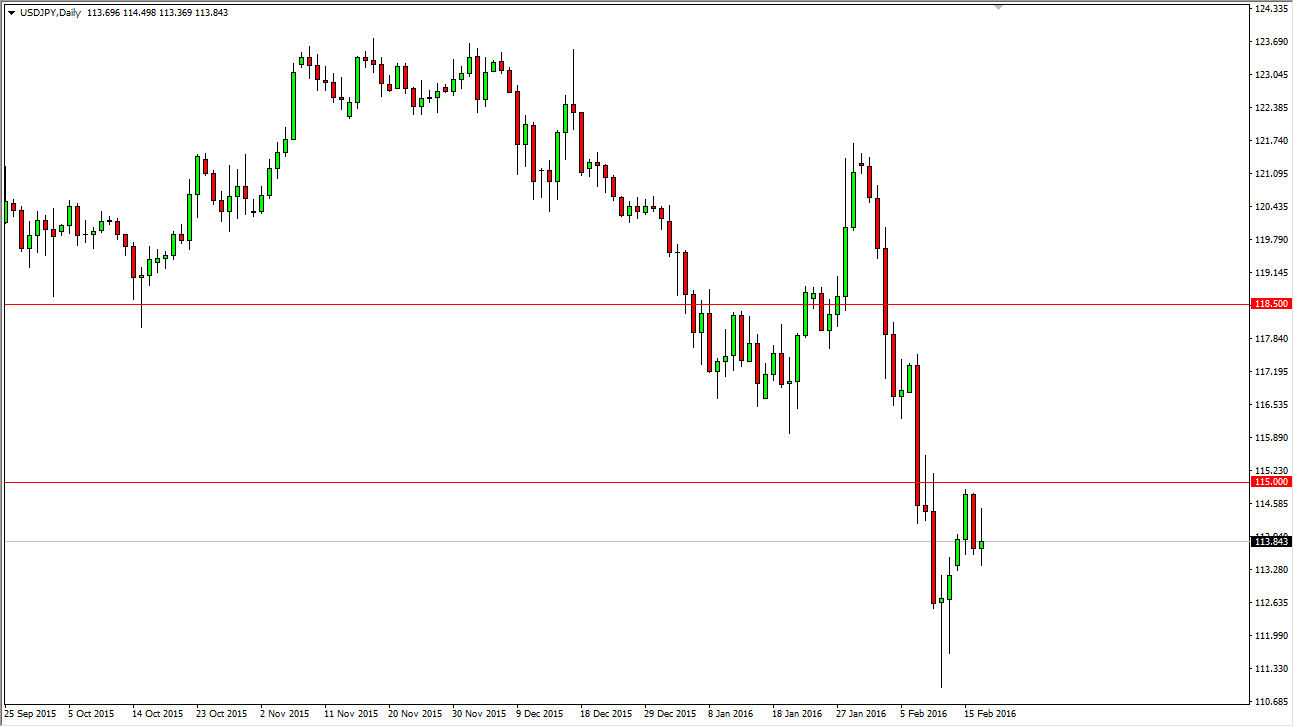

USD/JPY

The USD/JPY pair initially tried to rally during the day on Wednesday but struggled just below the 115 handle. I believe that we are going to see continued consolidation and the fact that we formed a shooting star suggests to me that perhaps the consolidation is going to lead to lower levels near the 112 handle. This wouldn’t be much of a surprise to be honest with you, because there are a lot of concerns when it comes to the financial markets around the world and of course this particular pair seems to be very sensitive to that. On the other hand, if we can break above the 115.50 level, I feel that the market could very well go to roughly 117. Ultimately though, it does look like the downside is probably going to be favored at this point in time.

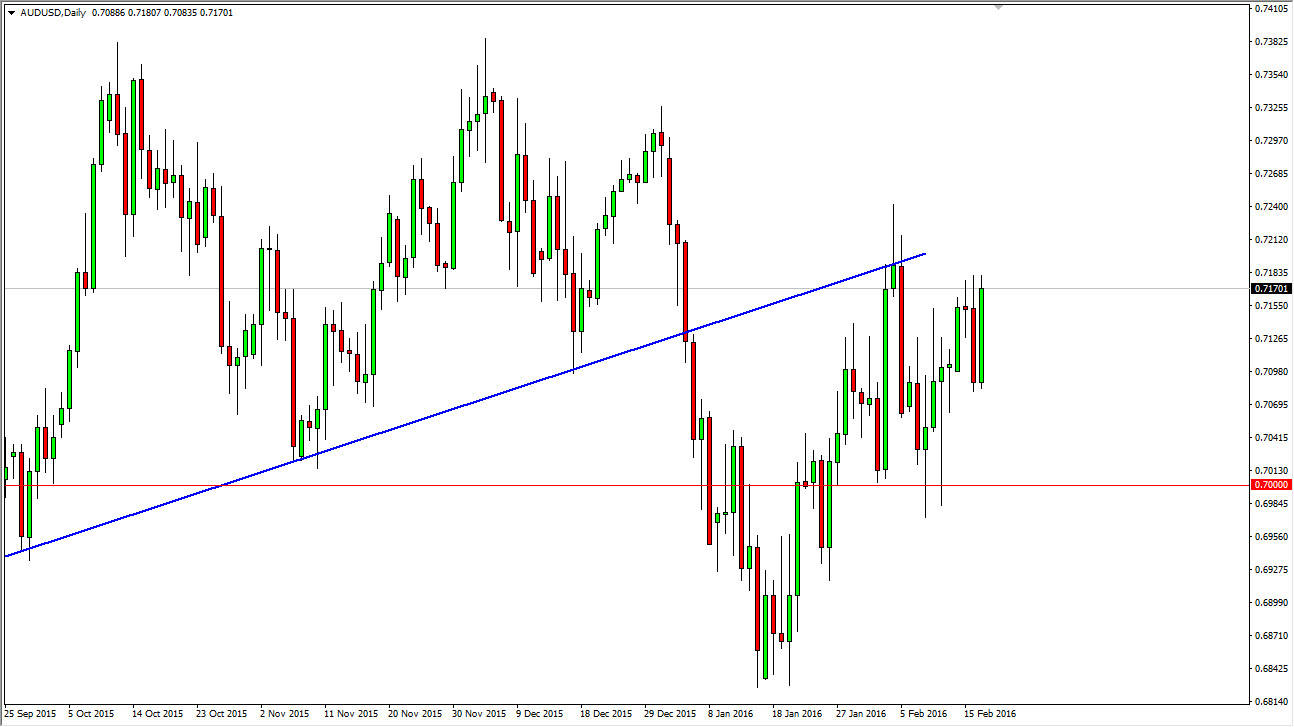

AUD/USD

The Australian dollar rose during the course of the day on Wednesday, but we still find ourselves just below the vital 0.72 level. At this point in time, even though things look stronger today, quite frankly I still feel that we could very well fall from here and as a result I would be more than willing to sell a resistive or exhaustive candle that forms in this general vicinity.

If we did break above the 0.7250 level, at that point in time, I feel that the Australian dollar could really start to rally at that point. But I also understand that there are a lot of concerns in Asia, and that always weighs upon the Australian dollar as it is considered a proxy for Asian growth. On top of that, we also have gold markets which look rather healthy but don’t seem to be helping the Aussie, which is a bit of an anomaly in and of itself. Given enough time, I think we continue to consolidate between the 0.70 level on the bottom, and the 0.72 level on the top.