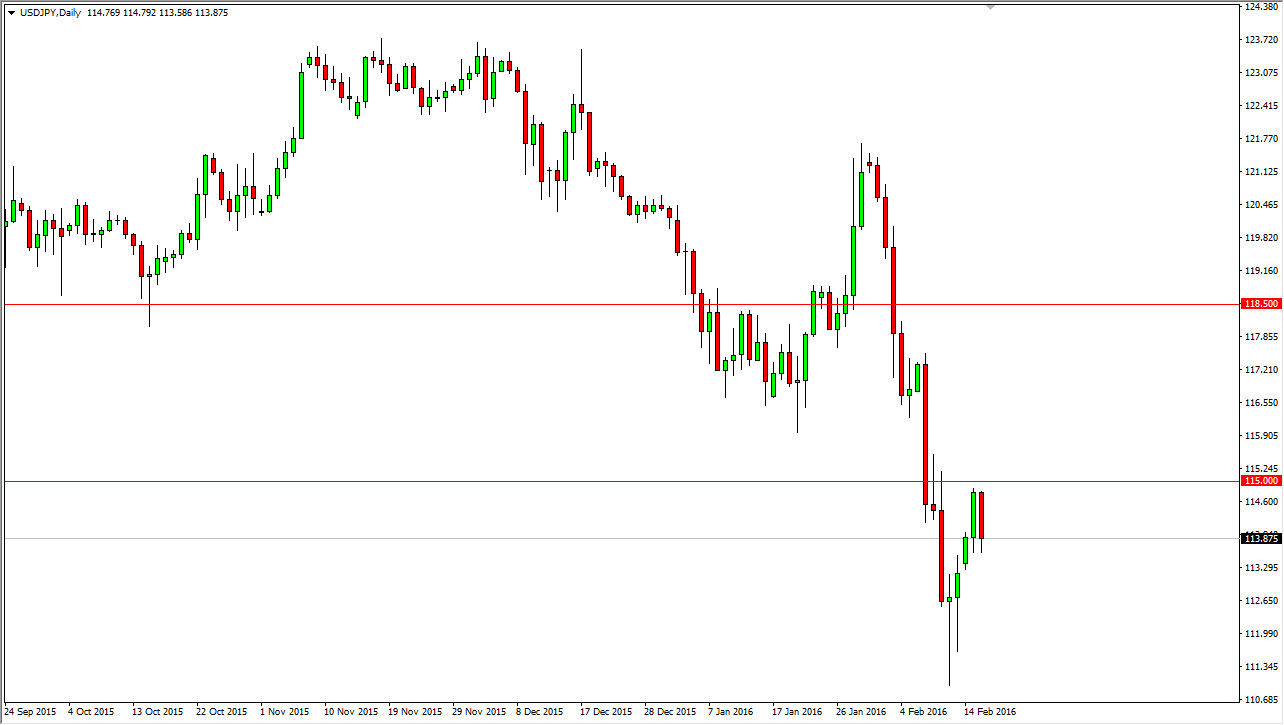

USD/JPY

The USD/JPY pair fell during the day on Tuesday, testing the 115 handle. That area offered enough resistance to turn things back around and as a result it looks as if the markets are going to continue to struggle going forward. The fact that we couldn’t break above that level is a very negative sign, and I believe we will eventually try to reach down to the 112 level. That is an area that has a lot of support around it, so I don’t associate we feel that a break down below it. Given enough time, it’s very likely that this market will continue to be susceptible to the volatility and the risk appetite found in the stock markets. In the meantime, I believe that buying this market is going to be almost impossible as there are so many negative headwinds out there.

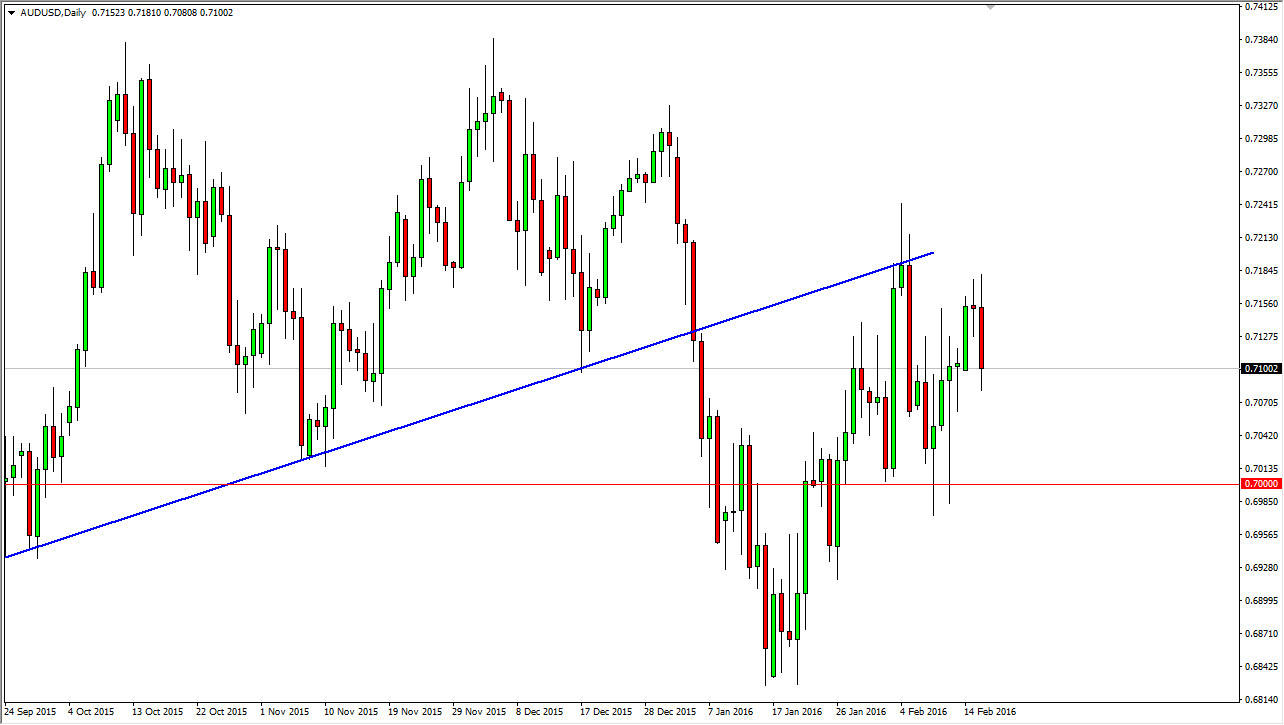

AUD/USD

The AUD/USD pair initially tried to rally during the course of the day on Tuesday but found enough resistance above to turn things around and form a rather negative candle. This is not surprise me at all as there are a lot of concerns with growth in Asia and of course the world in general. The Australian dollar tends to be very sensitive to commodities overall, and with that being the case it’s very likely that this market will continue to sell off at this point in time looking for support which I believe we will find somewhere near the 0.70 handle. With that being the case, the market more than likely will continue to look somewhat soft. I think short-term sellers will continue to drive where we go next. Even with gold markets looking fairly strong, the Australian dollar has not performed. Because of this, this tells me that most traders are worried about Asia, and not so much the gold pits.