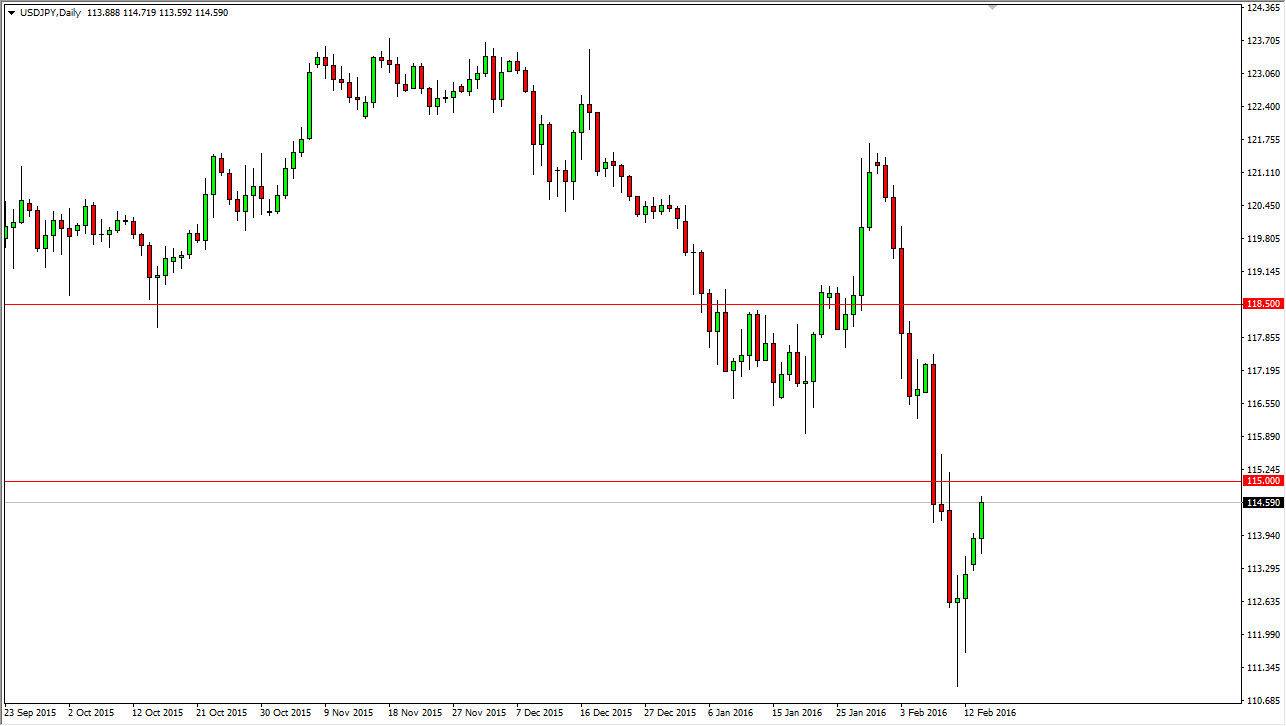

USD/JPY

The USD/JPY pair rose during the day on Monday, testing the 114.50 level. Ultimately, this is a market that should continue to find sellers, as the 115 level should end up being resistive. In fact, I believe there is quite a bit of resistance all the way to the 117 handle, and as a result we will more than likely see an exhaustive candle that we can sell fairly soon. I think that you have to be careful with this market anyway, because the USD/JPY pair tends to be very sensitive to economic risk appetite around the world.

There are a lot of concerns out there right now, and as a result I feel that it’s only a matter of time before the sellers get involved, and I will not hesitate to short this market. It’s not until we get well above the 117 level that I would consider buying this market. Ultimately, I think that it’s very likely that the market will continue to be difficult to deal with, as there are so many concerns around the world. Keep in mind that central bankers are starting to jawbone the markets again, so we will have sudden and violent moves from time to time.

AUD/USD

The AUD/USD pair initially tried to rally during the day but quite frankly could not hang onto the gains as we turned back around form a bit of a shooting star. It looks now as if we will more than likely fall from here and we could even go as low as the 0.70 level. I think that consolidation is the most likely of paths going forward, as we most certainly have quite a bit of volatility ahead of us and of course people are concerned about Asia and growth in that part of the world. Australia is a bit of a proxy for China, so while gold markets have been reasonably strong lately, the Australian dollar seems to ignore that.