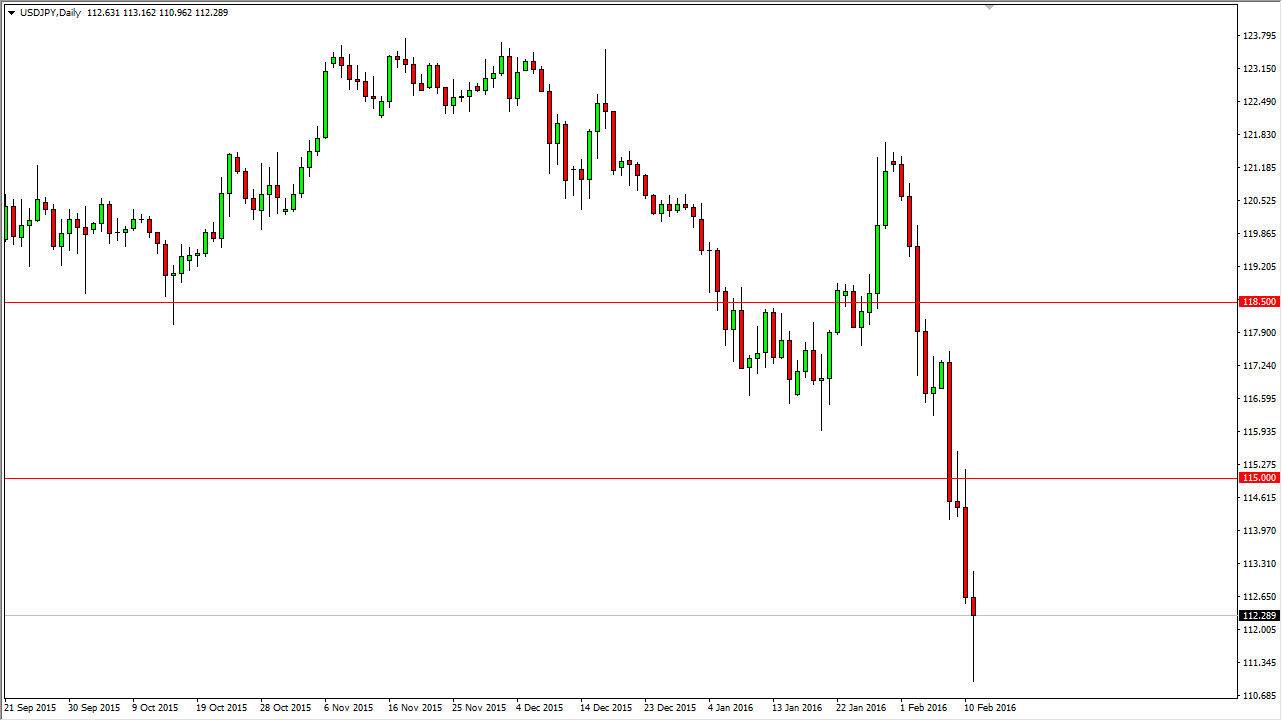

USD/JPY

The USD/JPY pair fell initially during the course of the session on Thursday, but did find a bit of resiliency underneath. By doing so, it looks like the market is going to end up forming a hammer. That’s a relatively bullish sign but at the end of the day I think that this market is far too bearish to try to “pick the bottom.” That’s a full game anyways, so at this point in time I think it’s probably going to be much easier to simply wait for a rally that show signs of exhaustion so that we can start selling. Once that happens, I will not hesitate to start selling this particular market as the US dollar is certainly on its back foot due to comments coming from Janet Yellen and the likelihood of the Federal Reserve having to wait to raise interest rates.

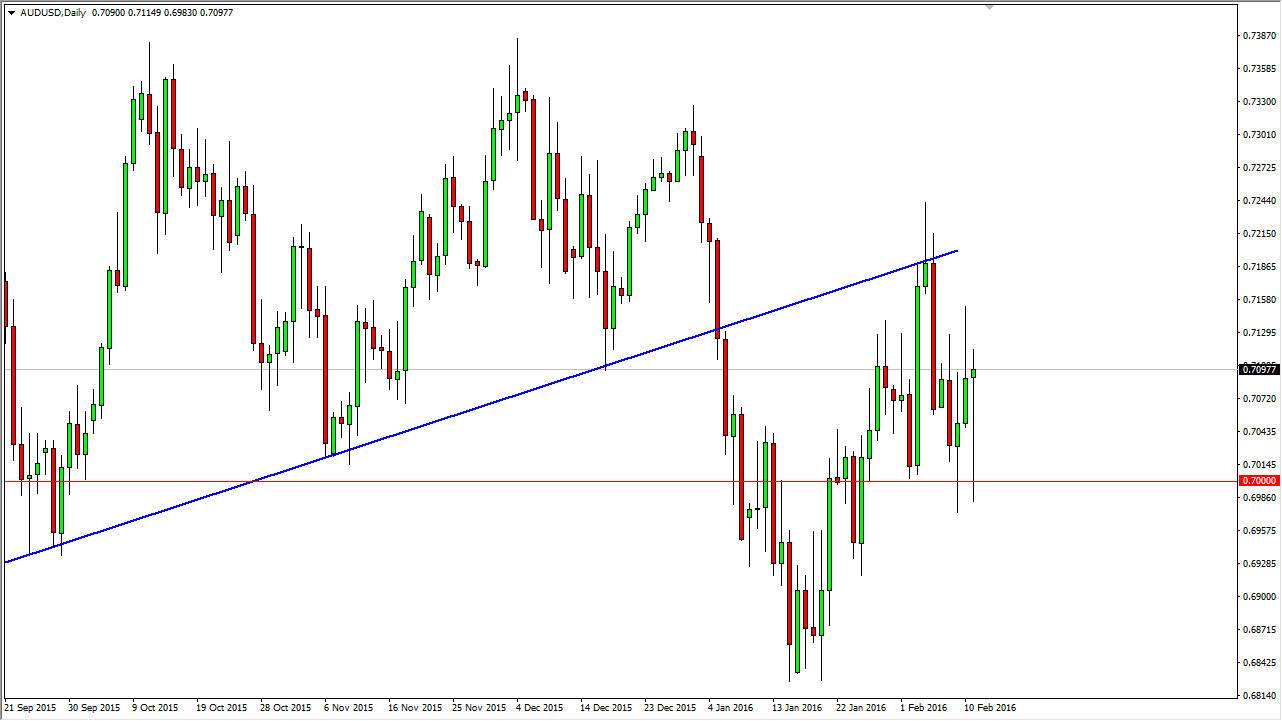

AUD/USD

The AUD/USD pair fell initially during the course of the session on Thursday, but found the 0.70 level to be supportive enough to turn things around and form a hammer. The hammer of course is a very bullish sign and it now suggests to me that the market is probably going to trying to go back towards the top where there is a significant amount of resistance. This essentially sets the Australian dollar up as a fairly consolidative market, as the pair should continue to bounce between the 0.70 level on the bottom, and the 0.72 level on the top in my estimation.

If you are short-term trader, you can simply go back and forth but I personally don’t like these types of markets because sooner or later you have to lose to see where the markets going to go. I am simply going to wait until we break out in one direction or the other to get involved. Gold markets are lifting the Australian dollar, but at the end of the day the Aussie doesn’t look anywhere near as strong as the yellow metal.