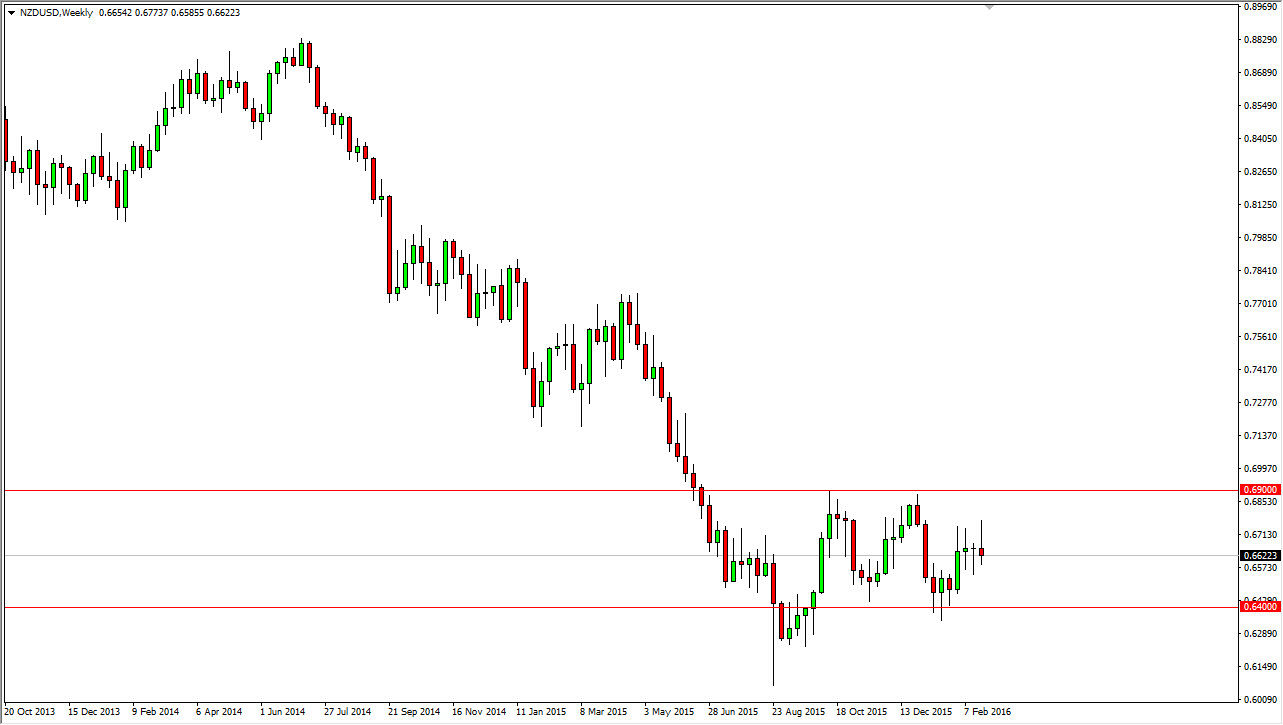

The NZD/USD pair has been very choppy over the last couple of months, but the one thing that I do like about this market is that the levels that we have to pay attention to have been so well defined. I believe that the 0.64 level below is massively supportive and will essentially be the “floor” in this market going forward. I believe that the 0.69 level above is massively resistive and should be the ceiling. In fact, I do not think that this market is going to be any different and I think we will continue to go back and forth between these 2 levels in general.

No Man’s Land

At this point in time, I feel like we are in no man’s land though, because we are essentially at “fair value.” In other words, pay attention to the 0.67 level, as that will be the median of trading as far as the range is concerned. In other words, it’s quite easy to buy down near the 0.64 level, and it’s quite easy to sell near the 0.69 level above. I would take profits at the 0.67 level, and wait for the market to go towards one of the extremes in order to get involved.

Needless to say, if we broke above the 0.69 level, the market would then break out to the upside and it could be a longer-term “buy-and-hold” type of situation. You could also say the same thing about a break down below the 0.64 level, because that would be a capitulation of support, and could send this market down to the 0.60 level. Keep in mind that the New Zealand dollar is highly sensitive to commodity markets in general, so that of course can have an extreme influence on this market.

All things being equal though, I do think that we continue to be very back and forth and with that being the case this is a market that will be excellent for shorter-term traders.