Gold rallied to its highest in nearly 14 weeks on Wednesday as falling equity markets and weakness in the U.S. dollar underpinned the precious metal. The XAU/USD pair was able to cleanly break through the resistance in the 1132/1 zone after a surprisingly soft reading on the U.S. services sector reinforced the view that the Federal Reserve will refrain from raising interest rates in coming months. The Institute for Supply Management's non-manufacturing index came in at 53.5, down from the previous month's 55.3 and below expectations for a reading of 55.1.

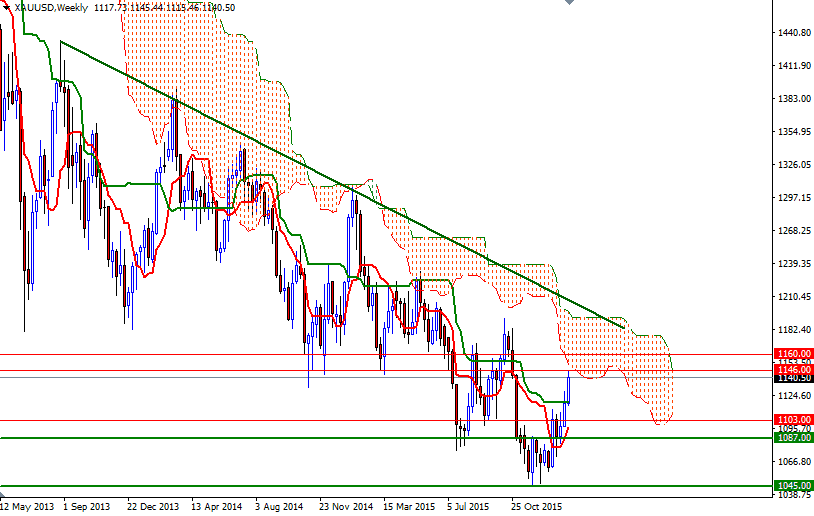

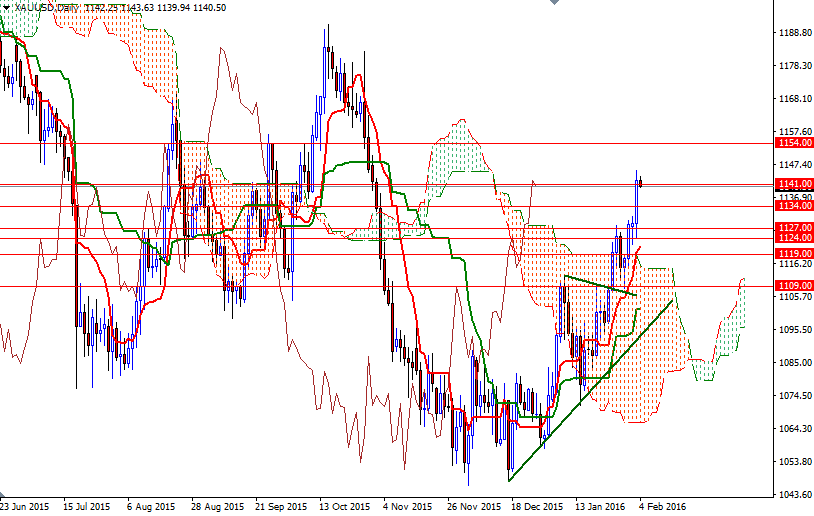

Not surprisingly, breaching the 1132/1 area drove up prices and as a result the market reached the fist upside target (1160/46) that I mentioned in both the quarterly and monthly analysis. XAU/USD is trading at 1140.50, slightly lower than the opening price of 1142.25. Focus now turns to the Labor Department's comprehensive non-farm payrolls report which will be released on Friday. The short-term charts have been pointing out higher prices since the market climbed above the 4-hourly Ichimoku cloud after establishing an ascending trend-line but I would advise caution at this point.

The area between the 1146 and 1160.50 levels has been troublesome in the past and now it is overlapped by the weekly cloud so it may create a tough situation for the bulls ahead of key data releases. If the bulls maintain the control and pass through the 1147/6 area, look for further upside with 1151 and 1154 as targets. Any failure to penetrate 1147/6 may put extra pressure on the market. In that case, XAU/USD could revisit 1138 and 1134. The bears will have to pull prices back below 1134 so that they can test 1131 and 1127.