By: DailyForex.com

Gold settled down $7.97 at $1238.38 on Friday as a recovery in risk appetite prompted investors to book profits after the previous session's rally to rally to the highest level. Despite Friday’s decline, the XAU/USD pair ended the week up nearly 5.6%, bolstered by notions that weak economic data and global turmoil will force the Fed to delay further rate hikes. Fed officials including Yellen cautioned that the impact of financial-market turbulence on the U.S. economy is still unclear and altering the outlook for growth. "The economic outlook is uncertain...Foreign economic developments, in particular, pose risks to US economic growth," the U.S. central bank chief said in her semi-annual testimony to Congress.

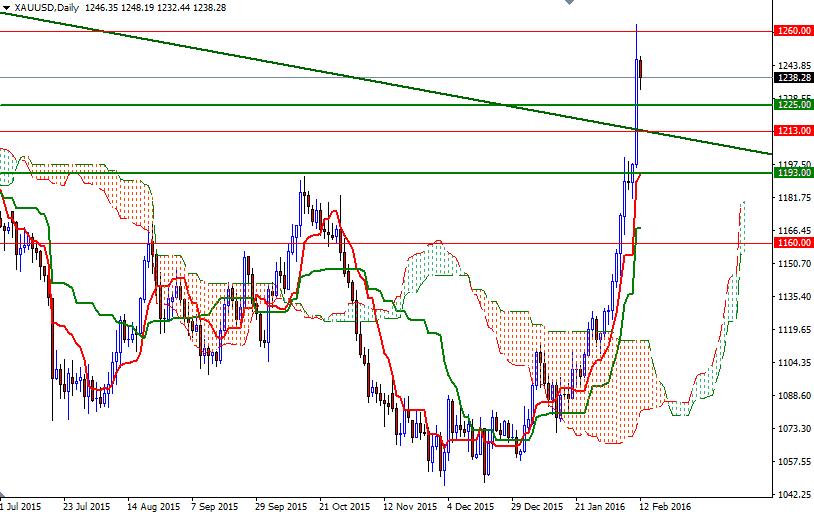

Technical buying pressure was also behind gold's jump last week. Breaking through the 1225 - 1193 resistance triggered a fresh round of buying and pushed prices rapidly. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 98428 contracts (the highest level in fourteen weeks), from 72822 a week earlier. Climbing above the weekly Ichimoku cloud is of course a bullish sign that alters the medium-term picture. Bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross on the weekly chart also supports this theory.

Based on the measurements, the initial target of this upwards move is the 1295/85 area - unless the market ends up back below 1171. During this journey, resistance can be found in the 1250/48, 1262/0 and 1274/2 regions. Despite the fact that the XAU/USD pair had very strong week, having been rejected at 1262 makes me think that the market could return to the broken bearish trend line (the as long as resistance in the 1250/48 resistance is not surpassed. This would make sense, given that the market has traveled a pretty long distance in a relatively short period. If the fall doesn't halt at 1213, there is probably support at around 1205 and that is likely to extend all way down to the 1193/1.