By: DailyForex.com

GBP/USD Signals Update

Yesterday’s signals were not triggered.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4205.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4087.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4350.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trade 2

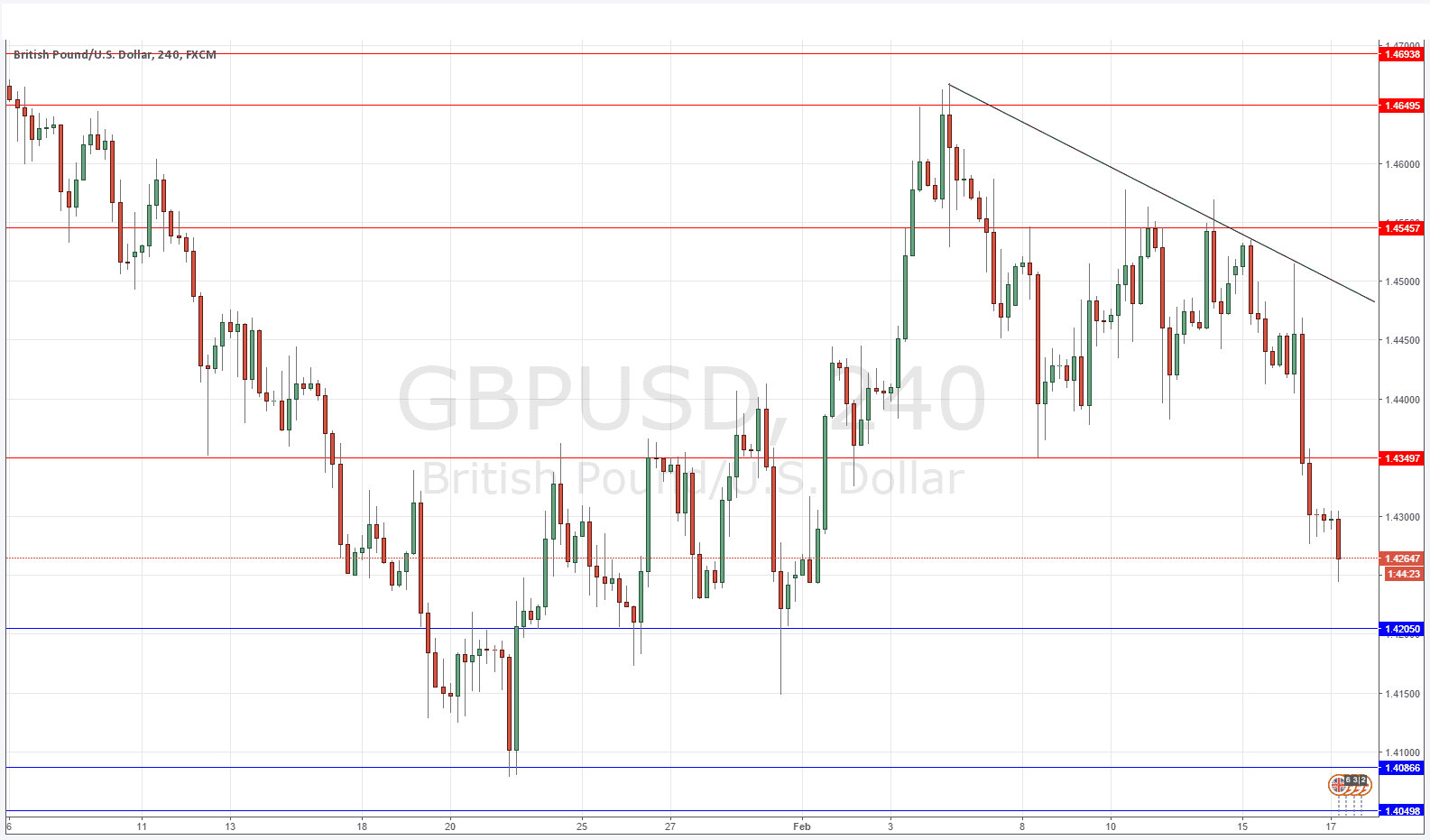

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of the descending trend line currently sitting at around 1.4485.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

I was wrong yesterday that this pair wasn’t going to do much, in fact it fell very heavily by 100 pips or so quite quickly and then broke down below the recent lows and fell for another 100 pips! The anticipated support at 1.4316 was broken down very easily, so the previous inflection point some way above that at 1.4350 should now become good resistance.

Although it took a while for this pair to resume its fall, it should be remembered that this pair is a strong, long-term downwards trend, so falls are still likely to be sharper than rises.

If the FOMC is more bullish than expected, we can expect this pair to fall further. The fact it has fallen again during the late Asian session just passed suggests a bearish picture.

Concerning the GBP, there will be releases of the Average Earnings Index and the Claimant Count Change at 9:30am London time. Regarding the USD, there will be releases of PPI and Building Permits data at 1:30pm, followed later by the FOMC Meting Minutes release at 7pm.