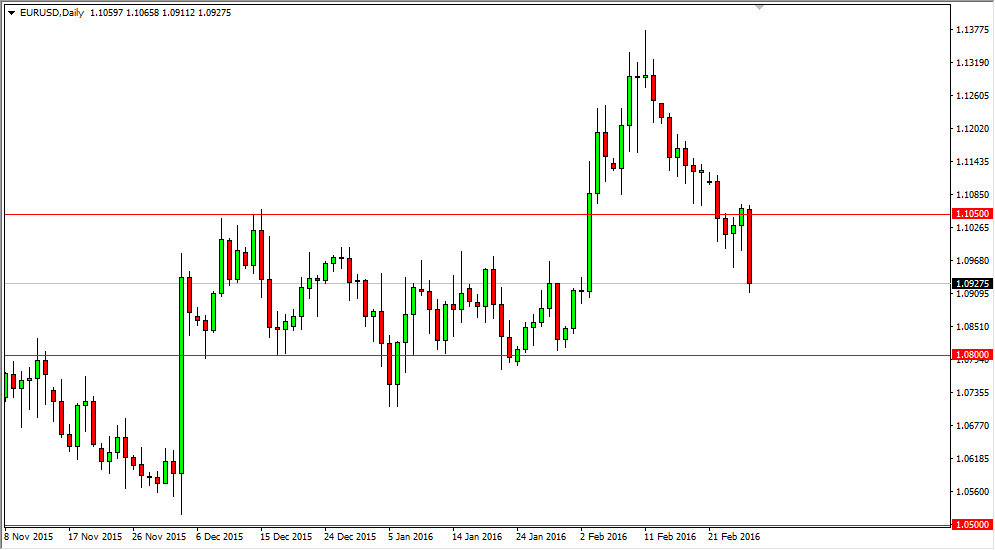

EUR/USD

The EUR/USD pair fell rather significantly during the course of the session on Friday, breaking to the 1.09 level at one point. We closed towards the bottom of the range, and that of course is a very negative sign. However, there is a significant amount of support just below so I would not be surprised at all if we see some type of bounce that shows signs of resistance. I think at that point in time, I would go ahead and start shorting the Euro again and aim for the 1.08 level.

This is because the 1.08 level has been so reliable for support, and as a result it is an excellent target. Yet even the Friday candle broke below 3 candles that had formed hammers on the daily chart, so having said that the negative candle is very strong and persuasive.

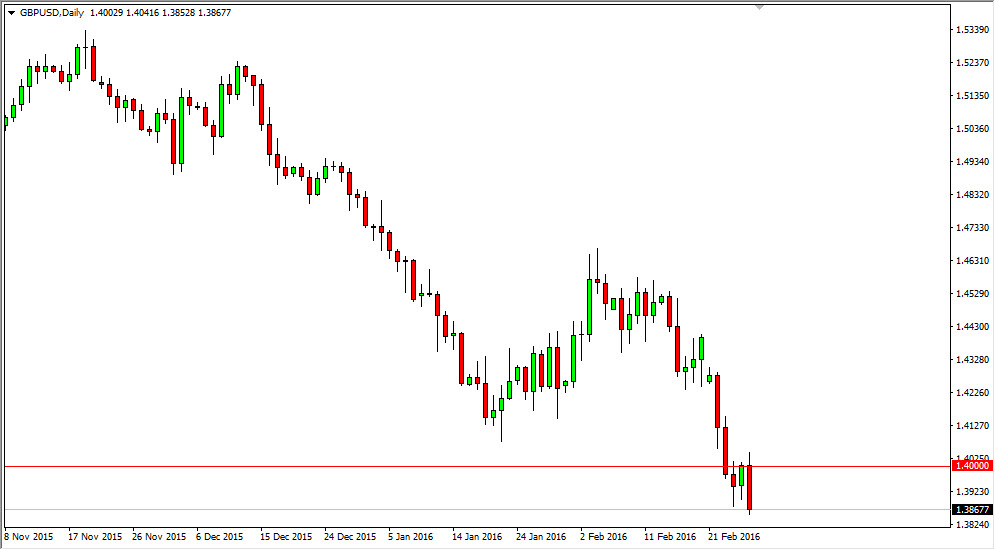

GBP/USD

The GBP/USD pair initially tried to rally on Friday, but the area above the 1.40 level was a bit too resistive to let the market continue going higher. That being the case, it looks as if the turnaround was significant and that of course is a very negative sign. Now that we have made a fresh, new low again, it’s likely that the market will continue to fall towards the next major round number in my opinion, which is the 1.35 level. However, there is quite a bit of noise between here and there so it’s likely that we will get choppy conditions. With that, short-term rallies will be used to sell the British pound as far as I see, and ultimately, this is a market that should continue to find sellers again and again as there are a lot of concerns that London will vote to leave the European Union, which has been very negative for the British pound so far.

As far as buying is concerned, we would have to clear the 1.41 level before I would even consider doing so, which is something that probably is a going to happen anytime soon.