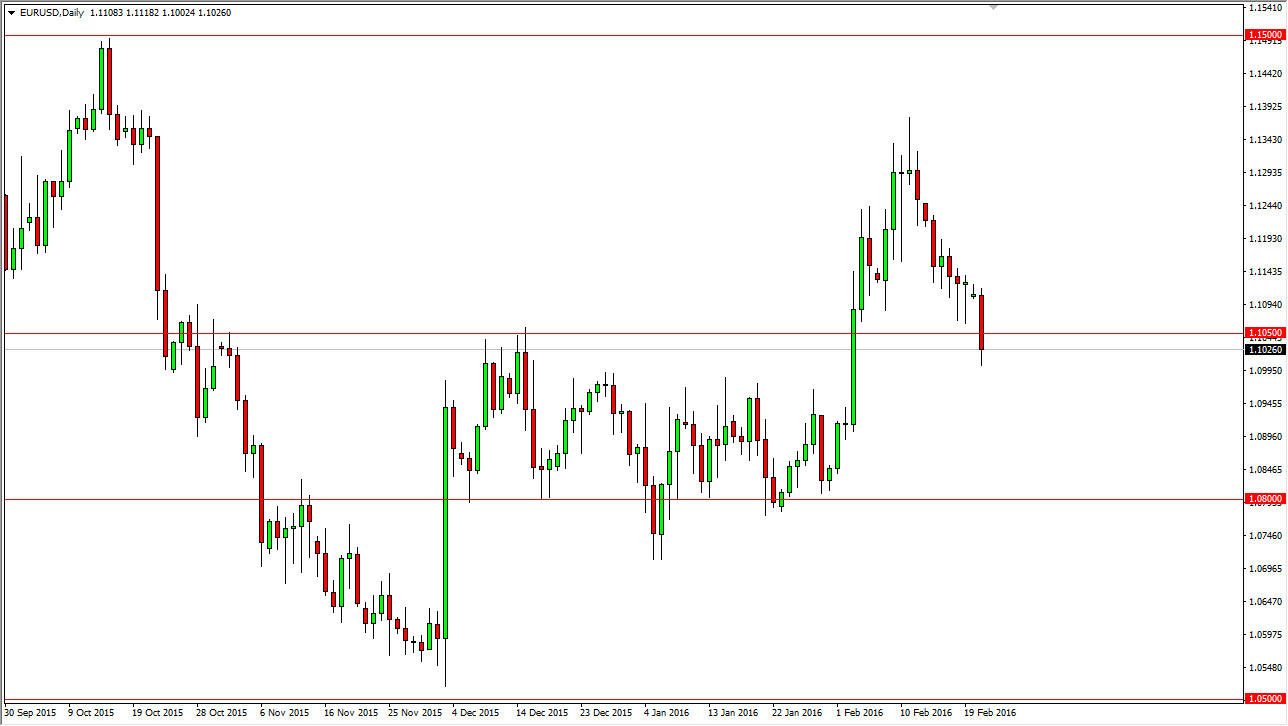

EUR/USD

The EUR/USD pair broke down during the day on Monday, slicing through the 1.1050 level, which of course is a significant move. However, I have stated repeatedly that it’s not until we get below the 1.10 level that I am comfortable shorting this market, so having said that it is likely that we will have to wait until we see some type of decisive action before playing a decent sized position. With that being said, if we can break down below the 1.10 level I feel that this market will drop down to the 1.08 handle. On the other hand, if we can break back above the 1.1050 level, I feel that the market should continue to much higher. In fact, at that point I think that the Euro would try to reach the 1.13 handle given enough time.

GBP/USD

The GBP/USD pair fell rather rapidly during the day on Monday, as the British pound lost quite a bit of value in general. A lot of this comes down to the idea of Great Britain leaving the European Union, and with that being the case it looks as if we are trying to make a significant move lower, perhaps breaking down below the 1.40 level. Because of this, the market should continue to see sellers, but the short-term bounce may suggest that perhaps we need to try to break down a couple of different times in order to build up enough momentum to finally do it. On a seller of exhaustive rallies, and most certainly a seller of a break down below the move to the 1.40 level, which would be very negative. I don’t really have any interest in buying the British pound at this moment, because quite frankly it looks horrible everywhere. With that being the case, I’m simply looking for selling opportunities off of short-term charts.