AUD/USD Signal Update

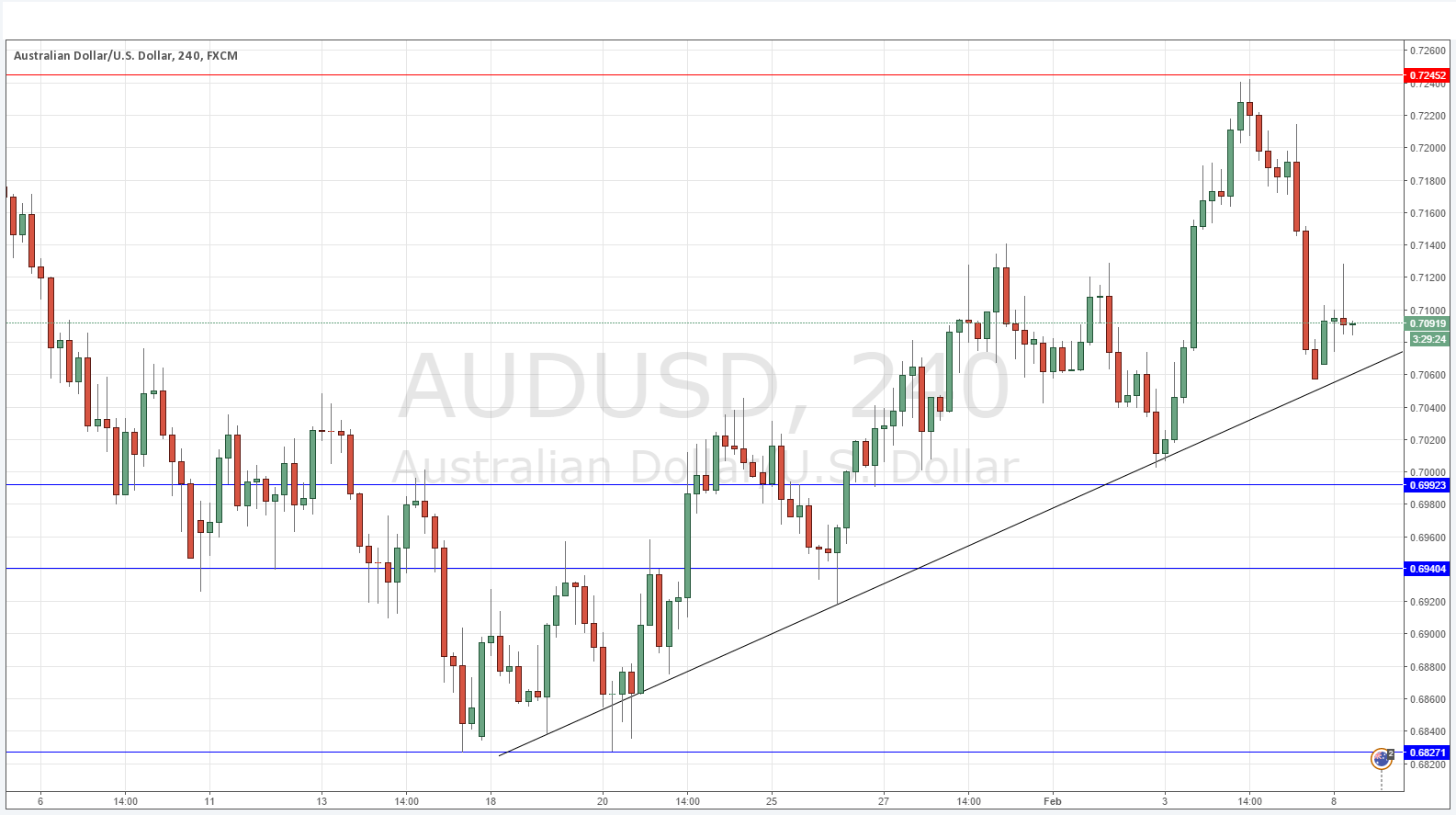

Last Thursday’s signals were not triggered as unfortunately the price turned just short of the anticipated resistance level of 0.7245.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am New York time and 5pm Tokyo time.

Long Trade 1

* Long entry following a strong bullish price action reversal on the H1 time frame immediately upon the next touch of the bullish trend line currently sitting at around 0.7065.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

* Long entry following a strong bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6992.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

AUD/USD Analysis

This pair fell very heavily at the end of the week following a nice run up over the past 3 weeks. The price began this week close to the supportive trend line which we can see clearly within the chart below, but has since begun to fall again and threatens to test it. If the price bounces at the line it could be a great signal to go long again, although there is another very key level below it quite confluent with the psychological number of 0.7000. We are too far away from the resistance at 0.7245 to worry about it today in the absence of any major news.

There is nothing due today concerning either the AUD or the USD.