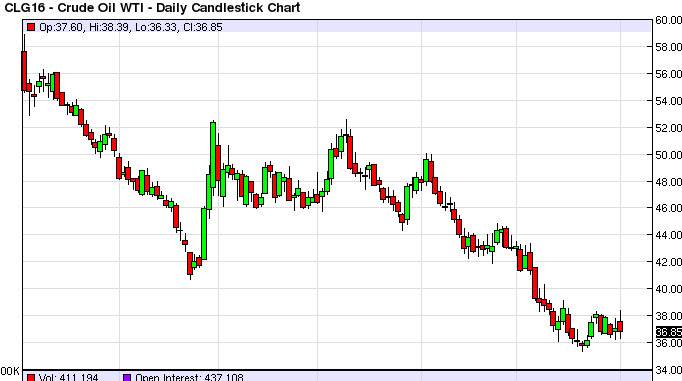

The WTI market initially trying to rally during the course of the day on Monday, mainly in reaction to the tensions between the Saudi Arabian government and the Iranians. At this point in time though, it appears that cooler heads have prevailed as the rallies in the beginning of the day were sold off rather drastically, forming a bit of a shooting star.

The reality in this market is that the supply far exceeds the demand, as we are currently extracting almost 2,000,000 barrels of excess supply a day out of the ground. Because of this, I find it very difficult to think that rallies of any substantial amount will happen anytime soon. Add on top of that the fact that the US dollar is strengthening, you have a recipe for much lower pricing. I believe that short-term rallies all the way to the $39 level are selling opportunities, and that the market will eventually test the $35 handle again.

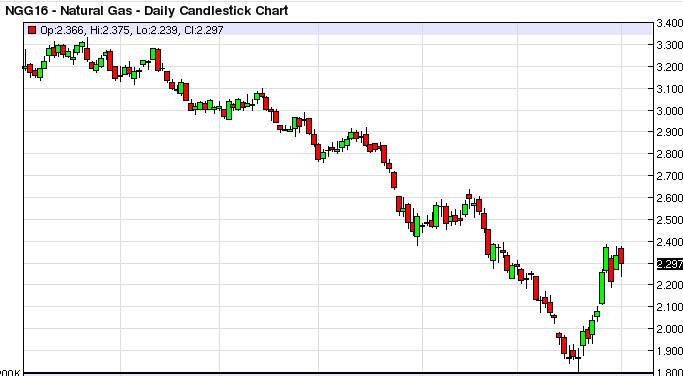

Natural Gas

The natural gas markets had a very volatile session on Monday as well, falling straight down during the day. However, we did get a bit of support at the $2.22 level, and the market formed a little bit of a hammer. Truthfully though, even though we’ve had a massive bounce recently, I think a lot of it can be written off to end of the year position squaring, and in the next few sessions we should have a clear view on what the market is going to do next.

True, temperatures are getting colder in the northeastern part of the United States, but quite frankly the supply is almost out of control at this point. The Chinese of course are short on supply of natural gas, so that does offer a bit of support, but ultimately I think the downtrend line in the cluster that coincide at the $2.50 level means that we will eventually see the sellers come back. With this, I think that short-term traders can continue to sell short-term rallies for small positions, but ultimately I think a daily resistive candle will be the signal as to when the next leg down begins.