By: DailyForex.com

EUR/USD

The EUR/USD pair initially tried to rally during the course the week and ended up falling into the 1.08 level. In doing so, it looks like the sellers are finally starting to get a little bit of an upper hand in this market, so I believe that short-term rallies will probably offer short-term selling opportunities. However, there are a lot of issues at the moment as far as clarity is concerned, simply short-term trades are about the only thing you get.

USD/CAD

The USD/CAD pair initially tried to rally during the course of the week but turned back around as the area above the 1.45 level was a bit too rich. Ultimately though, the biggest reason for this market turning back around would’ve certainly been the bounce that we had in the crude oil markets. They have a great influence on the Canadian dollar in general, so it is possible that we continue a little bit lower. However, I would anticipate buyers reentering the market somewhere between the 1.38 level and the 1.40 level.

GBP/USD

The GBP/USD pair ended up forming a hammer for the week, and that of course is a very bullish sign. I think if we can break above the top of the hammer the market will probably go higher for a while, offering buying opportunities during the course of this week. However, at the first signs of resistance or struggle, I’d be very quick to take profits.

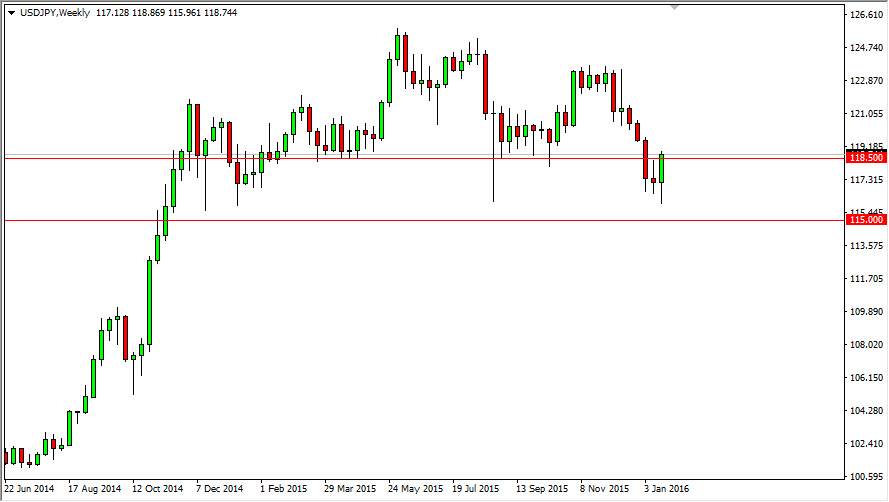

USD/JPY

The USD/JPY pair formed a bullish candle during the course of the week, but most importantly broke the top of a shooting star from the previous week. Now that we are above the 118.50 level again, I believe that this market will continue to go higher. With this, I believe that short-term pullbacks are buying opportunities, and of course a break above the top of the range for the week also offers buying opportunities.