USD/CAD Signal Update

Yesterday’s signals were not triggered as the bullish price action took place a little below 1.4050.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken between 8am London time and 5pm New York time today.

Long Trade 1

* Long entry following a bullish price reversal on the H1 time frame upon the next touch of 1.4000.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Long entry following a bullish price reversal on the H1 time frame upon the next touch of 1.3977.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry after bearish price action on the H1 time frame following a touch of 1.4314.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

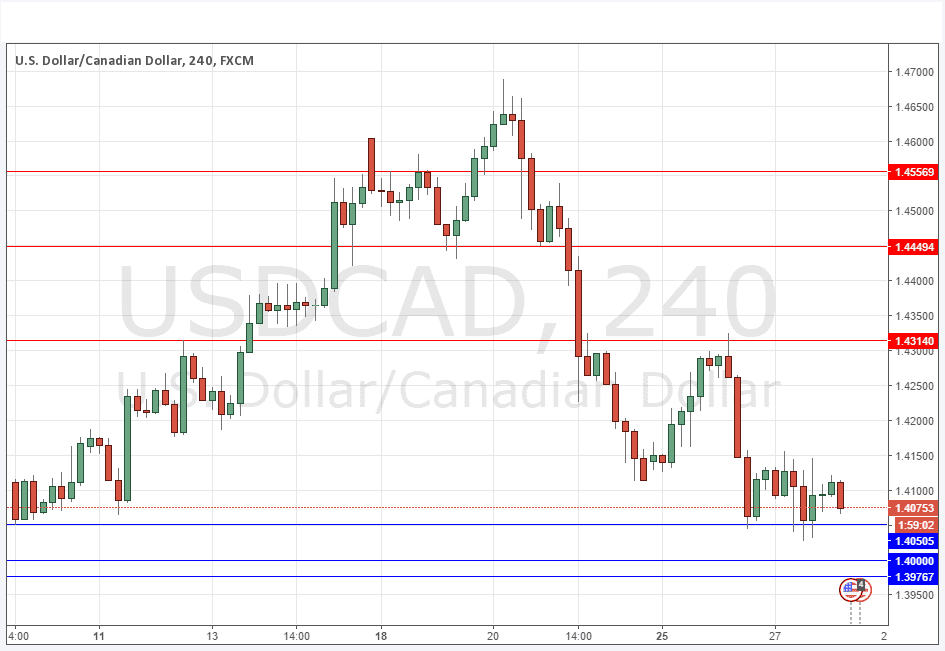

USD/CAD Analysis

I wrote yesterday that a double bottom at around 1.4050 would begin to look like a much better long trade. We have that double bottom now but the price is finding it difficult to rise. However this area from 1.4000 to 1.4050 should really be key support and produce some kind of upwards move which is well overdue. We may have already had that bounce, with the area at 1.4150 seeming to now act as resistance. This means that if the price does not break its recent lows but can turn around and break up past 1.4150 we should have some bullish momentum. However there is still a lot of selling pressure on this pair.

As well as the psychologically key level of 1.4000, we also have support at 1.3976

Concerning the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time, followed by the FOMC Statement and Federal Funds Rate at 7pm. There is nothing due regarding the CAD.