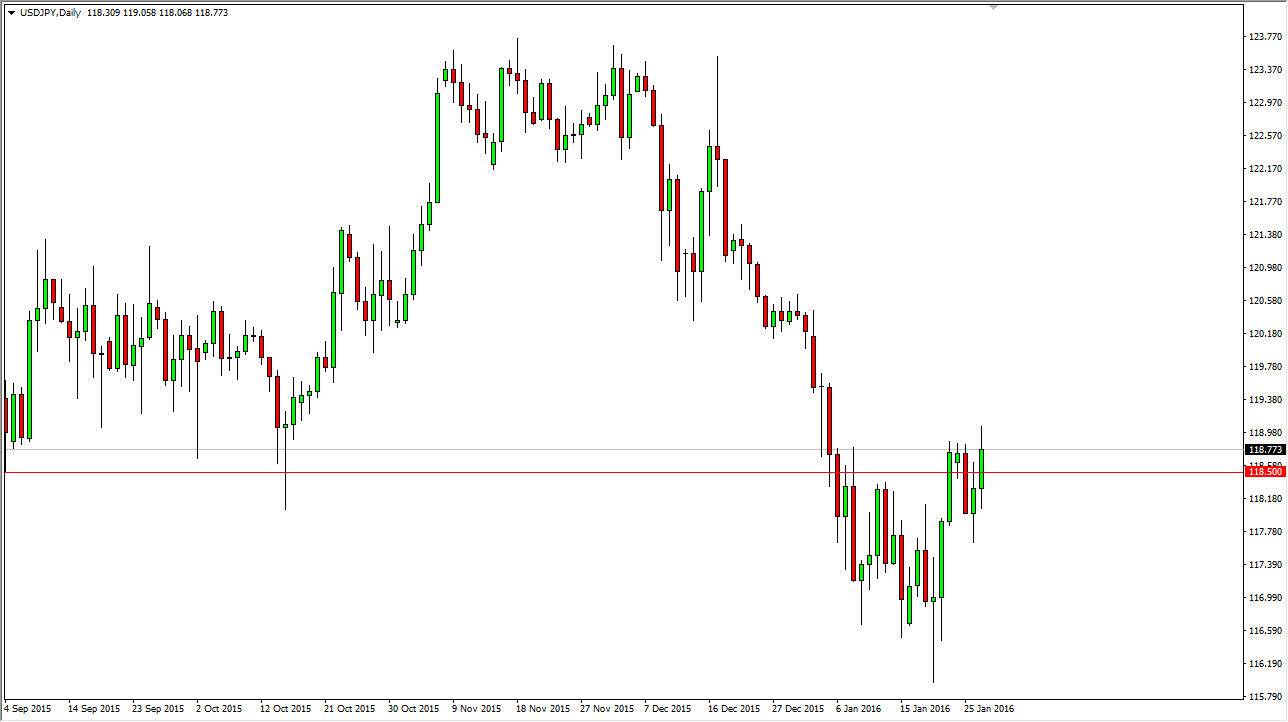

USD/JPY

The USD/JPY pair broke higher during the day on Wednesday, clearing the recent resistance that we had seen over the last several candles. Ultimately, I believe that if we can break above the top of the range for the day on Wednesday, this market will go much higher probably targeting the 120 level first, and then possibly the 120.50 level after that. I also believe that we will go higher than that given enough time but there is probably going to be some volatility on the way up.

Keep in mind that this pair is highly sensitive to risk appetite around the world, so pay attention to the stock markets. If the stock markets go higher, this pair typically will do the same. Of course, you can guess that the exact opposite is true as well. At this point, I don’t really have any interest in selling because there’s more than enough support just below.

NZD/USD

The NZD/USD pair initially tried to rally during the course of the day on Wednesday but turned back around to form a very negative looking candle. However, the industry decision coming out of Wellington, and more importantly, the statement, will move this market rather drastically. At this point in time, looks as if the 0.66 level is massively resistive, but the 0.64 level is massively supportive. Ultimately, it is very likely that the market will be choppy and difficult to trade over the next session or so.

We will more than likely have to wait until the daily close to get any clarity, and at this point in time I believe that the market needs to see some type of impulsive candle to place any conviction behind a trade. With this being said, I believe that short-term traders will continue to be the masters of this market as short-term high-frequency trading will probably be the norm.