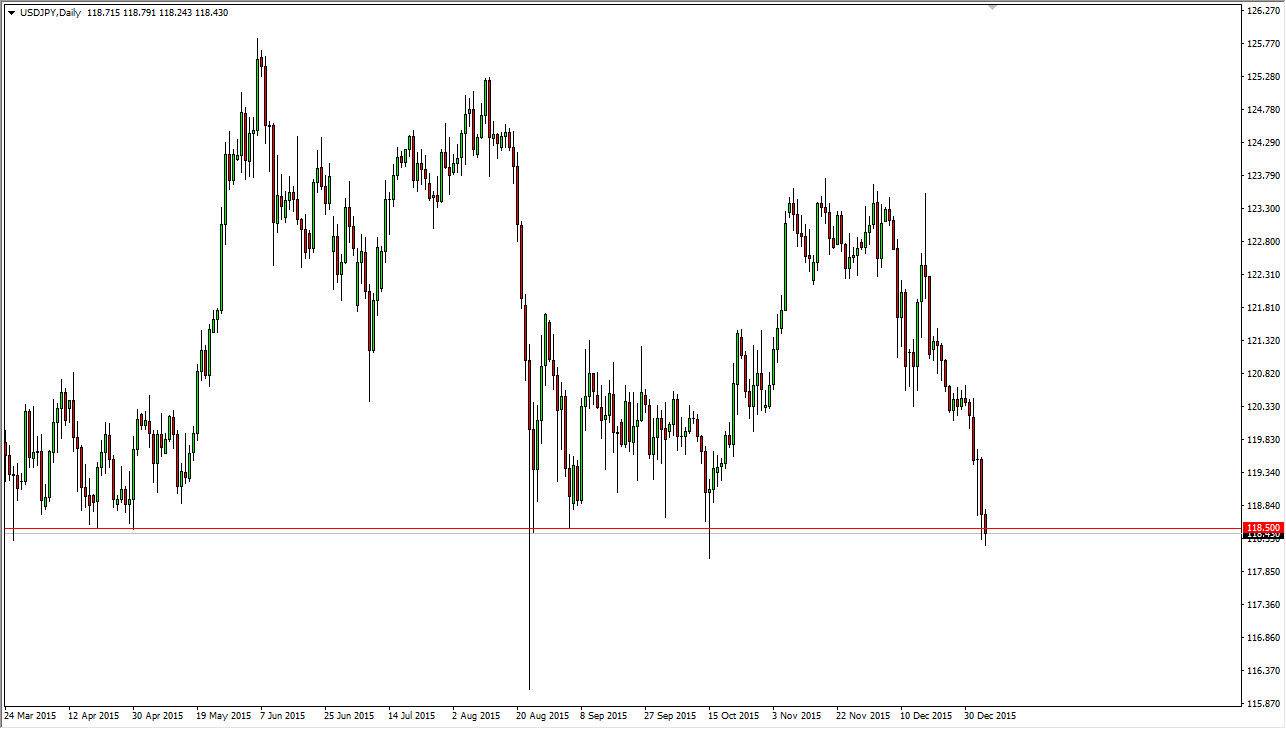

USD/JPY

The USD/JPY pair fell again during the session on Wednesday, testing the 118.50 level for support. At the time of writing, we have in fact found it, but it should be noted that it is only with a bit of trepidation that we have held on. After all, the FOMC Meeting Minutes will certainly influence this market, but most importantly beyond that we get the jobs number on Friday. With that being said, it makes sense that this market is essentially grinding around what has been a very important level.

Simply put, the best way to play this market is probably ignoring the news is much as possible, and focusing on the technical analysis. If we can break above the 119 level, I feel that the market is going to grind its way towards the 120 level, and then possibly even the 123.50 level after that. On the other hand, if we break down below the 118 level, I feel it essentially “opens the trapdoor” for a move back down to the 116 handle.

AUD/USD

This pair is a little bit more clear and what’s going on in my opinion. After all, the uptrend line that I’ve been paying so much attention to has been absolutely broken, and as a result it looks like we are going to try to test the 0.70 level. I think that we go below there as well, probably trying to reach the 0.69 level which was the most recent major low. As long as we can stay below the uptrend line that we have broken on the chart, I don’t see any reason to buy this pair at all. In fact, I think that short-term rallies should be nice selling opportunities going forward for most traders.

It is very telling that the Australian dollar fell so hard on a daily gold rose. This tells me that there are several issues with the Aussie at the moment.