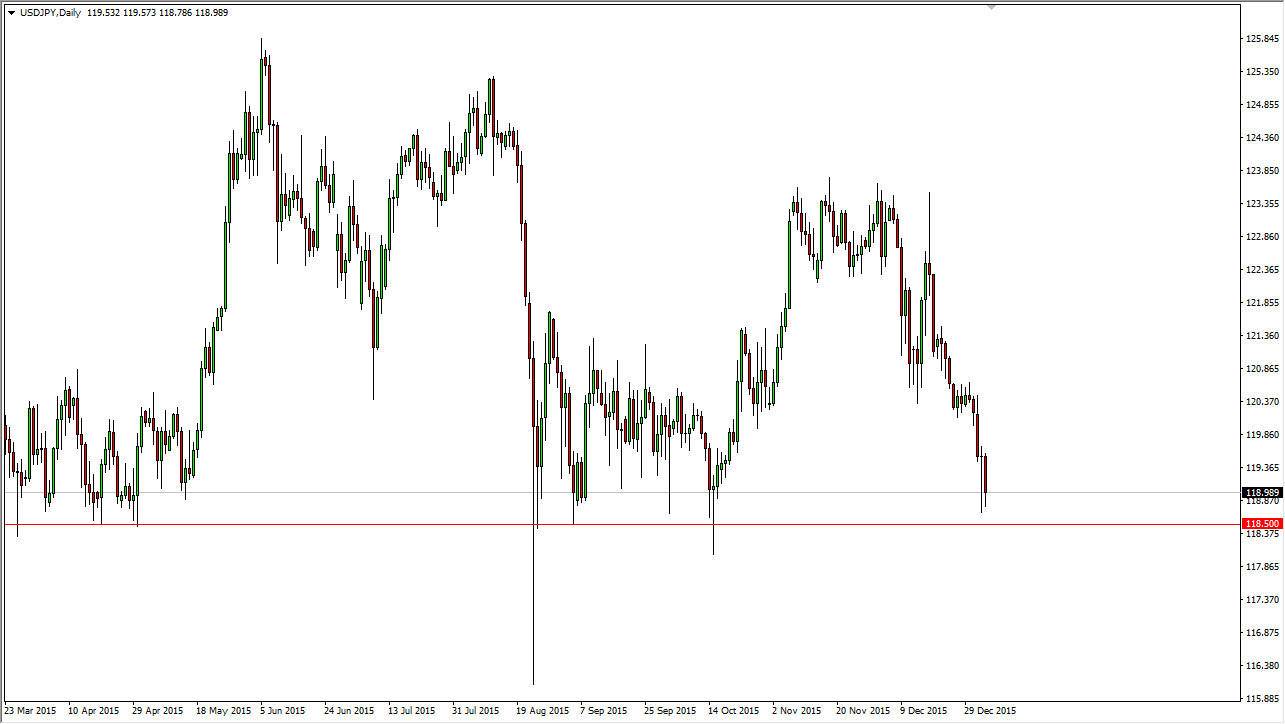

USD/JPY

The USD/JPY pair fell again during the day on Tuesday, breaking the bottom of the hammer from the Monday session. This is a very negative sign, but quite frankly we have an even more positive sign just below at the 118.50 level that should continue to attract a lot of attention. After all, this area has been very supportive over the last several months, and it is not until we get below there that I feel this market can fall significantly. Until then, I have to assume that short-term bounces will be the way to play this market.

I believe that the one-hour chart is starting to show significant support near the 119 handle, and obviously extends down to the previous mentioned 118.50 handle. I think that if we can get a little bit of a move higher, short-term traders will probably try to push this market back to the 120 level which should be resistive based upon previous reactions to the area. Short-term trades are probably about as good as it will get.

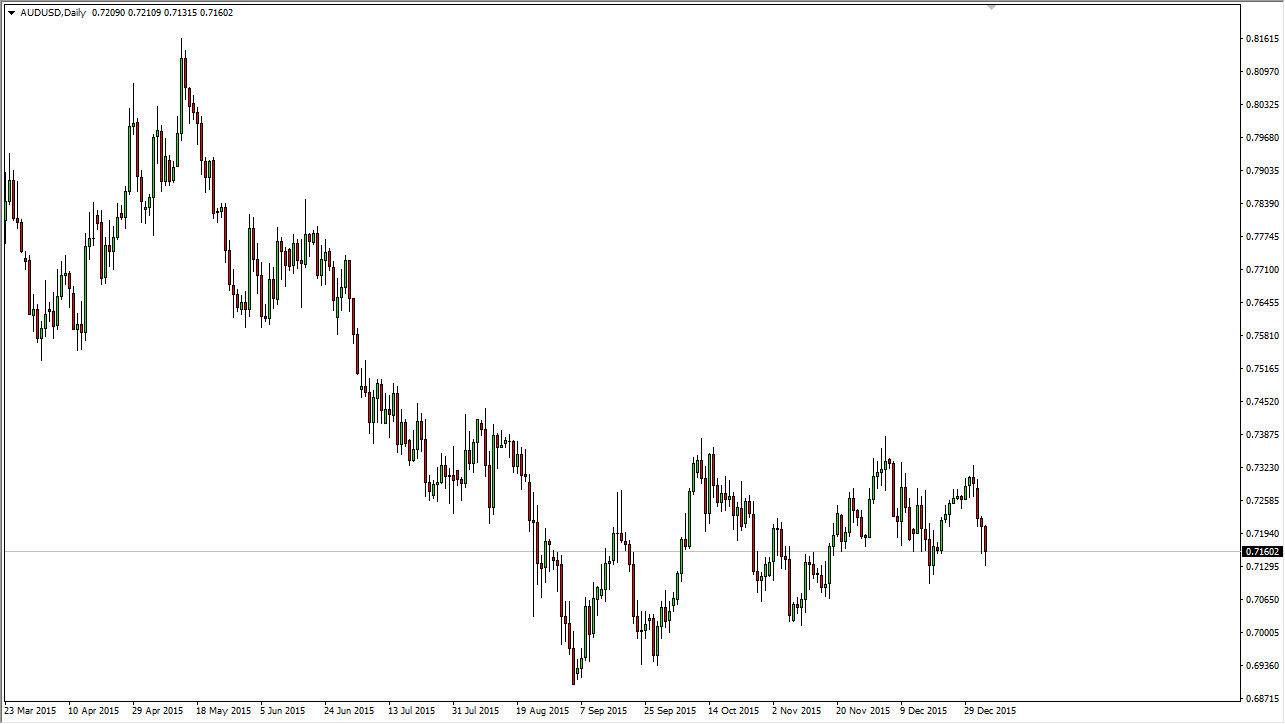

AUD/USD

Looking at the AUD/USD pair, we are starting to see a significant amount of downward pressure in this market, and as a result we are testing what is obvious support from the uptrend line that I have been talking about. This was the previous uptrend line from before, and possibly even the bottom of an ascending triangle, ascending wedge, or something to that effect. Either way, we have seen a significant amount of support for the Australian dollar.

Having said that though, I believe that if we break down below the uptrend line, this market can really start to unwind. The reason why I think this could happen is the fact that we broke down below the bottom of the hammer from the previous session. Unlike the USD/JPY pair, this market only has what I view as temporary support. After all, the Australian dollar simply could not rally even as the gold markets did. I think that if we can get below the 0.71 level, this market will unwind down to the 0.69 handle. If we do rally from this trend line, I will probably just stay on the sidelines.