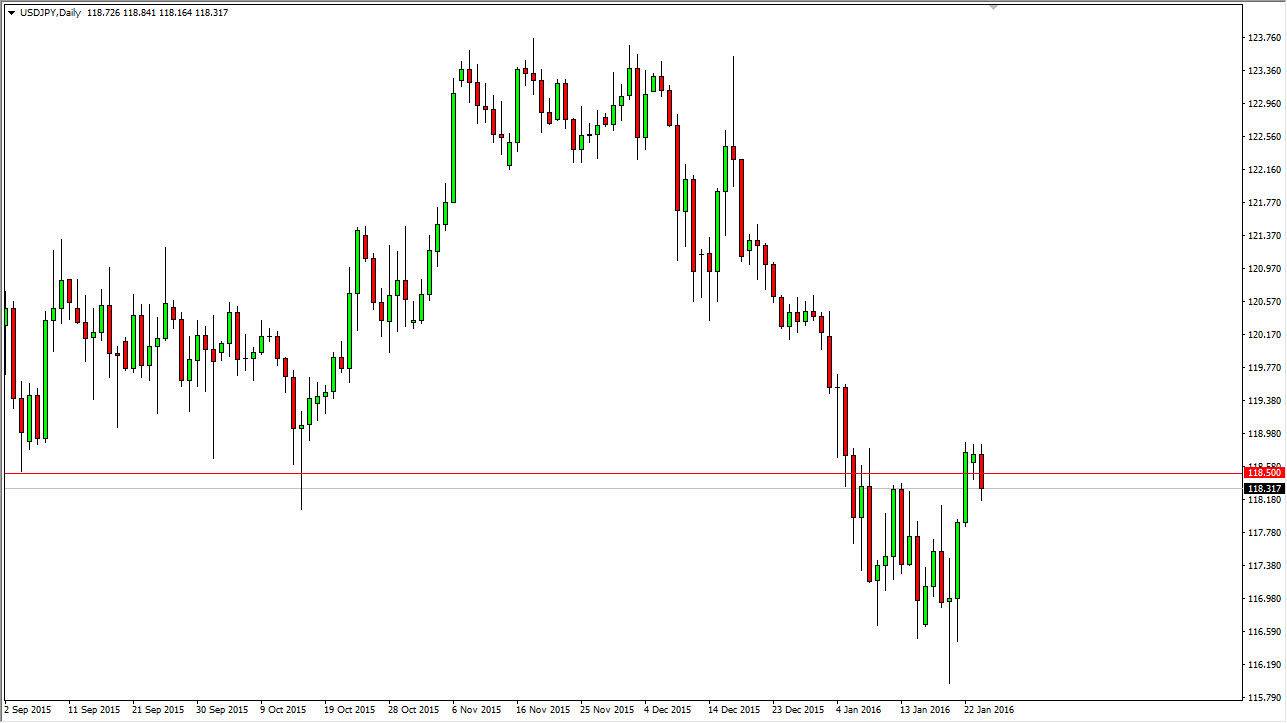

USD/JPY

The USD/JPY pair fell during the course of the day on Monday, as the 118.50 level continues to be an attractive level to the markets. I do see quite a bit of support below though, so I’m a bit hesitant to start selling at this point. It would be much easier for me to buy this market on a break above the previous couple of candles than it would be to sell this market as the noise just below should continue to be quite difficult. With this, I am essentially “buy only” at this point in time, although I am the first to admit that the market looks bearish in general. It’s just that it’s going to be a bit difficult to short, but it is going to be much easier to buy because it would be such an obvious move above obvious resistance. Keep in mind that this market should react with the risk appetite of global markets overall, going higher if stock markets and the like go higher as well.

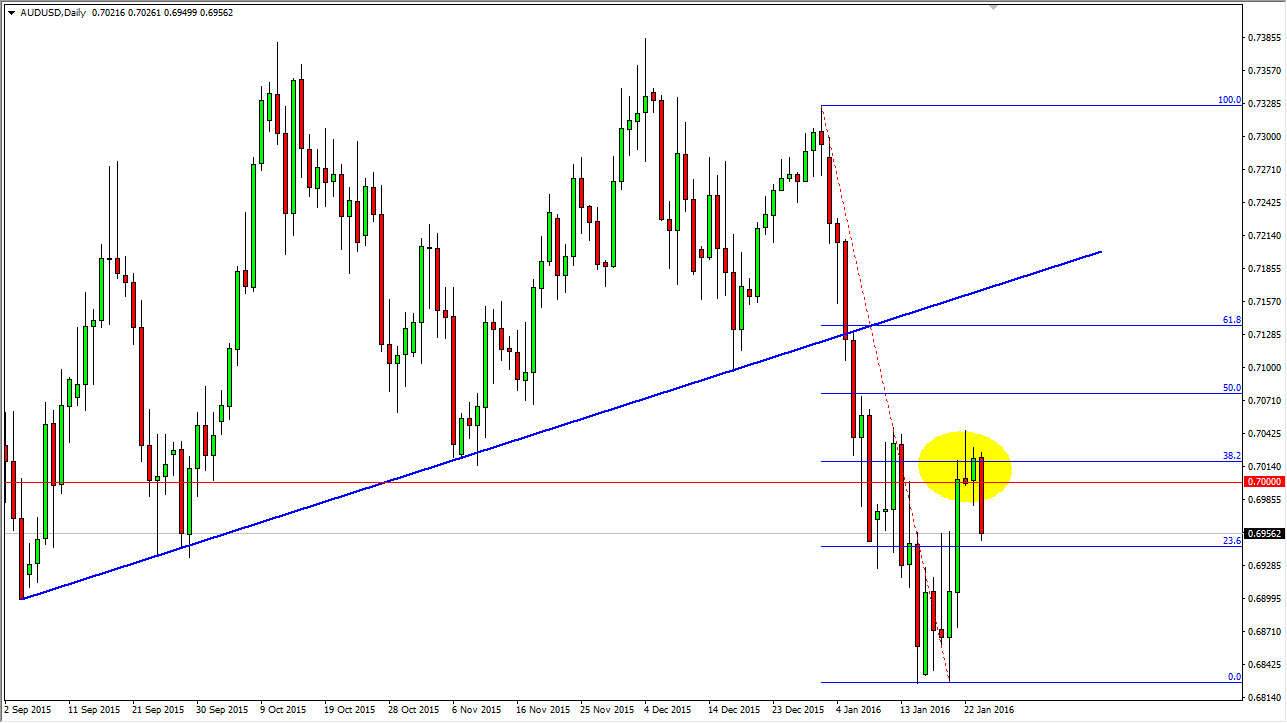

AUD/USD

The AUD/USD pair fell significantly during the course of the day on Monday, using the 0.70 level as a launching point to lower levels. Having said that though, we have broken down below the bottom the shooting star that formed for Friday, which of course was not only a large, round number, but it was also at the 38.2% Fibonacci retracement level. With this, and the fact that the market closed at the bottom of the range, I believe that this market will continue to go lower.

After all, the gold markets have looked somewhat resilient, but at the same time the Australian dollar has ignored this. This tells me that the Australian dollar is in serious trouble, and I believe that we at the very least are going to be reaching towards the lows that we hit last week. I am a seller.