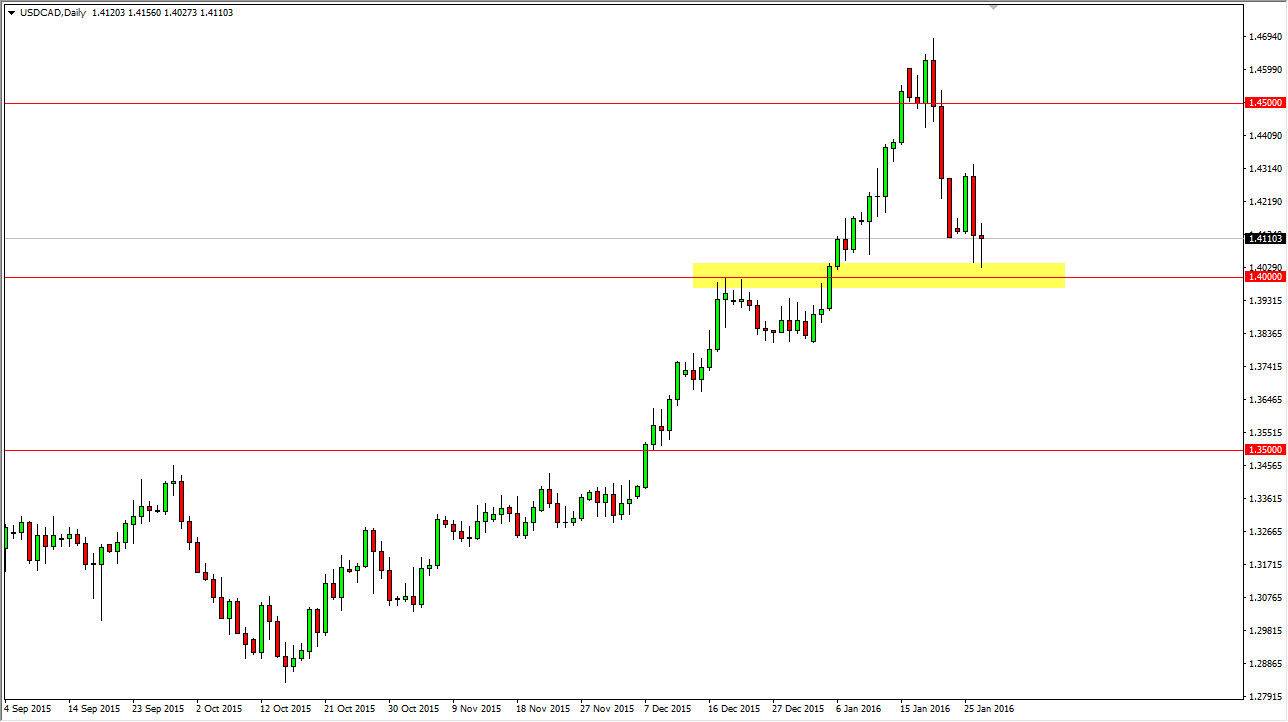

The USD/CAD pair initially fell during the day on Wednesday, testing the 1.40 level for support. This is an area that of course I would anticipate buyers to show up in, simply because of the large, round, psychologically significant impact of a round number like this. On top of that, this was an area that had been resistive before, so it should now show up as support anyway.

The longer-term market is very much in an uptrend, and as a result this could be a pullback that we’ve been waiting for to start going long again. I don’t like crude oil, and of course the Canadian dollar is highly influenced by that particular commodity. That commodity is running into significant resistance at the moment, and it now looks as if we could get a little bit of a pullback again or perhaps even a continuation of longer-term downtrend in that market, which should push this market higher.

Buying Dips

I’m still buying dips in this market, and I think that’s what this has been recently. Ultimately, I believe that the market will try to reach the 1.450 level again fairly soon, and as a result we should see bullish pressure enter on a break of the top of a hammer. I believe that the market should continue to favor the US dollar in general, as it is considered to be one of the “safest” currencies in the world. There is plenty of economic uncertainty out there to keep traders looking to buy US sellers as it is the only way to buy U.S. Treasuries.

At this point time, I think that the support runs all the way down to the 1.38 handle, so this zone should continue to be very important and I think that it’s very difficult to imagine the market breaking down below there. Once it does, that would of course be very negative, but I think the chart is already showing us that we are ready to bounce.