Gold settled up $10.91 at $1088.76 on Friday, recouping most of the losses from the previous session, as pressure on stock markets and weakness in the U.S. dollar underpinned the precious metal. Friday was another rough day for global equities. Major stock indexes suffered heavy losses and crude oil prices continued to drop, settling below $30 a barrel. On the economic data front, weak retail sales and industrial production figures cast shadow over world's largest economy. The Commerce Department said that retail sales fell 0.1% and the Federal Reserve reported that industrial production dropped %0.4 in July.

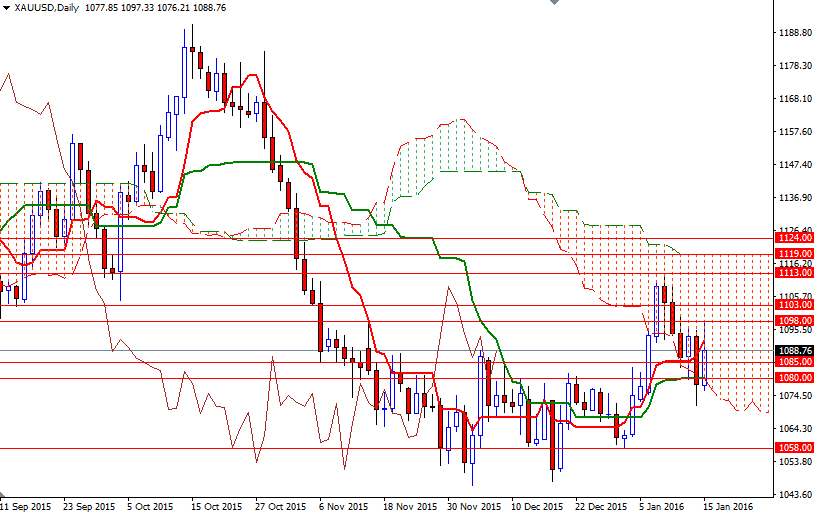

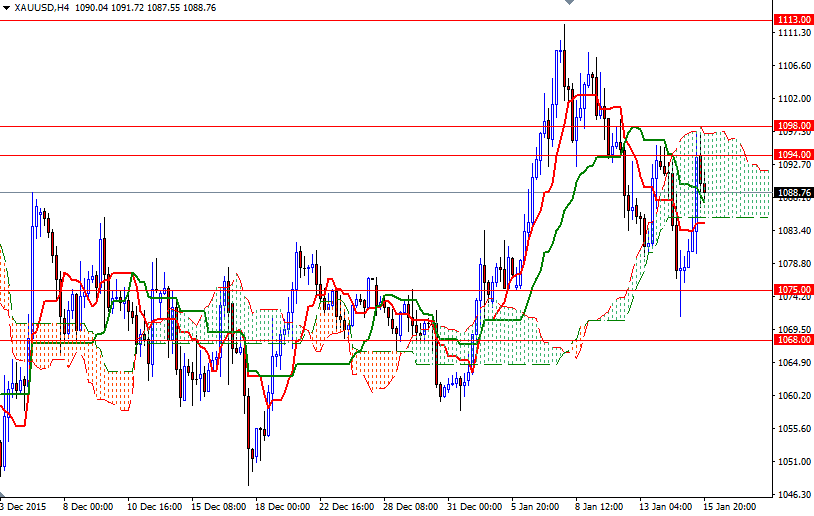

The XAU/USD pair initially tested the 1085 resistance and extended its gains after the bulls overtook bears. Not surprisingly, breaking above 1085 push prices higher and helped market revisit the resistance in the 1098/4 area as expected. Although long-term fundamentals, including normalization of the U.S. monetary policy, sluggish pace of inflation and slowing global growth, will likely keep the pressure up, the recent financial market turbulence and worries over the Chinese economy may prevent gold from losing too much ground. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 44718 contracts, from 26560 a week earlier.

Prices are inside the daily cloud at the moment and that suggests a range-bound movement. The area between the 1098 and 1094 levels has been blocking the bulls' way, so we need to break up above there in order to leave the 4-hourly Ichimoku cloud behind and continue to the upside. Anchoring somewhere beyond the 1098 level would suggest that that we are going to visit the 1105.50-1103 region. A daily close above 1105.50 could make me think that XAU/USD is on its way to test the next barrier at 1113. Currently the initial support is at 1085-1084.20, followed by 1080. If prices fall through 1080, XAU/USD will probably head back to 1075. A break below 1075 would trigger a drop towards 1068.