Gold prices ended Monday's session down $9.78, extending their losses to a second straight session, as strength in the U.S. dollar and a recovery in equities weighed on the market. The XAU/USD pair have advanced nearly 4.5% since the market bounced off the support around the $1047 level and is currently trading just below the $1099.50-1098 resistance area. Since the beginning of the new year, one beneficiary of the stock market sell-off has been gold. Gold historically has always been a safe commodity in times of turbulence but safe-haven gains tend to be short-lived and the long-term outlook remains relatively unfriendly for the precious metal, with the U.S. Federal Reserve set to raise interest rates further this year.

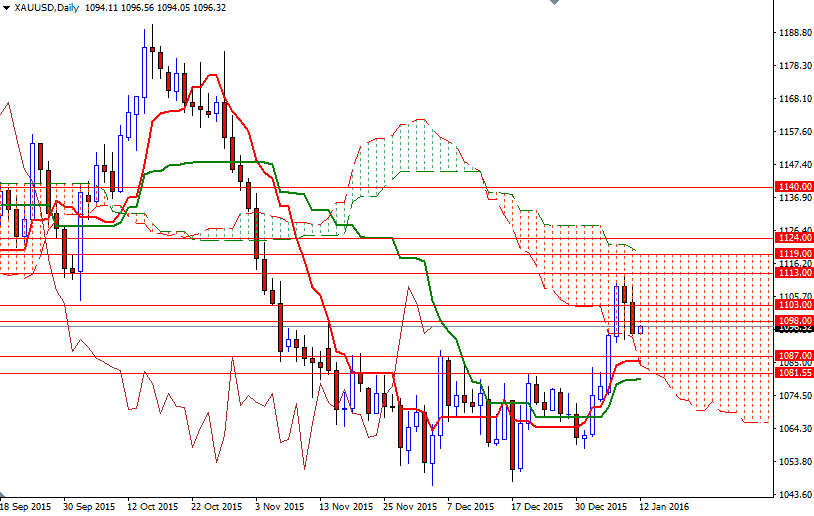

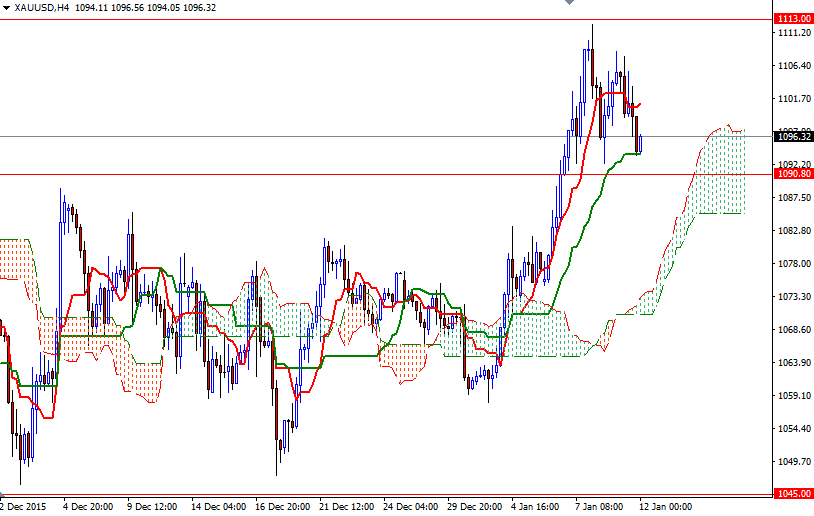

The XAU/USD pair is trading above the 4-hourly clouds and we have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses on both charts. Plus, the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices. From a short-term perspective, the recent upswing should remain intact as long as the market can hold above the Ichimoku cloud on the 4-hour time frame.

It is possible to see the XAU/USD pair challenging the 1103 level if the bulls can defend their ground and move beyond the 1099.50-1098 resistance zone. The bulls will have to break through the 1105.50-1103 region so that they can gain enough traction to test the next barrier at 1113. To the downside, the initial support stands in the 1092-1090.80 region followed by 1087-1085.32. The bears will have to drag prices below 1085.32 if they intend to put extra pressure on the market and march towards the 1081 level.