Gold retreated on Friday as investors took profits from a recent rally to a nine-week high. Despite Friday’s decline, the XAU/USD pair ended the week up nearly 4% to settle at $1104 an ounce, bolstered by safe-haven demand as falling oil prices, geopolitical risks and China fueled fears hit equities. Major stock indexes posted heavy weekly losses, oil prices retreated to another 12-year low and a nuclear test by North Korea added to worries. In the latest economic data, December payrolls growth came in above expectations. The Labor Department reported that the economy added 292000 jobs in December, surpassing consensus estimates of 203000. Data also showed that gains for the prior month were revised up but average hourly wages stagnated.

Although these figures show that the economy is on solid ground, stubbornly low inflation, a weak outlook for global growth and financial-market turmoil could dissuade the Fed from raising interest rates anytime soon - at least this is what the market is pricing in. "Some members emphasized the importance of confirming that inflation would rise as projected and of maintaining the credibility of the committee’s inflation objective", according to minutes of the Federal Open Market Committee’s December 15-16 meeting.

It seems that the fear factor and uncertainties in markets will cause investors to ignore good economic data out of the United States for a while. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 26560 contracts, from 19102 a week earlier. China's turmoil is more severe compared to August, so if instability persists, it could allow gold to sustain its upswing.

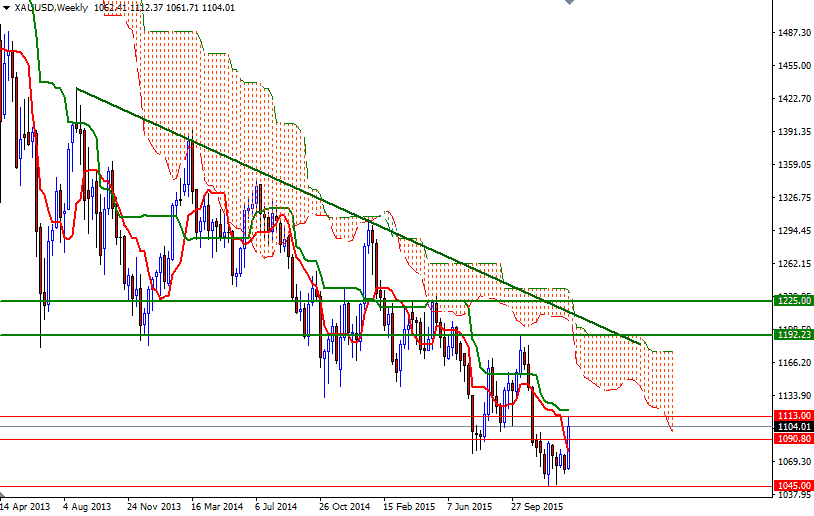

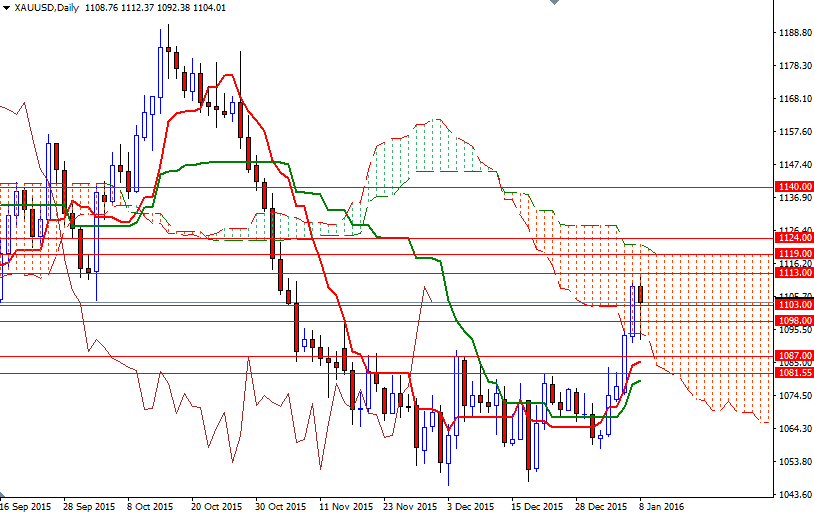

From a technical perspective, I think there are a couple of things to pay close attention. First of all, trading above the Ichimoku clouds on the 4-hour time frame gives the bulls an advantage - plus we have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen line (twenty six-period moving average, green line) crosses on both the daily and 4-hourly charts. Secondly, last week's price action marked a departure from the consolidation area between roughly the 1190 and 1145 levels. If the bulls can maintain the control, the XAU/USD pair is most likely headed for the 1160/40 region over the medium term. Of course, there are some resistance levels ahead (such as 1113, 1119 and 1124) for the buyers to break through. However, trading inside the daily Ichimoku cloud suggests that the market is not out of the woods yet. So it makes sense that we would run into a bit of resistance in this area. In that case, the market may have a tendency to revisit the 1090/87 region. Dropping below 1087 could open up the risk of a move towards 1081.