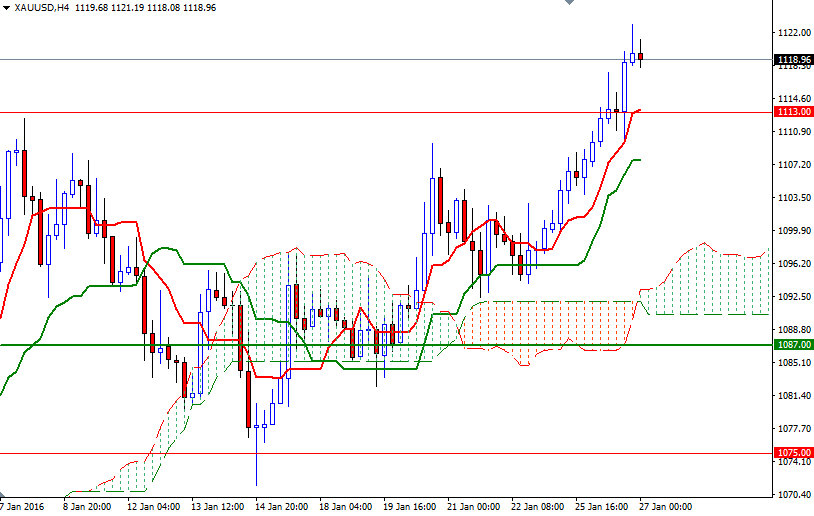

Gold prices climbed for a second straight session on Tuesday to settle at their highest level since early November as the weakness in the dollar and equities markets spurred investors’ appetite for the relative safety of the precious metal. The XAU/USD pair traded as high as $1122.87 an ounce after breaching a key resistance at $1113 provided additional momentum. The XAU/USD is currently trading at $1118.96, slightly lower than the opening price of $1119.68.

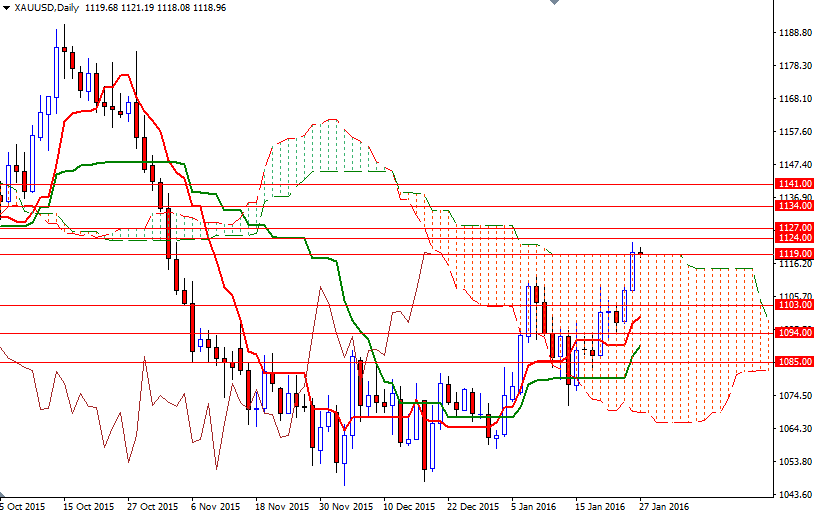

All eyes will be on the U.S. Federal Reserve today. There is a growing perception that that recent market turmoil and continued decline in inflation expectations will push the Federal Reserve to send a more dovish message at the conclusion of its monetary policy meeting, and this is supporting gold prices at the moment. From a technical point of view, the charts suggest that the XAU/USD pair may extend its gains and head towards the weekly Ichimoku cloud (1160/40 area) if prices anchor somewhere above the 1127/4 resistance. If the market trades above the daily cloud and penetrate 1127/4, I think the next stop will be the 1134 level.

On the other hand, if the bulls run out of steam and fail to hold the market above 1119, the XAU/USD pair will probably head back to the 1113 level. Breaking down below the 1113 level could put some pressure on the market and increase the possibility of an attempt to revisit the 1105.50 - 1103 area.