Gold prices settled slightly lower on Tuesday after shuffling between gains and losses but remained within the trading range of the past 5 days. The U.S. dollar's strength against other currencies is pressuring gold prices but weak equity markets and fears over the Chinese economy lend some sort of short-term support to the market. Unlike last summer, gold is reacting to what we are seeing in the equities market recently.

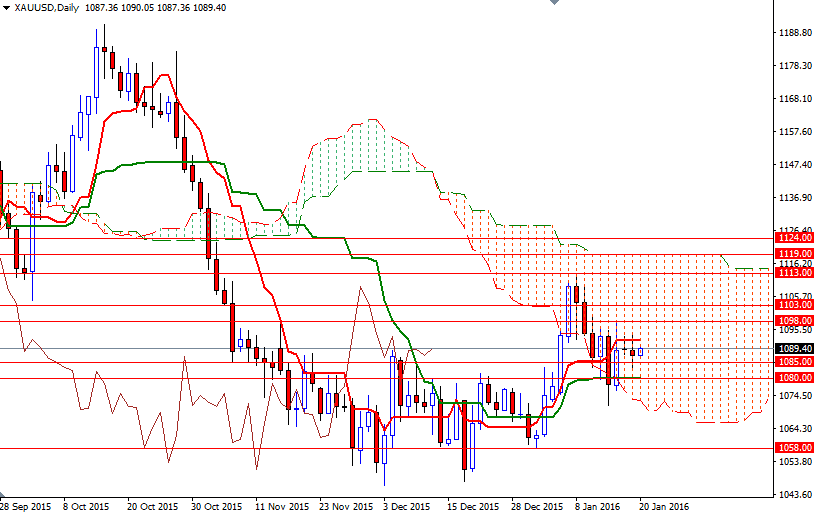

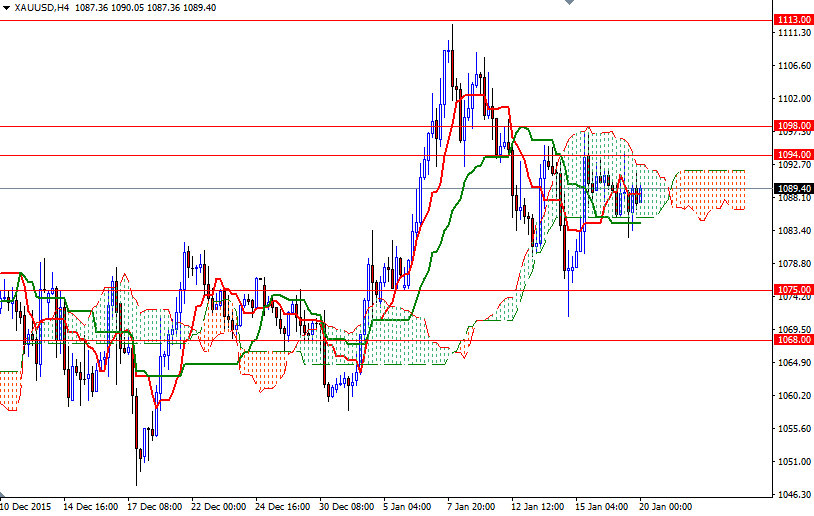

XAU/USD is trading at 1089.40, slightly higher than the opening price of 1087.36 as a further fall in equities and oil lured some investors back into the market. From a technical point of view, the long-term directional bias remains weighted to the downside, with the market trading below the weekly Ichimoku cloud. However, the current consolidation is not a big surprise as prices are staying within a range of 1098 to 1080 - the daily and 4-hourly clouds overlap in the same area. Positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines give the bears an advantage in the near-term.

Short term charts suggest that a retest of 1105.50-1103 is likely if the market breaks through the 1098/4 resistance. Closing above 1105.50 would be a sign of a stronger bullish recovery. In that case, XAU/USD will probably proceed to the 1113 level. To the downside, I will keep an eye on the 1085 and 1080 levels. The bears will have to drag prices below this area if they intend to make an assault on the 1075 and 1068 levels. A successful break below 1068 would imply that the 1064 and 1058 levels will be tested.