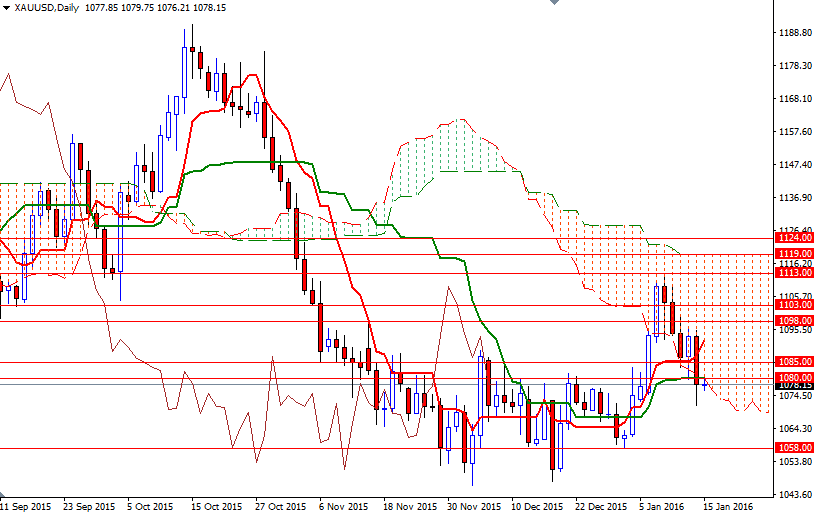

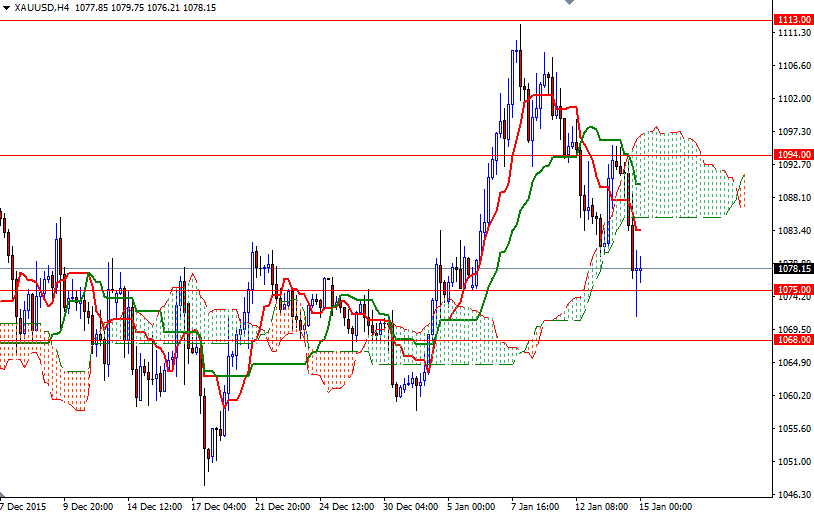

Gold prices fell for the fourth time in five days as a stronger dollar and a rebound in stock markets dimmed the appeal of the precious metal as an alternative investment. The XAU/USD pair initially tried to breach the resistance at around the 1094 level but the bulls surrendered after the buying dried up. As a result, prices reversed and broke below the bottom of the Ichimoku cloud on the 4-hour chart.

Although prices fell with momentum all the way down to 1071.30 after breaking below the 1080 support put some extra pressure, XAU/USD moved back up and closed the day above 1075. The short-term technical picture for gold seems to be weak, with the market trading below the 4-hourly Ichimoku clouds, but the candlestick with a long lower shadow (4-hour chart) indicates that some buying interest still exists. That said, I think it is possible to see prices heading back to the lower border of the 4-hourly cloud at 1085 first.

If the XAU/USD pair climbs above this barrier, buyers might have another chance to test the crucial barrier located in the 1098/4 area. Closing beyond that could put us back on track with such a scenario eying subsequent targets at 1103 and 1113. However, if the bears increase the downward pressure and we drop through 1075, then the 1068 will probably be the next stop. Once below 1068, for further downside with 1064 and 1058 as targets.