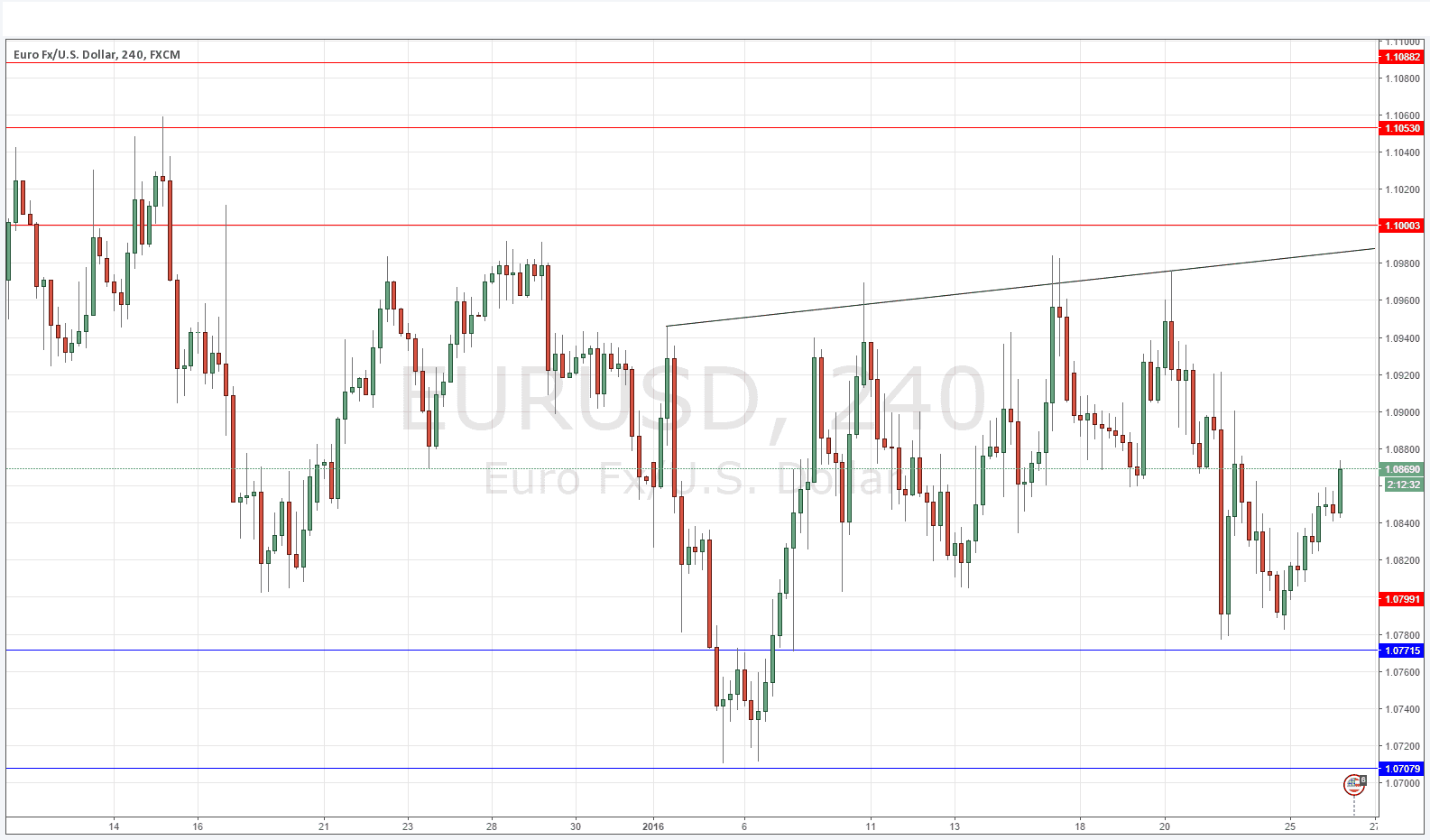

EUR/USD Signal Update

Yesterday’s signals were not triggered as none of the key levels were reached.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be taken before 5pm London time today.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0772.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0708.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1000.

* Put the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1053.

* Put the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

Risk-on sentiment has returned, with stocks and crude oil falling again. It is interesting to note that the Euro, in spite of everything including the hints at further QE by the ECB, has come to behave almost as a safety currency, rising in value when stocks and oil are falling. So in the current environment, the Euro is rising even against the USD which is also a safety currency. However I think that the heavy resistance that starts a little under 1.1000 is very prone to holding the price, which means that I see good selling opportunities should we get back up there and then turn around and begin falling again.

It seems as if we will range between 1.0772 and 1.1000 for a while longer yet.

Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time. There is nothing due regarding the EUR.