EUR/USD

During the day on Thursday, the EUR/USD pair initially fell during the trading session but turned back around to go much higher. Because of this, the market looks as if there were plenty of buyers in that general vicinity, and broke back above the 1.08 handle. Because of this, the market looks as if it could continue to go higher, but I believe that it’s only a matter of time before we sell off again. After all, this market recently made a “lower low”, and as a result I feel that the bearish pressure is starting to pick up. Quite frankly, this may have been a little bit of position squaring ahead of the employment numbers that come out later today. The Nonfarm Payroll Numbers of course can move the markets drastically, and as a result I understand how people who were short of this pair would probably be a little bit cautious about hanging onto the trade going into what is known as a very volatile time.

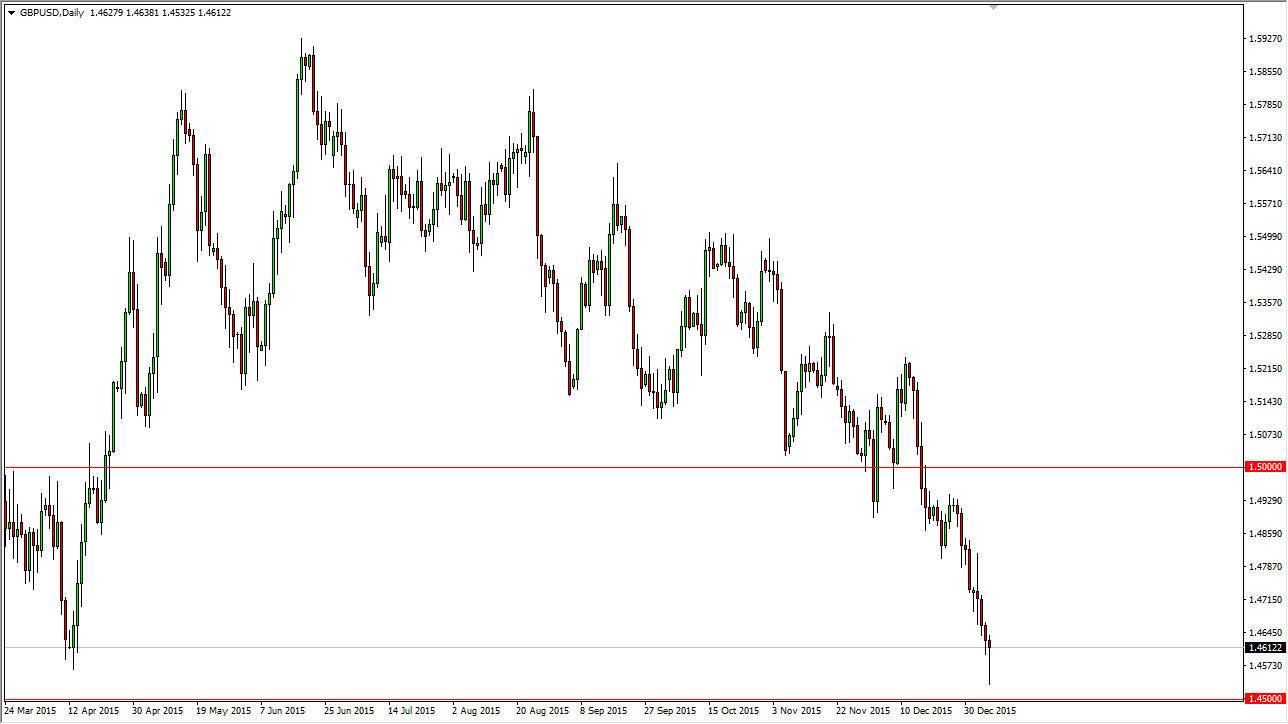

GBP/USD

The GBP/USD pair fell as well during the day on Thursday, testing the support level just below at the 1.40 region. Having said that, we bounced enough to form a bit of a hammer and I think that’s a very positive looking turn of events, but at the end of the day I think this market is simply oversold. If we can break above the top of the hammer, I believe that the market will probably continue to go higher, at least in the short-term. I believe that this is probably a market that’s going to be very good for sellers going forward, but we have to be very cautious and simply are waiting for signs of exhaustion.

On the other hand, if we break down below the 1.45 level, I feel at that point in time the market will go to the 1.43 handle. I have no interest in buying this market, at least not until we get above the 1.50 level, something that won’t happen today.