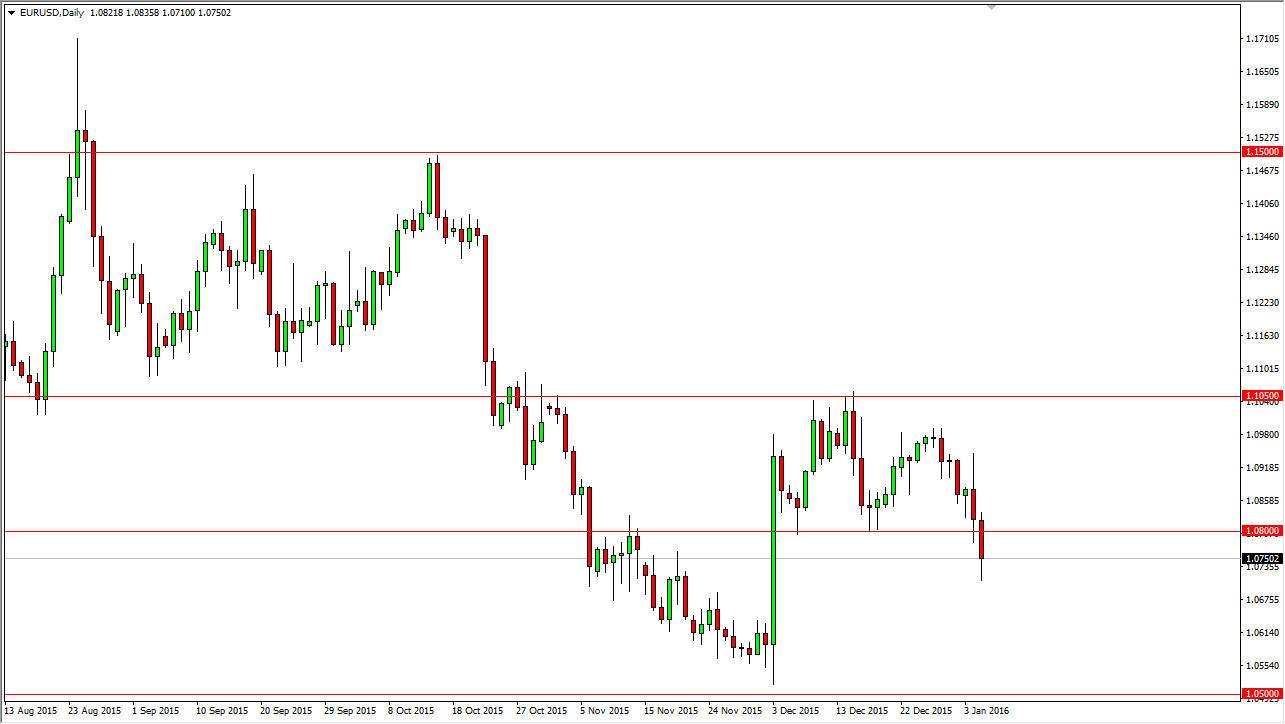

EUR/USD

The EUR/USD pair broke down during the day on Tuesday, breaking down below the 1.08 level, and as a result it looks as if the market is ready to continue lower, perhaps reaching down to the bottom of the next area which I see as the 1.05 handle. I believe that a break down below the bottom of the range for the day on Tuesday is probably reason enough to start selling. I think that there should be a good area to place stop losses above the 1.08 handle, as it should now be resistance.

On the other hand, if we break above the 1.08 level, I would have to rethink my entire position. Nonetheless, I think that it is going to be a negative market, but it will be rather choppy. You will have to deal with quite a bit of volatility if you are shorting the Euro.

GBP/USD

The GBP/USD pair fell during the course of the session on Tuesday, breaking below the 1.47 handle. Ultimately, the market looks as if it will continue to go lower, but could very well find quite a bit of selling pressure every time we rally on short-term charts. Quite frankly, short-term trading is probably the best thing you can do, as there is more than enough bearish pressure to continue to push this market lower. Ultimately, I believe that the market should then reach down to the 1.45 level given enough time, because it is a large, round, psychologically significant number, and of course you have to keep in mind that previously it has been important.

I have no interest in buying this pair until we get above the 1.50 level, which is something that seems very unlikely at this point in time. I believe that rallies should offer selling opportunities on resistive candles going forward and will continue to play the market as such.