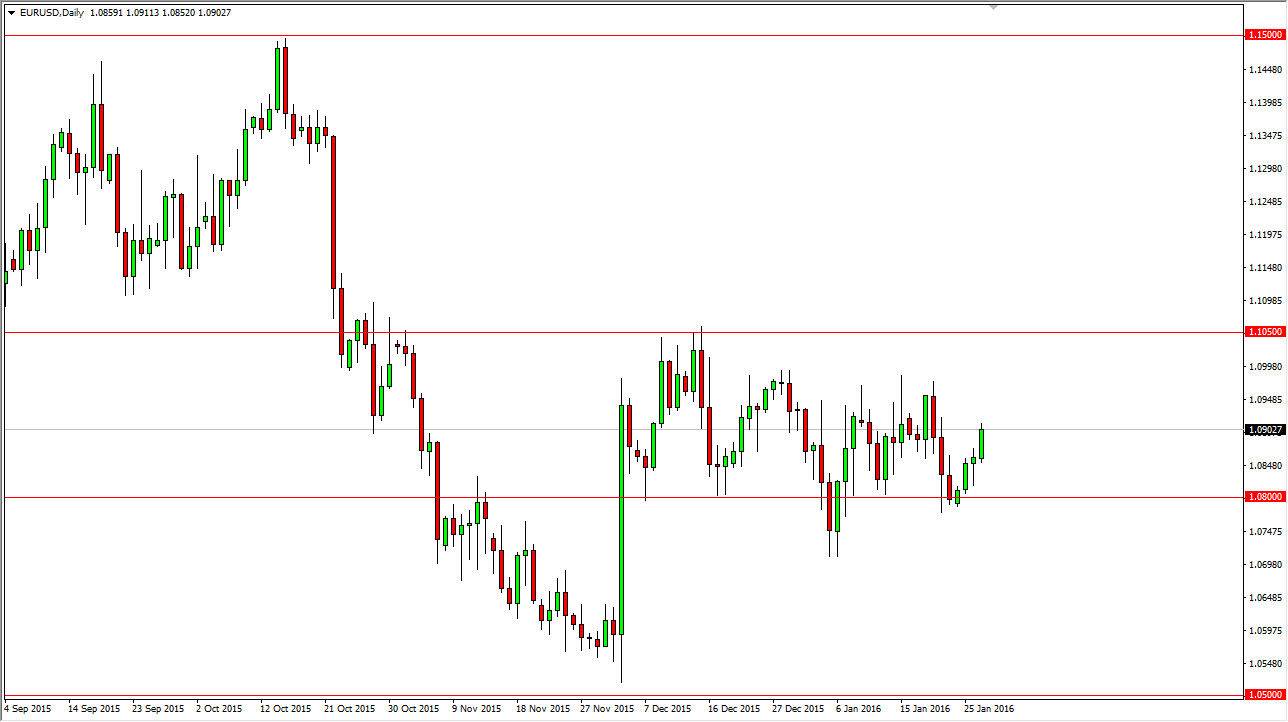

EUR/USD

The EUR/USD pair broke higher during the day on Wednesday, clearing the top of the hammer from Tuesday. This suggests that we are going to go higher, and as a result I believe that the market is going to try to reach the top of consolidation again at the 1.0950 level. Ultimately though, I do not believe that we’re going to break out with any significance, and I think that there is a significant amount of resistance all the way to the 1.1050 level. So any bullish position at this point in time will more than likely be short-term at best. The 1.08 level below should continue to be supportive, and therefore I feel that we will have simple back and forth trading going forward.

GBP/USD

The GBP/USD pair fell significantly during the course of the session on Wednesday, showing a pretty negative candle. I believe that we are going down to the 1.40 level given enough time, and that it’s only a matter time before the sellers continue to pressure the market. Any rally at this point in time should be a selling opportunity on short-term charts, and at this point in time I don’t really see any way to start buying this market. I think that the 1.45 level above is going to continue to be resistance, and a bit of a ceiling for the British pound.

Whether or not we get below the 1.40 level is of course a different question altogether, but at this point in time I would have to believe that the market does favor even lower levels. Keep in mind that the US dollar is the favored currency around the world, and although the British pound isn’t necessarily a “risky” currency, at the end of the day it is inferior to the US dollar when thought of in safety terms. Ultimately, we also have the Preliminary GDP numbers coming out of London today, so that of course could offer quite a bit of volatility.